Metaplanet adds $67M in Bitcoin following 10-to-1 stock split

Japan-based Metaplanet has expanded its Bitcoin holdings, purchasing 696 BTC for 10.152 billion yen ($67 million), the company announced in an April 1 post on X. The investment pushes Metaplanet’s total Bitcoin stash to 4,046 BTC, valued at over $341 million at the time of writing.Source: MetaplanetStock split targets investor accessibilityThe acquisition comes shortly after Metaplanet issued 2 billion Japanese yen ($13.3 million) of bonds to buy more BTC, Cointelegraph reported on March 31.Source: Simon GerovichThe move also comes shortly after Metaplanet’s 10-to-1 reverse stock split. The company had previously warned in a Feb. 18 filing that its share price had risen significantly, creating a high barrier to entry for retail investors.“We implemented a reverse stock split consolidating 10 shares into 1. Since then, our stock price has risen significantly, and the minimum amount required to purchase our shares on the market has now exceeded 500,000 yen, creating a substantial financial burden for investors,” according to a Feb. 18 notice.Stock split announcement. Source: MetaplanetThe stock split aims to lower the price per trading unit to improve liquidity and expand the firm’s investor base.Metaplanet stock split history. Source: Investing.comThe 10-to-1 stock split was completed on March 28, according to investing.com.Related: $1T stablecoin supply could drive next crypto rally — CoinFund’s PakmanMetaplanet, often referred to as “Asia’s MicroStrategy,” aims to accumulate 21,000 BTC by 2026 as part of its strategy to lead Bitcoin adoption in Japan. With 4,046 BTC in its treasury, it currently ranks as the ninth-largest corporate Bitcoin holder globally, according to Bitbo data.Related: Crypto trader turns $2K PEPE into $43M, sells for $10M profitStrategy is also buying the Bitcoin dipMetaplanet’s purchase comes during a period of institutional dip buying, with Michael Saylor’s Strategy announcing its latest acquisition on March 31. Strategy purchased 22,048 Bitcoin for $1.92 billion at an average price of $86,969 per Bitcoin in its latest weekly BTC haul.The company now holds over 528,000 Bitcoin acquired for $35.63 billion at an average price of $67,458 per BTC, Saylor said in a March 31 X post.Source: Michael SaylorInstitutions are showing confidence in Bitcoin despite the global market uncertainty around US President Donald Trump’s looming tariff announcement, which may create significant volatility in both crypto and traditional markets.“Risk appetite remains muted amid tariff threats from President Trump and ongoing macro uncertainty,” Nexo dispatch analyst Iliya Kalchev told Cointelegraph.The April 2 announcement is expected to detail reciprocal trade tariffs targeting top US trading partners, a development that may increase inflation-related concerns and limit demand for risk assets like Bitcoin.Magazine: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – March 1

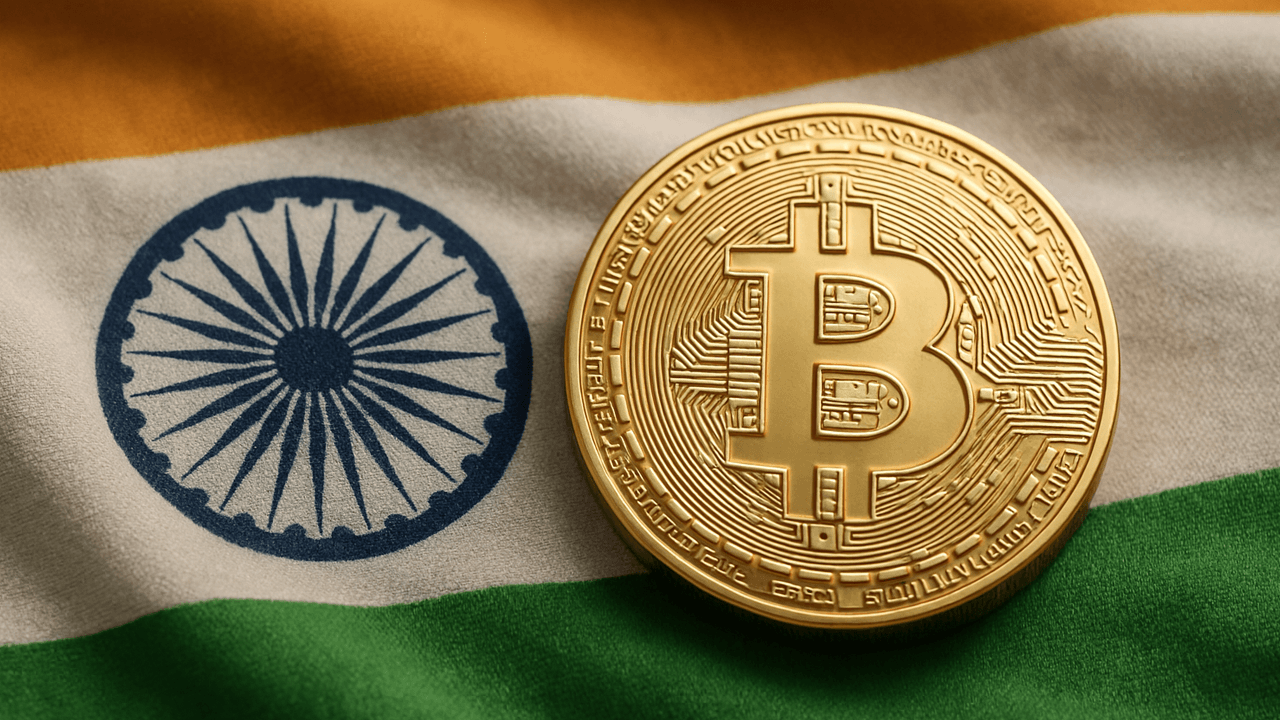

Japan-based Metaplanet has expanded its Bitcoin holdings, purchasing 696 BTC for 10.152 billion yen ($67 million), the company announced in an April 1 post on X.

The investment pushes Metaplanet’s total Bitcoin stash to 4,046 BTC, valued at over $341 million at the time of writing. Source: Metaplanet

Stock split targets investor accessibility

The acquisition comes shortly after Metaplanet issued 2 billion Japanese yen ($13.3 million) of bonds to buy more BTC, Cointelegraph reported on March 31. Source: Simon Gerovich

The move also comes shortly after Metaplanet’s 10-to-1 reverse stock split. The company had previously warned in a Feb. 18 filing that its share price had risen significantly, creating a high barrier to entry for retail investors.

“We implemented a reverse stock split consolidating 10 shares into 1. Since then, our stock price has risen significantly, and the minimum amount required to purchase our shares on the market has now exceeded 500,000 yen, creating a substantial financial burden for investors,” according to a Feb. 18 notice. Stock split announcement. Source: Metaplanet

The stock split aims to lower the price per trading unit to improve liquidity and expand the firm’s investor base. Metaplanet stock split history. Source: Investing.com

The 10-to-1 stock split was completed on March 28, according to investing.com.

Related: $1T stablecoin supply could drive next crypto rally — CoinFund’s Pakman

Metaplanet, often referred to as “Asia’s MicroStrategy,” aims to accumulate 21,000 BTC by 2026 as part of its strategy to lead Bitcoin adoption in Japan. With 4,046 BTC in its treasury, it currently ranks as the ninth-largest corporate Bitcoin holder globally, according to Bitbo data.

Related: Crypto trader turns $2K PEPE into $43M, sells for $10M profit

Strategy is also buying the Bitcoin dip

Metaplanet’s purchase comes during a period of institutional dip buying, with Michael Saylor’s Strategy announcing its latest acquisition on March 31. Strategy purchased 22,048 Bitcoin for $1.92 billion at an average price of $86,969 per Bitcoin in its latest weekly BTC haul.

The company now holds over 528,000 Bitcoin acquired for $35.63 billion at an average price of $67,458 per BTC, Saylor said in a March 31 X post. Source: Michael Saylor

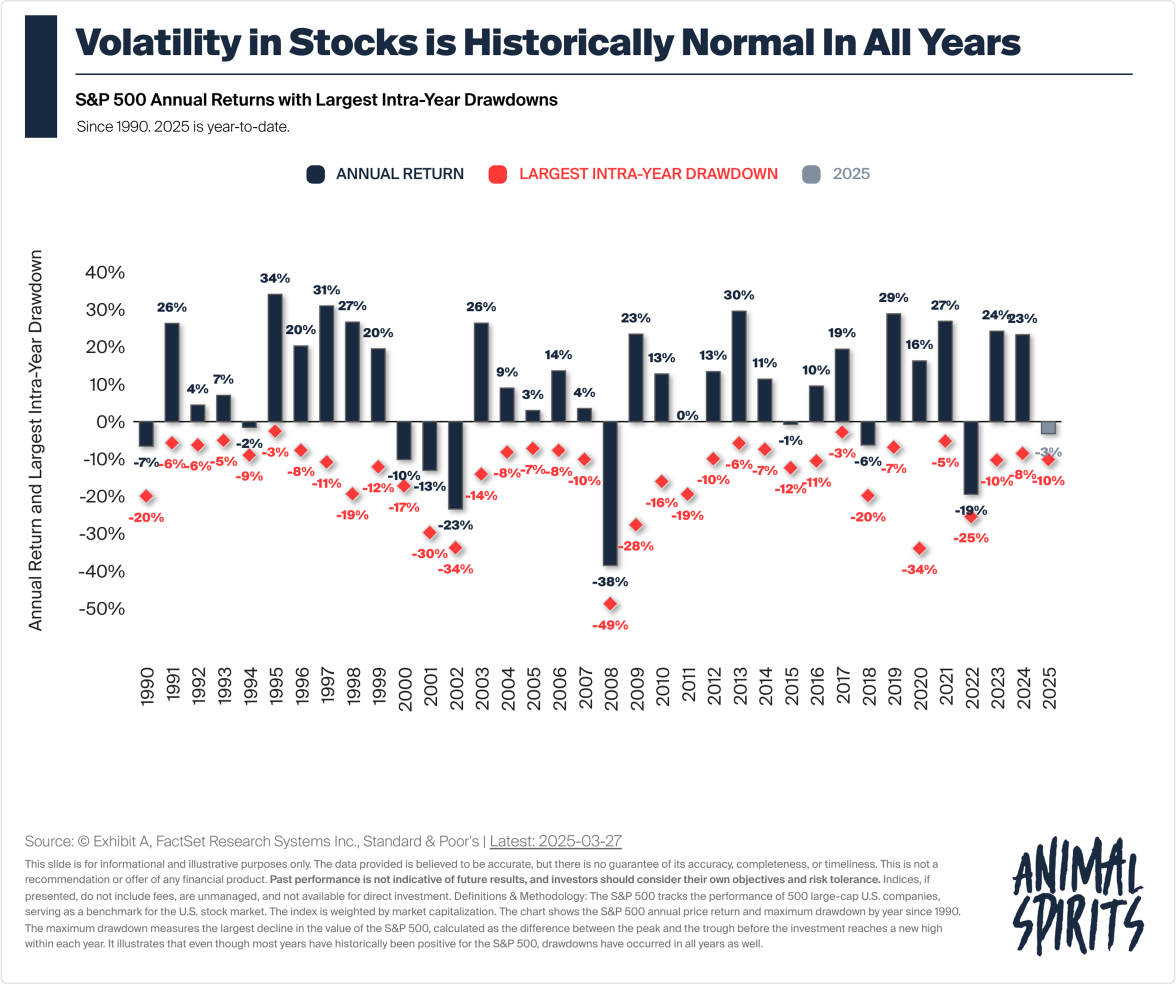

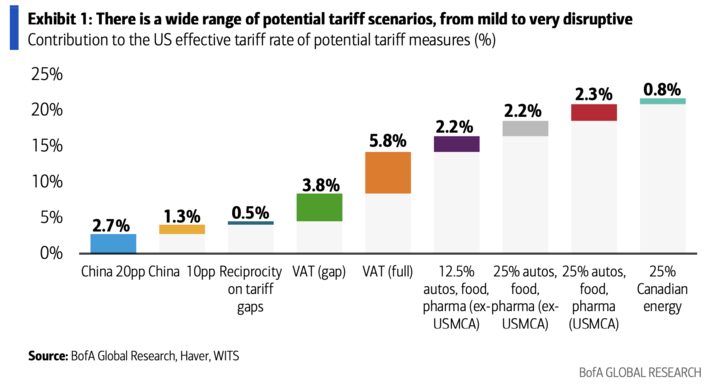

Institutions are showing confidence in Bitcoin despite the global market uncertainty around US President Donald Trump’s looming tariff announcement, which may create significant volatility in both crypto and traditional markets.

“Risk appetite remains muted amid tariff threats from President Trump and ongoing macro uncertainty,” Nexo dispatch analyst Iliya Kalchev told Cointelegraph.

The April 2 announcement is expected to detail reciprocal trade tariffs targeting top US trading partners, a development that may increase inflation-related concerns and limit demand for risk assets like Bitcoin.

Magazine: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – March 1