Most Americans Don’t Know These Mortgage Basics

At its most basic, mortgages are loans given to individuals buying a house. Within the framework of a home mortgage loan, the purchased property works as collateral. Aside from the down payment, which is often somewhere around 20% of the house’s value, a home buyer will borrow the money required to pay for the house, […] The post Most Americans Don’t Know These Mortgage Basics appeared first on 24/7 Wall St..

At its most basic, mortgages are loans given to individuals buying a house. Within the framework of a home mortgage loan, the purchased property works as collateral. Aside from the down payment, which is often somewhere around 20% of the house’s value, a home buyer will borrow the money required to pay for the house, which is financed through a mortgage. There is an assortment of mortgage types, such as fixed rate, with the specific kind of mortgages based on the buyer’s financial situation. Additionally, most mortgage terms are either 15 year or 30 years.

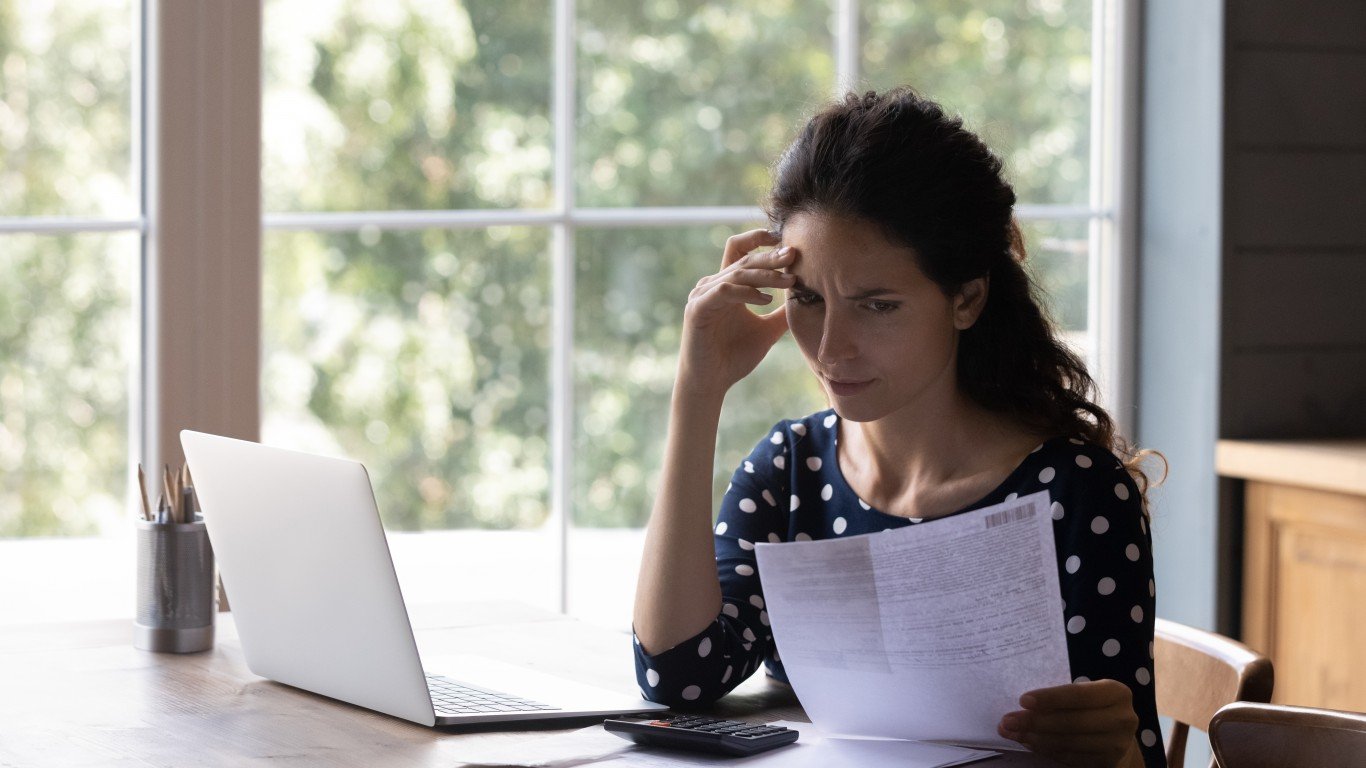

Despite the fact that the definition of a home mortgage can seem fairly straightforward at face value, the nature of these loans can be quite complex. Many first-time home buyers do not know much about the mortgage they will inevitably have to rely on the purchase their first home. Purchasing a home is a complex process, with the mortgage being a major piece of the puzzle. If you’re looking to learn more about the ins and outs of mortgages, check out these 20 questions and answers.

1. What is a mortgage?

The definition of a mortgage can be surprisingly confusing. However, it important to understand exactly what a mortgage is and who can get one.

Answer:

A mortgage is a loan used to buy property. That’s all it can be used for! The property acts as the collateral. In other words, if the borrower doesn’t make the payments, the lender can take ownership of the property.

Mortgages typically involve monthly payments over a set number of years. 15 to 30 years is the most common term.

2. How much down payment is typically required?

Americans have a lot of confusions about down payments. Different types of mortgages have different down payment requirements.

Answer:

Most experts recommend having at least 20% of the home’s price as a down payment, as this lets you avoid mortgage insurance, which adds extra to your monthly payments. However, there are options for lower downpayments, even as low as 3% in most cases.

This lower downpayment would require you to pay mortgage insurance, though.

3. What is the difference between a fixed-rate and an adjustable-rate mortgage?

You hear these words tossed around a lot, but not everyone understands what they mean.

Answer:

A fixed-rate mortgage has an interest rate that remains the same for the loan’s entire term, making monthly payments predictable. However, an adjustable-rate mortgage starts lower and then may change based on market conditions.

4. How is an interest rate different from an APR?

You’ll hear both interest and APR when applying for a mortgage, but these are different.

Answer:

The interest rate is the cost of borrowing the principal loan amount, while the APR (annual percentage rate) includes both the interest rate and other loan fees. The APR provides a more complete picture of what you’ll be paying, while the interest rate is a smaller portion of the APR.

5. What is private mortgage insurance?

If you have less than a 20% down payment, you’ll need private mortgage insurance. But what is it?

Answer:

Private mortgage insurance protects the lender if the borrower defaults on a mortgage. It’s added to the borrower’s monthly payment and is typically required by the lender if the borrower puts less than 20% down. Sometimes, this can be removed after the borrower has built up enough equity in the home.

6. What is a credit score, and how does it affect a mortgage?

Before you can get a mortgage, it’s important to understand your credit score.

Answer:

A credit score is a number that represents a borrower’s creditworthiness. Higher scores mean that the borrower is better at paying back loans, which usually leads to lower interest rates. Lower scores typically mean the opposite.

7. What is pre-approval, and why is it important?

Pre-approval is something you need to be thinking about long before you plan to buy a house.

Answer:

Mortgage pre-approval is a process where a lender reviews your financials and estimates how much they would be willing to lend you. Pre-approval shows sellers that you’re a serious buyer and gives you a realistic budget for your home search.

8. How does a mortgage term affect monthly payments?

Does your mortgage term matter? Yes, it does.

Answer:

The mortgage term is the length of time you have to repay your mortgage. Shorter terms mean a higher monthly payment, as you have less time to pay back the loan. However, your loan will also have less interest. Longer terms are the opposite. You’ll have a lower monthly payment but more interest.

9. What is equity?

We’ve mentioned equity in this article, but what is it?

Answer:

Equity is the portion of the home you “own.” It’s calculated by subtracting the mortgage balance from the home’s current market value. Equity is built as you make payments and property values increase.

10. Can you refinance a mortgage?

Sometimes, you’ll hear a lot of talk about refinancing a home. But what does this actually mean?

Answer:

Yes, refinancing replaces your existing mortgage with a new one, typically to reduce the interest rate, shorten the loan term, or tap into home equity. It’s often much cheaper than your original mortgage. However, there are often sizable fees involved.

11. What are closing costs?

You’ll need to pay closing costs, which is on top of your down payment. But what are closing costs?

Answer:

Closing costs are various fees that happen when you finalize a mortgage. Often, this includes things like title insurance and loan fees. These may range from 2% and 5% of the home’s purchase price.

12. What is an escrow account?

You may hear things about an escrow account while shopping for a house. Let’s look at what it is:

Answer:

An escrow account is a separate account held by the lender to collect funds for property taxes and homeowners insurance. When you pay your mortgage, a portion will go into this account to cover these expenses when they’re due.

13. What’s the difference between principal and interest?

This basic question can clear up a lot of confusion.

Answer:

Principal is the original loan amount borrowed, while interest is the cost of borrowing that money. Mortgage payments will include a payment on the principal and interest. However, more of the payment will go towards the interest in the beginning, as your loan will be bigger.

14. What is a debt-to-income ratio?

When you’re trying to buy a house, lenders will look at your debt-to-income ratio. But what is it?

Answer:

The DTI ratio is a measure of your monthly debt payments compared to your gross monthly income. Lenders use this ratio to determine how much home you can afford. A lower amount of debt compared to your income means that you can handle a higher monthly mortgage payment.

15. What is a loan-to-value ratio?

This is another ratio that’s important to keep in mind.

Answer:

The LTV ratio compares the loan amount to the home’s appraised value. If you have a lower ratio, that means you’ll have more equity in the home from the start, and you’ll be more likely to get approved, too. A higher LTV may impact your loan eligibility.

16. Can you pay off a mortgage early without penalty?

Many people plan to pay off their loan early, but there may be some complications involved.

Answer:

Some mortgages have prepayment penalties for paying off the loan early, though this is less common today. Each loan is different, so you’ll need to pay attention to the loan agreement to see if there are any extra payments for paying off your mortgage early.

There are also other reasons paying off your mortgage early might not make sense. We’ve talked about Dave Ramsey’s opinion on paying off your mortgage early, previously.

17. What is an amortization schedule?

You may hear this term thrown around.

Answer:

An amortization schedule is a table that shows each monthly mortgage payment, breaking down how much goes toward principal and interest over time. In the beginning, a lot of your payment will go towards interest, but you will pay more on principle over time, too.

18. What happens if you miss a mortgage payment?

While no one plans to miss a mortgage payment, you may find yourself in this hard position at some point.

Answer:

Missing a mortgage payment can result in late fees and may impact your credit score. If payments are consistently missed, the lender may initiate foreclosure proceedings, which leads to the loss of the home.

19. What is a rate lock?

You may be offered a rate lock on your mortgage. Should you take it?

Answer:

A rate lock is an agreement with the lender to secure a specific interest rate for a set period. Often, this occurs when you’re trying to buy a home. Locking in the rate protects the borrower from rate increase before closing.

20. How can you improve your chances of getting a better mortgage rate?

There are lots of ways!

Answer:

Improving your credit score, reducing your debt, and saving for a larger down payment can help secure a lower interest rate. You may also want to consdier shopping around and comparing different lenders, as they aren’t always the same. Rates and terms differ widely.

The post Most Americans Don’t Know These Mortgage Basics appeared first on 24/7 Wall St..