Meet the Historically Boring Asset That Has Risen 610% Since 2000 and Crushed the S&P 500 Index

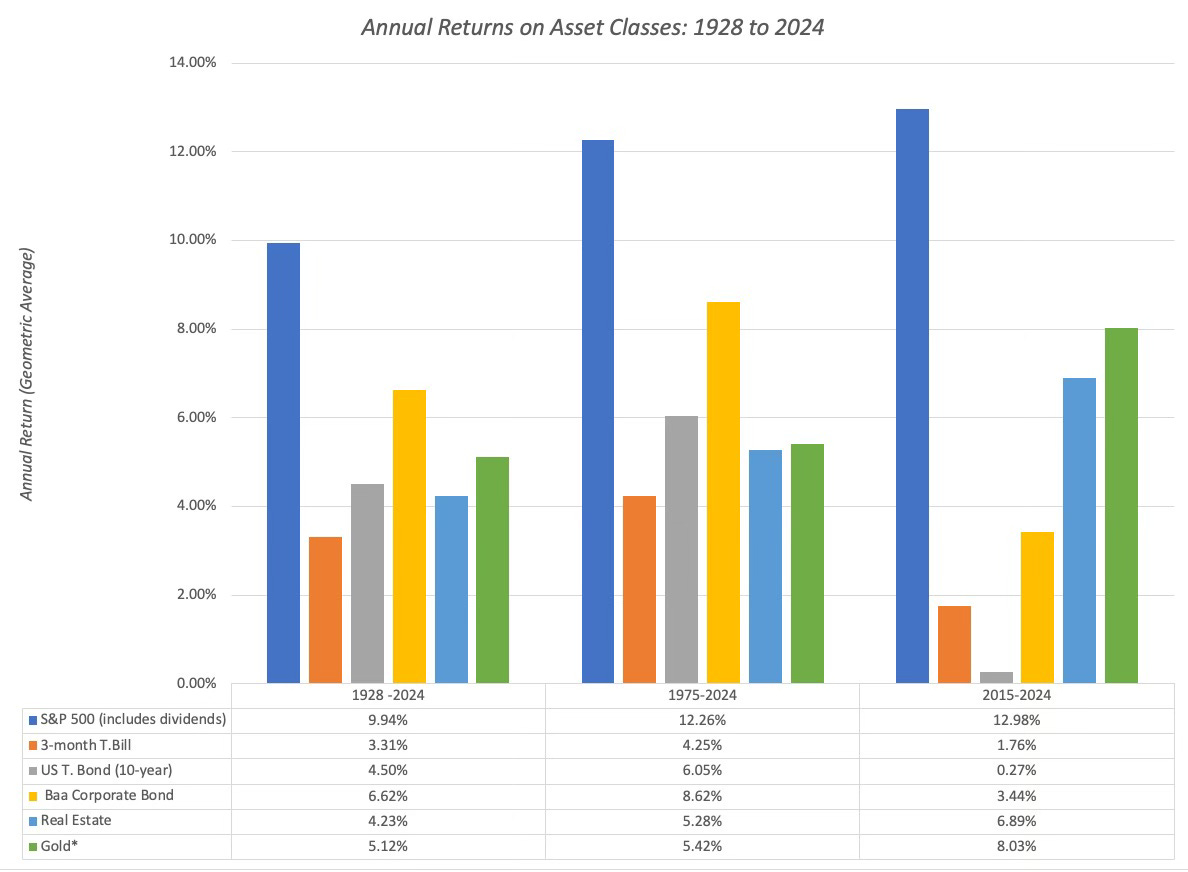

Stocks have always been viewed as the more aggressive investment that carry more risk but generate higher returns compared to safer assets like bonds. A traditional portfolio calls for 60% of capital allocated toward equities and 40% toward bonds. Younger investors are now encouraged to be more aggressive toward stocks earlier in their lives due to longer life expectancies and the higher cost of living.But as most investors know, things don't always go as planned, and sometimes even the most unlikely of assets can outperform. After a sizable run over the past few years, driven by a myriad of different factors, a historically boring asset in the form of an exchange-traded fund is now up 610% since 2000 and is crushing the broader S&P 500 index. Let's take a look.Several years ago, if you had told many investors that SPDR Gold Shares (NYSEMKT: GLD) would surpass $315 and an ounce of gold would surpass $3,400, they might have laughed. But that's exactly what has happened, thanks in particular to an incredibly strong couple of years for the commodity. Gold is up some 26% this year, 43% over the past 12 months, and about 88% over the last five years. It's also crushed the broader stock market since 2000.Continue reading

Stocks have always been viewed as the more aggressive investment that carry more risk but generate higher returns compared to safer assets like bonds. A traditional portfolio calls for 60% of capital allocated toward equities and 40% toward bonds. Younger investors are now encouraged to be more aggressive toward stocks earlier in their lives due to longer life expectancies and the higher cost of living.

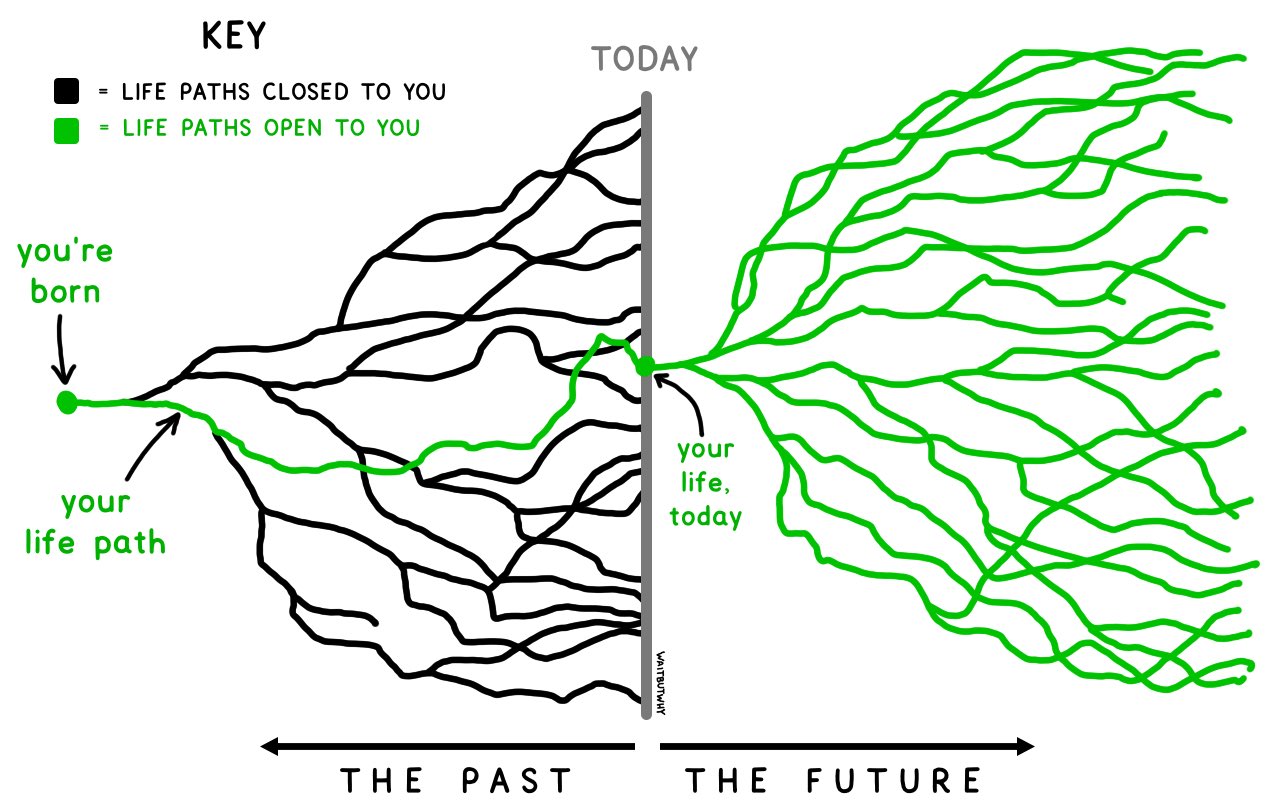

But as most investors know, things don't always go as planned, and sometimes even the most unlikely of assets can outperform. After a sizable run over the past few years, driven by a myriad of different factors, a historically boring asset in the form of an exchange-traded fund is now up 610% since 2000 and is crushing the broader S&P 500 index. Let's take a look.

Several years ago, if you had told many investors that SPDR Gold Shares (NYSEMKT: GLD) would surpass $315 and an ounce of gold would surpass $3,400, they might have laughed. But that's exactly what has happened, thanks in particular to an incredibly strong couple of years for the commodity. Gold is up some 26% this year, 43% over the past 12 months, and about 88% over the last five years. It's also crushed the broader stock market since 2000.