NIO (NIO) Stock Price Prediction and Forecast 2025-2030 For February 13

Shares of NIO (NYSE:NIO) popped 2.3% at the open on Thursday before tapering off and finishing the day up 1.19%. The price jump accompanied an announcement that in the Q4, AlphaStar Capital Management bought a new stake in the EV-maker to the tune of 123,270 shares valued at approximately $537,000. However, NIO’s institutional ownership remains relatively […] The post NIO (NIO) Stock Price Prediction and Forecast 2025-2030 For February 13 appeared first on 24/7 Wall St..

Shares of NIO (NYSE:NIO) popped 2.3% at the open on Thursday before tapering off and finishing the day up 1.19%. The price jump accompanied an announcement that in the Q4, AlphaStar Capital Management bought a new stake in the EV-maker to the tune of 123,270 shares valued at approximately $537,000. However, NIO’s institutional ownership remains relatively low at 8.19%.

The bump has added to a strong month for the stock, which is up 4.93% since Jan. 13. Shares have risen 9.51% over the past six months but remain down -25.26% over the past year. In January, JPMorgan analyst Nick Lai downgraded NIO from “Buy” to “Hold” and lowered his price target to $4.70 from $7. That followed another downgrade earlier in the month. On Jan. 7, HSBC cut its outlook for the company from a “Buy” rating to a “Hold” rating.

There are some encouraging tailwinds for shareholders, though. In early January, NIO rolled out its latest software update to European customers — version 2.4.0 of the Banyan operating system. This update introduces over 50 new features and enhancements, including a new driving mode specifically for the ET5 and ET5 Touring models. Inspired by NIO’s electric supercar, the EP9, this new “EP Mode” driving experience was previously only available in the Chinese market.

The Chinese carmaker’s high-performance models, which feature a +600-mile range, have caught the eye of vehicle enthusiasts and investors, while addressing range anxiety issues by creating battery swap technology as a supplement to charging. NIO is one of the 10 largest vehicle manufacturers in the world and the third largest in China.

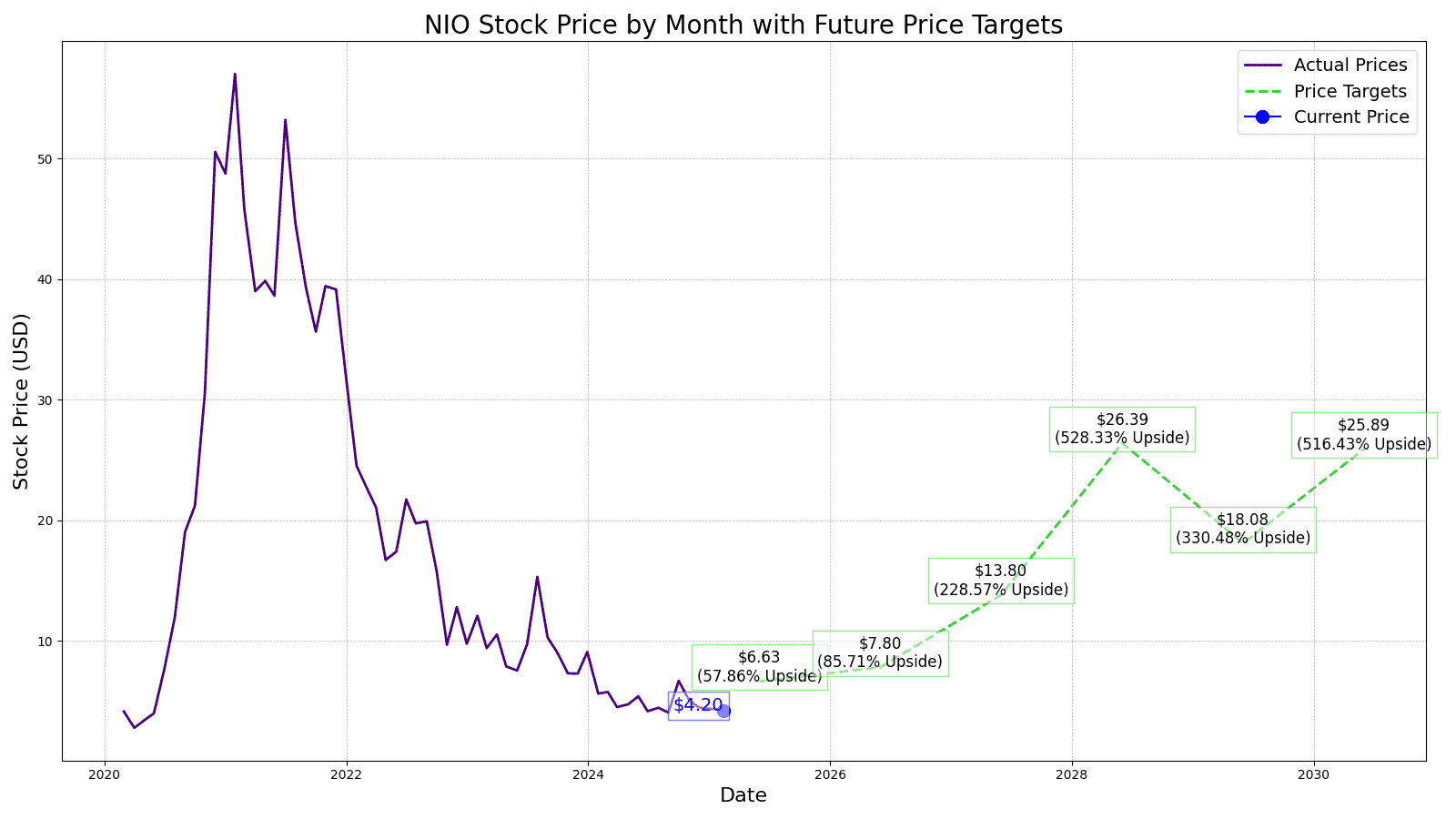

From a stock performance standpoint, NIO has been a tale of two stories. When shares debuted on the New York Stock Exchange on Sept. 12, 2018, at $9.90, they struggled to build that momentum. It wasn’t until the summer of 2020 when the stock began to surge, gaining over 810% from June 26, 2020, to Feb. 9, 2021, when the stock hit its all-time high of $62.84. Shares have fallen considerably since, but the long-term outlook remains strong.

24/7 Wall Street aims to provide readers with our assumptions about the stock’s prospects going forward, what growth we see in NIO stock for the next several years, and what our best estimates are for NIO’s stock price each year through 2030.

Key Points in this Article:

- NIO is the third-largest EV company in China.

- NIO is the first EV to pioneer swappable battery packs.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. The report includes a complete industry map of AI investments that includes many small caps.

NIO Stock Early Stage Growth

The following is a table of NIO’s revenues, operating income and share price for its first few years as a public company.

Here’s a table summarizing performance in share price, revenues and profits (net income) from 2014 to 2018.

| Share Price (End of Year) |

Revenues (CNY) | Operating Income | |

| 2018 | $5.39 | 4,951.2 | (9,595.6) |

| 2019 | $3.45 | 7,824.9 | (11,079.2) |

| 2020 | $40.00 | 16,257.9 | (4,607.6) |

| 2021 | $16.70 | 36,136.4 | (4,496.3) |

| 2022 | $7.87 | 49,268.6 | (15,640.7) |

| 2023 | $4.71 | 55,617.9 | (22,655.2) |

Revenue and operating income in Billion CNY (1CNY=.14 USD)

Now let’s take a look at Rivian (NASDAQ:RIVN) the first few years it was a publicly traded company (here is Rivian’s stock price forecast):

| Share Price (End of Year) |

Revenues | Operating Income | |

| 2021 | $50.24 | $55.0 | ($4,220.0) |

| 2022 | $19.30 | $1,658.0 | ($6,856.0) |

| 2023 | $10.70 | $4,434.0 | ($5,739.0) |

| TTM | $15.35 | $4,997.0 | (5,790.0) |

The revenue growth for both firms is similar but Rivian’s operating loss is more than double the yearly operating loss of NIO.

NIO formerly contracted its manufacturing to Jianghuai Automobile Group, paying a fee for each vehicle produced in addition to fixed cost. They have since acquired the factory from JAC. This agreement is beneficial for a young start-up in a very capital-intensive market. However, when scale is reached, the variable cost model has its downsides.

3 Key Drivers of NIO’s Stock Performance

- Product Portfolio Expansion and Growing Market Share

- New Model Launches: Similar to Tesla, NIO started off with a higher-end roadster and used the higher-end models to re-invest into more affordable, mass-market vehicles. NIO aims to push further into price-conscious markets while also adding options for its more premium customers.

- Add-On Services: With NIO’s battery swap technology, the company plans to roll out an innovative battery-as-a-service solution for its customer base. The company plans on building over 4,000 swap stations by the end of 2025, with 1,000 of them being located outside of China.

- Increased Vehicle Deliveries and Market Penetration

- Growing NEV Adoption: The market for new market vehicles (NEVs) is on the rise in China. NIO expects vehicle deliveries in 2025 to double the output from 2023 (roughly 165,000 units). This still only makes up about 2% of the Chinese NEV market and gives NIO plenty of roadway to grab market share for years to come.

- International Expansion: NIO’s strategy includes expanding its market presence outside China. The company built its first overseas battery-swap station in Hungary in 2022 and has several service centers and NIO accessory businesses throughout Europe.

- In December 2024, the company delivered 31,138 vehicles, good for a 72.9% year-over-year increase. In total, 221,970 vehicles were delivered in 2024, which was a year-over-year increase of 38.7% compared to 2023. Cumulative deliveries reached 671,564 as of Dec. 31, 2024.

- Advancements in Technology and Customer Experience

- Battery and Charging Solutions: NIO’s advancements in battery technology and charging solutions aim to alleviate range anxiety among consumers and help lower the overall cost of the vehicle by 15% to 30%.

- Focus on Younger Consumers: NIO’s leadership in EV technology will provide brand equity to younger generations of drivers who value enhanced technology packages.

NIO Stock Forecast Through 2030

| Year | Revenue* | Shares Outstanding | P/S Est. |

| 2025 | 97,052 | 2,050 mm | 1x |

| 2026 | 114,172 | 2,050 mm | 1x |

| 2027 | 134,643 | 2,050 mm | 1.5x |

| 2028 | 257,634 | 2,050 mm | 1.5x |

| 2029 | 176,533 | 2,050 mm | 1.5x |

| 2030 | 189,548 | 2,050 mm | 2x |

*Revenue in CYN millions

Compared to Rivian and Tesla, NIO’s price-to-sales valuation will be moderately discounted. While NIO is in solid financial standing and has a premium brand image, it’s still uncertain how much competition the company will face in China and expanding overseas. The company is already spending a quarter of revenues on R&D and if NIO can’t capitalize on this spend, the stock price will be sluggish compared to North American EV manufacturers.

NIO Share Price Estimates 2025-2030

How NIO’s Next 5 Years Could Play Out

Wall Street analysts give NIO a one-year price target of $5.31, representing a 26.24% increase from today’s share price. Based on 12 analysts’ ratings, the stock is a consensus “Hold.”

Here at 24/7 Wall Street, we expect to see a revenue growth of 60% for the year, with a price-to-sales multiple of 1x, which puts our price target at $6.63, an upside of 57.86% from today’s opening share price.

NIO Stock’s Price Target for 2030

We estimate NIO’s stock price to be $25.89 per share. Our estimated stock price will be 516.40% higher than the current stock price.

| Year | Price Target | % Change From Today’s Price |

| 2025 | $6.63 | 57.86% |

| 2026 | $7.80 | 85.71% |

| 2027 | $13.80 | 228.57% |

| 2028 | $26.39 | 528.33% |

| 2029 | $18.08 | 330.48% |

| 2030 | $25.89 | 516.43% |

The post NIO (NIO) Stock Price Prediction and Forecast 2025-2030 For February 13 appeared first on 24/7 Wall St..