Nvidia Invested in CoreWeave, but I Won't Be Buying the IPO

Tech giants like Microsoft (NASDAQ: MSFT) and Meta have been splurging on artificial intelligence (AI) accelerators and building out massive AI data centers but also have been relying on start-up CoreWeave to meet soaring demand for AI computing capacity. CoreWeave has built a specialized cloud computing platform focused primarily on running AI workloads, and almost all its revenue comes from long-term contracts with major technology companies. At the end of 2024, the company was operating more than 250,000 GPUs within its data centers.AI accelerator market-leader Nvidia (NASDAQ: NVDA) invested in CoreWeave back in 2023, and now, the AI cloud platform is planning to go public and will likely target a valuation of at least $35 billion. The company is expected to raise over $3 billion from its initial public offering (IPO), which will help fuel further expansion. Revenue exploded by more than 700% in 2024 to $1.9 billion, and CoreWeave plowed $8.7 billion into capital expenditures as it expanded its footprint to meet customer demand.CoreWeave is profitable on an operating basis, although interest payments on its debt eats up all its operating profit. While operating profitability, predictable long-term contracts, and booming demand for AI computing capacity are positives for the company, investors considering buying CoreWeave stock once it goes public should tread carefully.Continue reading

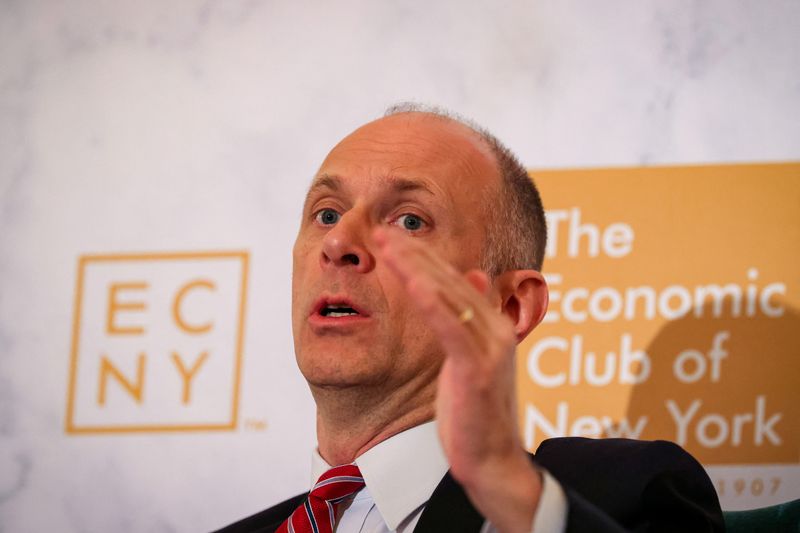

Tech giants like Microsoft (NASDAQ: MSFT) and Meta have been splurging on artificial intelligence (AI) accelerators and building out massive AI data centers but also have been relying on start-up CoreWeave to meet soaring demand for AI computing capacity. CoreWeave has built a specialized cloud computing platform focused primarily on running AI workloads, and almost all its revenue comes from long-term contracts with major technology companies. At the end of 2024, the company was operating more than 250,000 GPUs within its data centers.

AI accelerator market-leader Nvidia (NASDAQ: NVDA) invested in CoreWeave back in 2023, and now, the AI cloud platform is planning to go public and will likely target a valuation of at least $35 billion. The company is expected to raise over $3 billion from its initial public offering (IPO), which will help fuel further expansion. Revenue exploded by more than 700% in 2024 to $1.9 billion, and CoreWeave plowed $8.7 billion into capital expenditures as it expanded its footprint to meet customer demand.

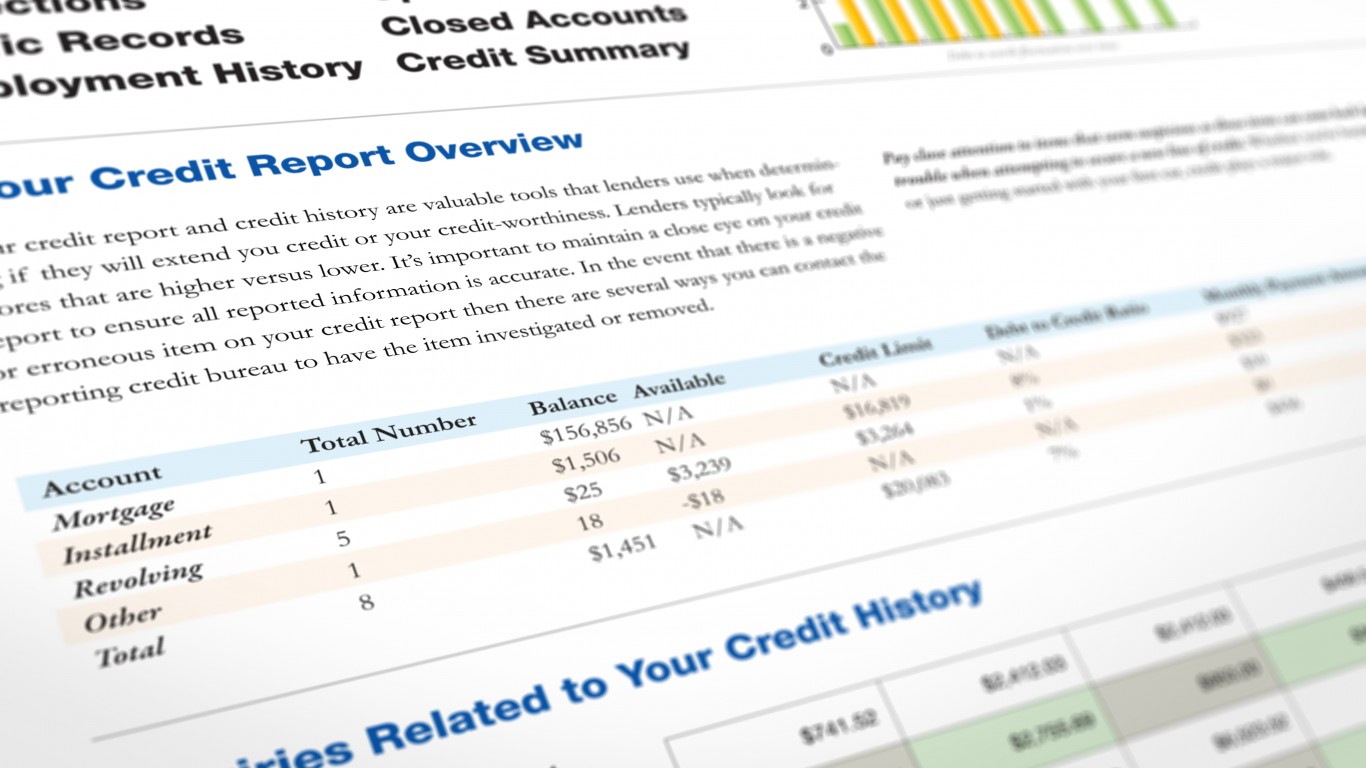

CoreWeave is profitable on an operating basis, although interest payments on its debt eats up all its operating profit. While operating profitability, predictable long-term contracts, and booming demand for AI computing capacity are positives for the company, investors considering buying CoreWeave stock once it goes public should tread carefully.