Nvidia Is Down 27% From Its Peak. History Says This Is What Happens Next.

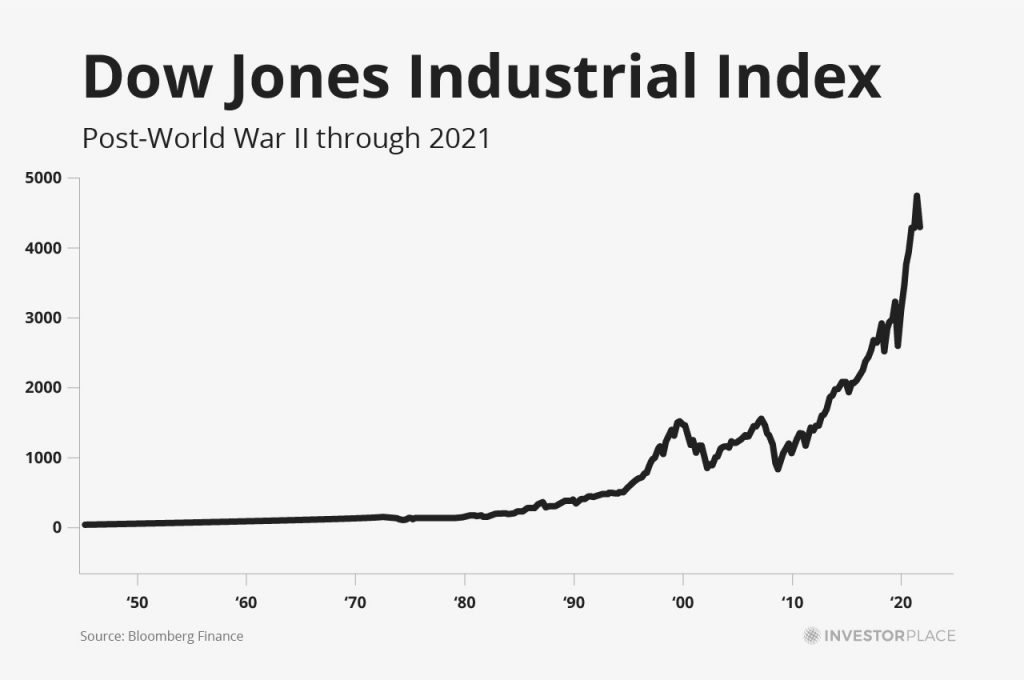

Nvidia (NASDAQ: NVDA) has been the unquestionable leader of the artificial intelligence (AI) boom of the past two-plus years with the stock up more than 600% since the start of 2023 and its market cap now hovering around $3 trillion.However, lately, Nvidia stock has looked surprisingly mortal. Share prices of the AI chip leader trade down about 16% year to date, and the stock fell 8% last Thursday following its earnings report even as it beat estimates and offered solid guidance. The company reported 78% revenue growth in the fourth quarter to $39.3 billion, which topped the consensus at $38.2 billion, and adjusted earnings per share (EPS) improved from $0.49 to $0.89, ahead of estimates at $0.85. Finally, its Q1 guidance called for revenue of around $43 billion, better than analyst expectations of $42.05 billion. The sell-off may indicate some investor fatigue with Nvidia, and the stock continued to slide in the ensuing days as it got caught up in the concerns about President Donald Trump's new round of tariffs as well as concerns that some of its chips may have been illegally exported to China. The stock now trades down 27% from its peak just a few months ago and at its lowest point since September 2024.Continue reading

Nvidia (NASDAQ: NVDA) has been the unquestionable leader of the artificial intelligence (AI) boom of the past two-plus years with the stock up more than 600% since the start of 2023 and its market cap now hovering around $3 trillion.

However, lately, Nvidia stock has looked surprisingly mortal. Share prices of the AI chip leader trade down about 16% year to date, and the stock fell 8% last Thursday following its earnings report even as it beat estimates and offered solid guidance. The company reported 78% revenue growth in the fourth quarter to $39.3 billion, which topped the consensus at $38.2 billion, and adjusted earnings per share (EPS) improved from $0.49 to $0.89, ahead of estimates at $0.85. Finally, its Q1 guidance called for revenue of around $43 billion, better than analyst expectations of $42.05 billion.

The sell-off may indicate some investor fatigue with Nvidia, and the stock continued to slide in the ensuing days as it got caught up in the concerns about President Donald Trump's new round of tariffs as well as concerns that some of its chips may have been illegally exported to China. The stock now trades down 27% from its peak just a few months ago and at its lowest point since September 2024.