My Dad Died with No Estate – Why Does the IRS Keep Asking for Money?

When a parent passes away, we are often consumed with grief, exhaustion, and planning of funeral services. In the months and years that follow, we are forced to face a new life without our family member by our side. Amid so many stressful changes, some of us are also forced to deal with confusing notices […] The post My Dad Died with No Estate – Why Does the IRS Keep Asking for Money? appeared first on 24/7 Wall St..

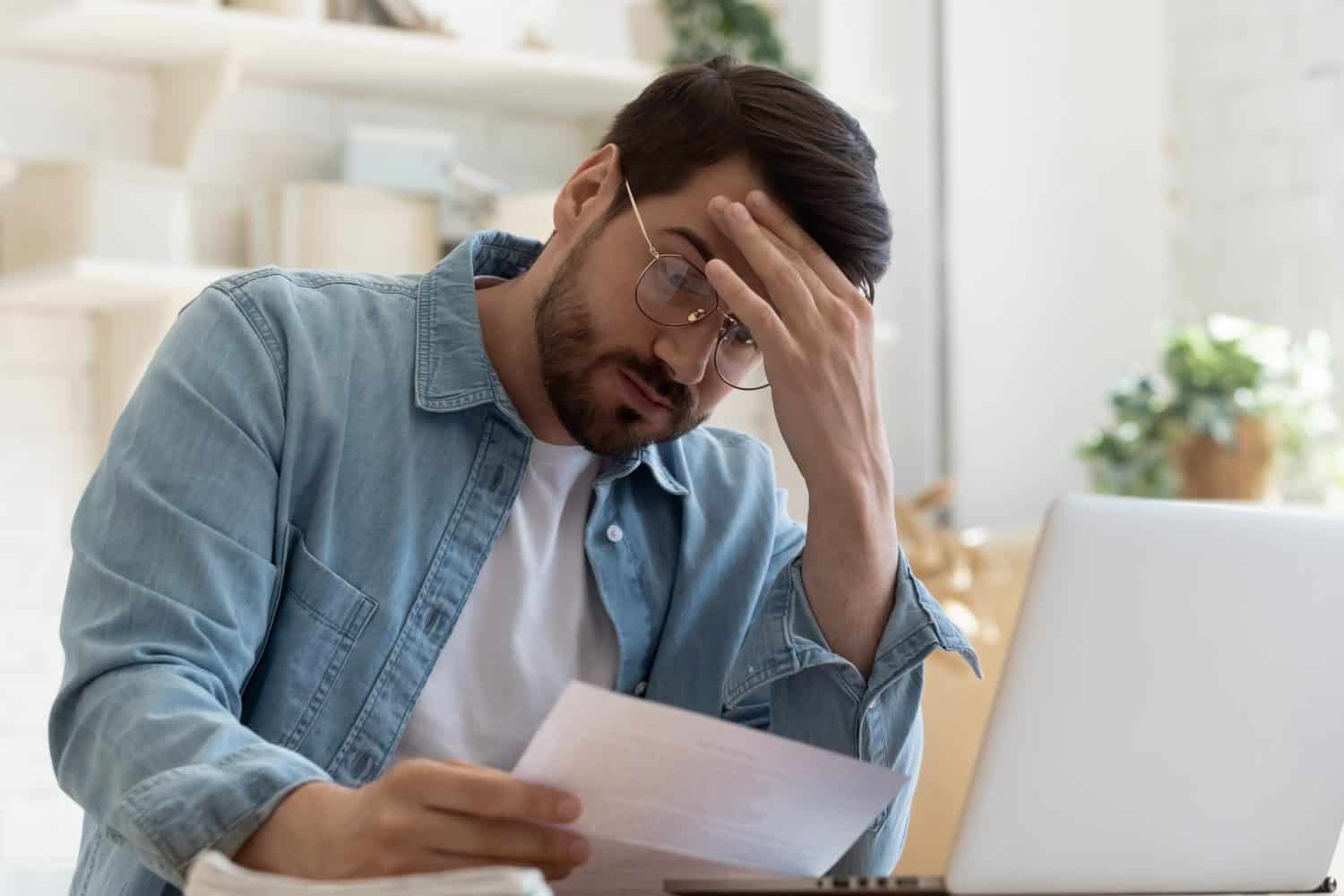

When a parent passes away, we are often consumed with grief, exhaustion, and planning of funeral services. In the months and years that follow, we are forced to face a new life without our family member by our side. Amid so many stressful changes, some of us are also forced to deal with confusing notices from the IRS. A Reddit user recently posted about receiving IRS letters requesting tax debt payments tied to her deceased father. He passed away in 2018 with no estate, and yet the letters kept coming.

Can tax debt survive a person? In a way, yes. However, the IRS can only collect taxes on an estate passed down via inheritance; they can’t collect money from surviving family members who did not inherit anything. Despite these restrictions, federal systems can be faulty and attempt to hold relatives responsible. Certain steps can help protect you from these intrusive notices from the IRS.

This slideshow covers everything you need to know regarding unpaid taxes of a deceased loved one. We discuss what the IRS is eligible to collect on, as well as what it cannot, alongside the importance of assets versus debt. Lastly, we explore when you need to respond to the IRS and when it is okay to remain silent. If you’ve found yourself in a similar situation to our Reddit user, read up on how to best move forward.

What Happens to IRS Debt When Someone Dies?

- IRS debt does not automatically disappear upon death; the IRS may seek repayment from the deceased’s estate.

- If there is no estate or assets, the IRS has limited ability to collect and may eventually write off the debt.

Can You inherit IRS Debt?

- Family members are generally not liable for IRS debt unless they inherited assets from the deceased.

- If no assets were passed on, there is usually no legal obligation for surviving relatives to pay.

What if the IRS Keeps Sending Letters?

- It’s common for the IRS to continue sending mail to deceased individuals if their records haven’t been updated.

- Relatives can return the mail with a note that the recipient is deceased or send a death certificate to the IRS.

What Counts as an Estate?

- An estate includes property, bank accounts, investments, and other valuable assets left behind.

- If the estate has value, the IRS can legally claim what’s owed from it before heirs receive anything.

When to Do Nothing

- If the deceased had no estate and no assets were inherited, it’s often best to ignore IRS letters.

- Without an estate to go after, the IRS typically cannot enforce repayment and may close the case over time.

How to Notify the IRS of a Death

- Send a copy of the deceased’s death certificate to the IRS to have records updated.

- This can prevent further mailings and unnecessary confusion or stress for family members.

When Professional Help May Be Needed

- If the IRS begins to pressure surviving family members or if complications arise, seek help from a tax attorney or professional.

- They can provide formal communication and protect your legal rights.

IRS Debt vs. Other Debts

- Unlike many private debts, IRS debts don’t go through traditional collections when a person dies.

- However, the IRS is persistent and may still pursue resolution until they confirm it’s uncollectible.

Preventing Future Confusion

- It’s wise to organize tax documents and leave clear instructions for heirs about outstanding tax issues.

- Keeping communication with the IRS clear can avoid future family headaches.

The Bottom Line

- IRS debt doesn’t follow someone beyond the grave if there’s nothing to collect from.

- Keep calm, stay informed, and seek help if needed to resolve lingering tax matters

The post My Dad Died with No Estate – Why Does the IRS Keep Asking for Money? appeared first on 24/7 Wall St..