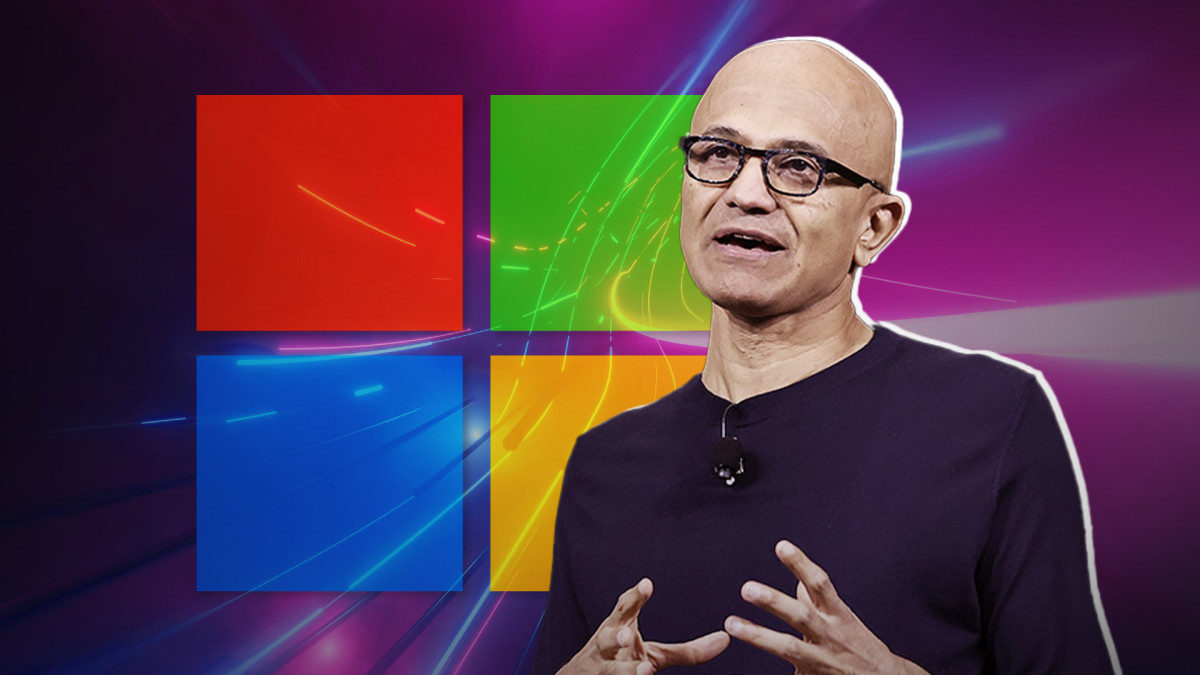

Major tech company CEO reveals surprising upside of tariffs

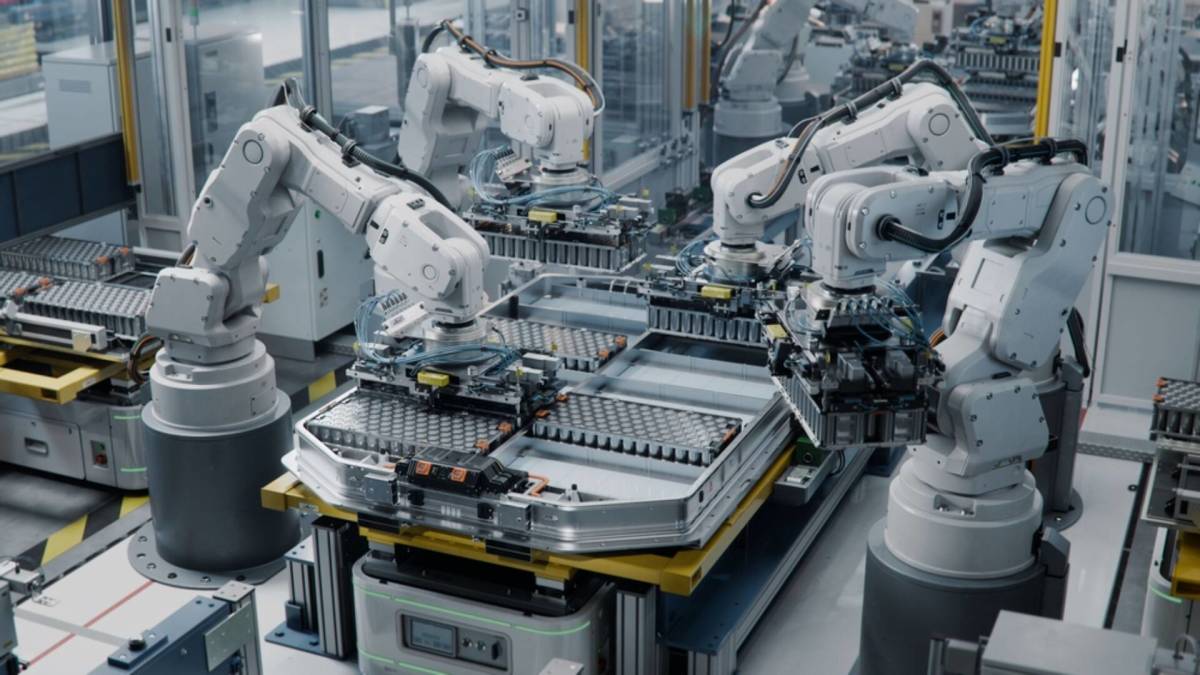

A top tech executive says recent tariff changes are driving renewed urgency in US battery production.

The on-again, off-again tariff game continues. May 12 saw a major, yet temporary, relief for many industries, but especially technology.

That’s when the U.S. and China agreed to temporarily decrease tariffs in an effort to diminish the trade war between them. Under the new deal, the U.S. will lower its average tariffs on Chinese products from 145% to 30%, while China will decrease its duties on American goods from 125% to 10%, according to the joint statement.

Related: Apple iPhone decision will upset customers, appease White House

The agreement couldn’t have come at a better time, considering that many companies have been building up supplies as a way to prepare for the upcoming high tariffs. In the first quarter of 2025, U.S. imports of lithium-ion batteries from China grew by 10%, writes PV Magazine, citing CEA.

Further, the tariff plans have already caused major carmakers like Honda (HMC) , Toyota (TM) , and Nissan (NSANY) to drop their plans for battery plants and investments outside of the U.S.

Could this be good news for some of the U.S.-based battery producers?

Panasonic’s recent strategic moves

Panasonic Holdings Corporation (PCRFF) is one of the world’s largest battery makers. It ranks sixth among the 10 top EV battery makers based on 2024 market share, according to South Korean market research firm SNE Research. The list has been dominated by Chinese and Korean companies.

Over the recent years, Panasonic has been betting big on Tesla Inc. (TSLA) from the early days of the electric vehicle (EV) market. However, there’s been a recent slowdown in EV demand, which has affected Panasonic’s battery business, as the company has been one of the main suppliers of Tesla, Mazda, and Subaru.

More Automotive:

- Detroit automakers warn UK trade deal will hurt US auto industry

- Former Nissan CEO makes a harsh prediction for the company's future

- Toyota makes decision on popular crossover US customers will love

Other recent challenges, including fierce competition from Chinese companies such as Haier and Midea, have also impacted the company’s electronics sector (TVs, refrigerators, microwaves, and similar products), writes NDTV World.

On May 9, the company announced it will cut 10,000 staff globally, with half of the jobs eliminated in Japan, and half overseas. The layoffs account for about 4% of its global workforce of around 230,000 employees, reported Reuters.

The electronic giant’s restructuring move aims to enhance profitability and achieve a 10% return on equity by the fiscal year ending in March.

CEO says key customer is urging faster production of U.S.-made batteries

Panasonic CEO Yuki Kusumi recently said its main customer (most likely Tesla) is urging the company to accelerate the start of production at its new Kansas plant, reported Financial Times.

“As we’ve been told by our customer to get Kansas moving quickly, we’re hurrying to do so,” Kusumi said in an interview in Tokyo. While he did not directly mention Tesla, the EV giant was Panasonic’s biggest customer for a long time.

The desire to accelerate supplies of Panasonic’s American-made products stems from U.S. tariffs that have made Chinese batteries less profitable to bring to the country.

Kusumi mentioned that the customer is thinking about switching from Chinese-made batteries to domestically produced ones, as this move could make their electric vehicles eligible for U.S. consumer tax credits.

For about eight years, the tech giant has been producing batteries in Nevada, supporting Tesla in boosting production and sales of Tesla’s Model 3 and Model Y vehicles, writes The Japan Times.

The Kansas battery factory has been under construction since 2022, and it is expected to reach mass production by March 2027, when it will lift its production capacity by 60%.

While Panasonic is urged to speed up the production start at its second U.S. factory in Kansas, the company is halting plans for a third plant.

"The talk of a third factory was based on anticipation of large-scale EV adoption, but I doubted we’d see a quick transition, especially in the U.S., because of issues such as charging infrastructure, battery cost, and reliability,” Kusumi said as reported by The Japan Times. "As things stand now, I’m relieved we didn’t move forward with securing a location for a third factory.”

Related: Elon Musk gets devastating news as the 'anti-Tesla' catches on

Kusumi also discussed the possibility of lower demand for EVs, especially at a time when Tesla’s CEO Elon Musk has been a target of many unsatisfied U.S. citizens who are against Trump’s politics and Musk’s leadership of the Department of Government Efficiency.

Protests had sometimes even reached the point of vandalism, with Tesla vehicles being set on fire. Tesla’s first-quarter automotive sales dropped 20% year over year.

Still, Kusumi remains optimistic. “There are risks, but we are planning on robust demand for batteries from our main customer as of now,” he said.