Movement Labs Secretly Promised Advisers Millions in Tokens, Leaked Documents Show

Signed memos reveal that Movement Labs, a Trump-backed crypto startup, offered up to 10% of its token supply to shadow advisers through undisclosed agreements.

Movement Labs, the scandal-plagued crypto startup backed by Donald Trump’s World Liberty Financial, quietly promised large stakes of its token to early insiders—undisclosed deals that now raise fresh questions about who really holds power behind the scenes.

Even before its token launch, Movement Labs committed large portions of MOVE’s supply to a handful of early advisers — arrangements that were never disclosed to investors and only surfaced through internal documents reviewed by CoinDesk.

Two business memos obtained by CoinDesk — one promising a single adviser nearly $2 million a year — show how Movement, founded in 2023 by two 20-year-old Vanderbilt dropouts, leaned heavily on these advisers to gain a foothold in the crypto industry.

Movement Labs said the agreements, dated shortly after the project's founding, were exploratory in nature and non-binding.

The existence of the agreements nonetheless casts new light on the chaotic inner workings of Movement, which came under fire after CoinDesk reported last month that insider market-making deals enabled token dumping by insiders.

The fallout has sparked waves of finger-pointing inside the company, centering on who steered Movement into a predatory agreement with a Chinese market maker under terms that analysts say incentivized predatory selling.

The tension has boiled over into a public rift between co-founders Rushi Manche, who was terminated by Movement Labs this month, and Cooper Scanlon, who stepped back from his CEO role but remains at the company.

“When we started Movement, I was the CTO — leading the engineering team. I left most business decisions, including the contracts, to Cooper,” Manche told CoinDesk in an interview for this report. “When priorities changed, our roles changed, but Cooper’s decisions in the early days heavily shaped the way the launch went.”

Shadow advisers

CoinDesk spoke to more than a dozen people familiar with Movement over the course of its investigation, including current and former employees who were granted anonymity so they could speak freely.

The agreements obtained by CoinDesk concern Sam Thapaliya and Vinit Parekh, both of whom played behind-the-scenes roles in shaping the project during its early stages. Together, they were allocated access to as much as 10% of the total MOVE token supply in signed memoranda of understanding that insiders say were intentionally kept off the books.

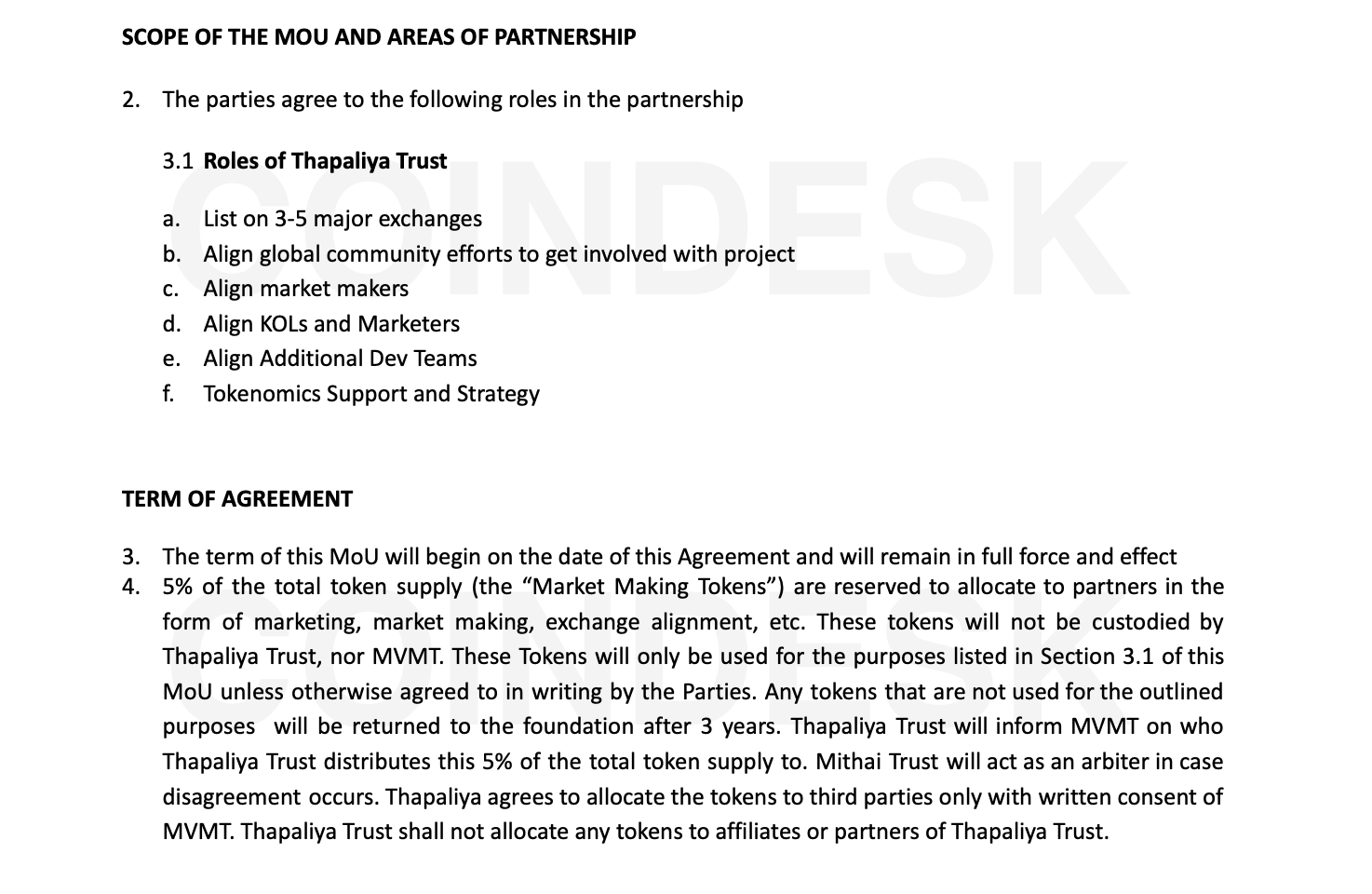

Thapaliya, the CEO of Zebec Protocol and an early advisor to Manche and Scanlon, was loaned 5% of MOVE’s supply for marketing and market-making purposes, according to one of the agreements obtained by CoinDesk. A second agreement allocated Thapaliya 2.5% of the token's total supply, worth more than $50 million at recent prices.

Movement Labs told CoinDesk the signed agreements with Thapaliya were not binding, but Thapaliya claimed the agreements "were never voided."

While framed as memoranda of understanding — normally considered non-binding — the agreements examined by CoinDesk also include provisions stating "both parties" must consent to their termination.

"I plan on pursuing legally to exercise my claim to retrieve 2.5% of tokens," Thapaliya said.

Employees at Movement referred to Thapaliya as a “shadow co-founder” and said he was often consulted by Scanlon and Manche for major decisions.

His name also surfaced in internal communications regarding Movement’s deal with Web3Port. The Chinese market maker was later blamed for dumping $38 million in tokens after MOVE’s debut — an event that triggered a sell-off and Binance account bans.

The amount loaned to Web3Port, 5% of MOVE's supply, was identical to the amount loaned to Thapaliya per the agreement.

When contacted by CoinDesk in advance of the initial investigation, Thapaliya denied having any financial interest in Movement Labs or the Movement Foundation. He also denied involvement in the Web3Port deal.

In later messages on Signal, Thapaliya told CoinDesk that his work with Movement was consistent with their agreement: “As per the contract signed in February 2023, I fulfilled the agreed terms by supporting Cooper [Scanlon] in exchange-related discussions, strategizing token allocation, assisting with market maker selection, and helping hire the team that audited his airdrop model.”

Memoranda of understanding

The use of informal agreements to quietly allocate tokens to insiders reflects a broader pattern within the crypto industry, where large sums can change hands without appearing in official fundraising disclosures.

In 2024, CoinDesk reported that Eclipse — another project linked to Thapaliya — secretly allocated 5% of its token supply to an employee at Polychain, a major crypto venture firm that later invested in the project. Polychain is also an investor in Movement Labs. Eclipse's deal with the Polychain employee was scrapped following the publication of CoinDesk's investigation.

What these cases illustrate is not necessarily fraud, but the ease with which crypto startups can make significant financial commitments behind closed doors — commitments that can later shape the trajectory of an entire token ecosystem, often without the community or even some employees ever knowing.

One person familiar with the matter said Movement's agreements were tailored to explicitly avoid disclosures to investors or community members.

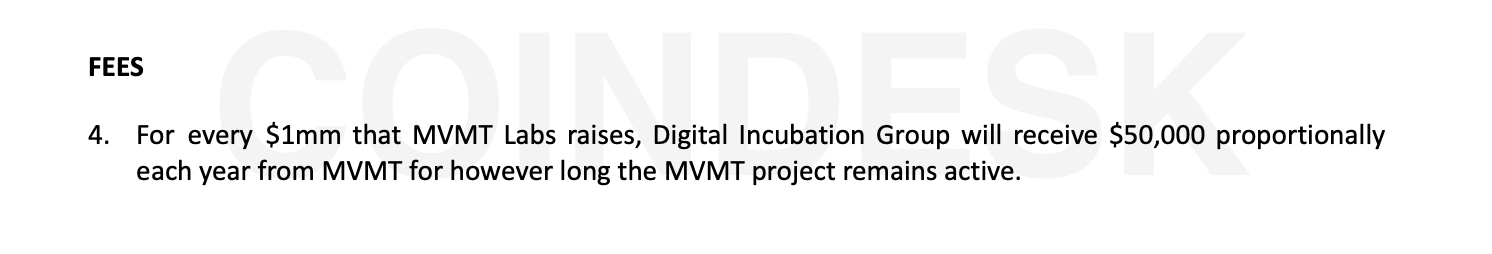

In another 2023 agreement obtained by CoinDesk, Movement Labs agrees to give an entity linked to Vinit Parekh, "Digital Incubation Group," $50,000 annually for every $1 million raised by Movement Labs — a sum that would total approximately $2 million per year, based on Movement’s $38 million in funding. Another agreement granted a separate Parekh entity control of 2.5% of the MOVE token supply.

In exchange for his allocation, Parekh’s firm, Digital Incubation Group, was tasked with a broad mandate, including: “development of strategy framework, validated by relevant stakeholders; consultation through the pre-seed raise process (including advice and connection to investors), close seed raise; development of tokenomics and release plan; engage in structuring team pre-product launch.”

Like Thapaliya’s agreements, Parekh's were structured as memoranda of understanding with a termination clause requiring consent from both "parties." Parekh and Movement Labs both said the agreements were exploratory and that funds never changed hands between either party.

Two people close to Movement Labs said that Parekh, a Microsoft product manager-turned blockchain industry consultant, was nonetheless a frequent presence at Movement's San Francisco office and played a role in the company's hiring, marketing, and strategy decisions.

"I just care about the ecosystem," Parekh told CoinDesk in an interview. "No money was given to me or to anyone I know," in connection to the agreements, "[b]ut I did help them on the marketing strategy and understanding how to do go-to-market."

A rift between founders

The fallout from Movement’s market-making scandal has exposed a widening rift between its co-founders, Manche and Scanlon.

After an excerpt from one of the Thapaliya agreements leaked on X, Manche pointed to Scanlon’s signature on the memo, highlighting his former partner’s role in approving the deal. He also reposted a message questioning whether Movement Labs was “throwing [Manche] under the bus” while Scanlon “played innocent.”

Manche was ousted from Movement Labs earlier this month, shortly after CoinDesk reported he had helped coordinate the project’s controversial market-making agreement with Web3Port and an intermediary known as Rentech — a third party that Movement later claimed misrepresented itself in the deal.

CoinDesk has since learned that Manche also played a role in facilitating a separate arrangement between Web3Port and Kaito, another crypto project that shares the same director and general counsel as Movement Foundation. A contract reviewed by CoinDesk shows that OpenKaito Foundation loaned 2.5% of its KAITO token supply to Web3Port for market-making purposes.

The agreement — which was also leaked on X by an anonymous account — was terminated shortly after it was signed, according to an X post from Kaito founder Yu Hu. Unlike the Movement deal, it did not include terms that experts said incentivized pump-and-dump behavior.

A person familiar with the matter said Manche introduced Kaito to Rentech, which then connected the project to Web3Port.

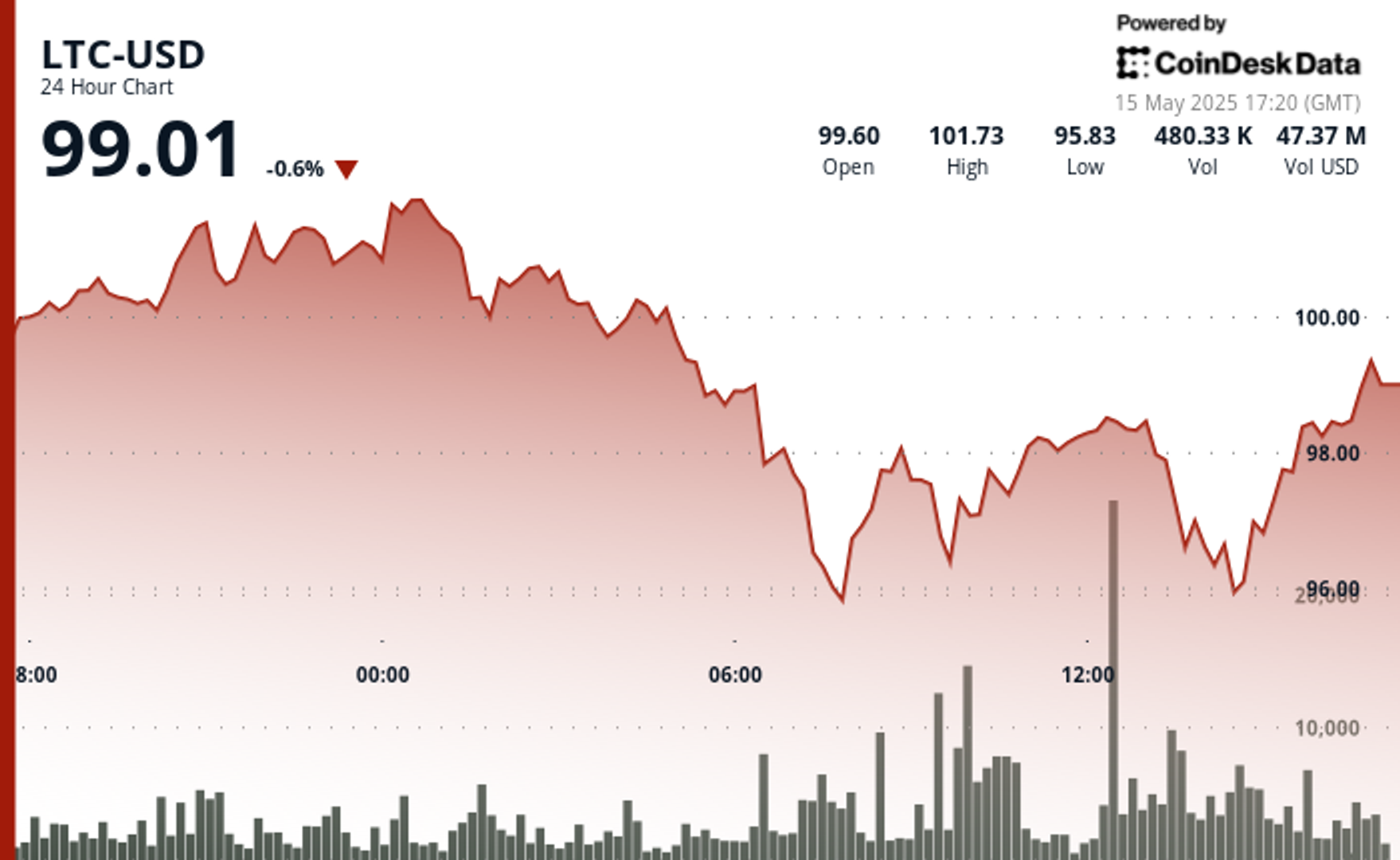

The controversy has already dented Movement’s reputation in an industry that once saw the startup as a rising star. Coinbase, the largest U.S. crypto exchange, announced it would suspend trading of the MOVE token on May 15. The token’s price fell by 50% in the following week.

On May 7, Movement Labs said it would spin out a new entity, Movement Industries, to serve as the network’s primary developer. Scanlon remains with the organization but has stepped down as CEO.