Lucid Group Still a Wreck Despite Record Production and Deliveries

Despite Lucid Group (NASDAQ:LCID) driving higher after hours following its fourth-quarter earnings report that was released on Tuesday, Feb. 25, the stock crashed when the markets opened, tumbling 12%. Although Lucid beat analyst expectations for the quarter, the results still paint a messy picture of a luxury electric vehicle (EV) maker struggling to live up […] The post Lucid Group Still a Wreck Despite Record Production and Deliveries appeared first on 24/7 Wall St..

Despite Lucid Group (NASDAQ:LCID) driving higher after hours following its fourth-quarter earnings report that was released on Tuesday, Feb. 25, the stock crashed when the markets opened, tumbling 12%.

Although Lucid beat analyst expectations for the quarter, the results still paint a messy picture of a luxury electric vehicle (EV) maker struggling to live up to its hype. While Lucid has some bright spots, the risks are crushing, and its future still looks shaky unless it turns things around fast. That isn’t likely.

Lucid Group (LCID) beat analyst expectations in the fourth quarter, producing and delivering more luxury EVs than at any other time in its history.

The growth is illusory, though, as the threat of the industry losing federal tax credits and incentives likely pulled sales forward.

Lucid is still generating significant losses, with little hope of turning it around, meaning further cash infusions will be needed.

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

24/7 Wall St. Insights:

Sales motoring higher

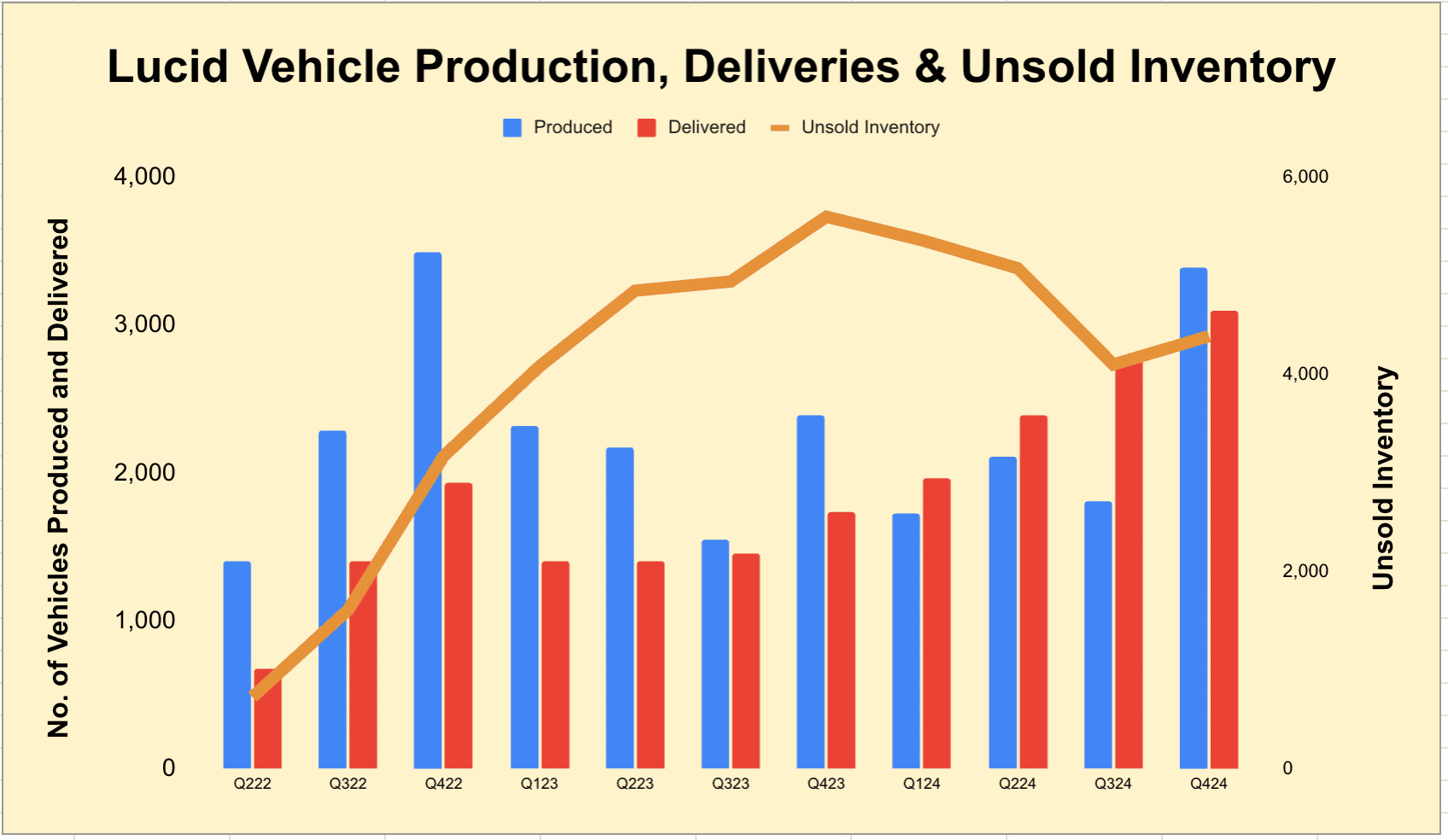

Lucid posted revenue of $234.5 million, a 49% increase from last year, smashing through the $200.5 million Wall Street was expecting. The luxury EV maker produced 3,386 vehicles and delivered 3,099 in the quarter, with full-year 2024 deliveries hitting 10,241, up 71% from 2023, while production of 9,029 vehicles just met its 9,000-vehicle guidance.

That’s solid growth for a niche luxury EV player. Lucid also launched the Lucid Gravity SUV, aiming for production scale in 2025, and set a pretty ambitious 2025 production target of 20,000 vehicles — double last year’s output. Its $7.89 billion market cap and $5.16 billion in liquidity as a result of ongoing cash infusions from the Saudi Arabian government, shows it still has plenty of cash to burn.

CEO Peter Rawlinson also stepped down from day-to-day oversight of the vehicle maker to assume a role as “strategic advisor,” helping lift investor hopes of a turnaround as interim CEO Marc Winterhoff is viewed as a fresh start for scaling Gravity and Lucid’s midsize platforms.

Hitting the brakes

But don’t get too excited. Lucid’s risks are massive and could sink it. While its fourth-quarter net loss of $397.2 million was better than the $716.3 million analysts were estimating, it was far worse than last year’s $159.9 million. The performance shows Lucid is still bleeding cash.

For the full year, Lucid Group lost $2.97 billion, 12.2% wider than in 2023, with operating losses expanding to $732.9 million in Q4. Research and development costs hit $1.18 billion in 2024, up 26% year-over-year, mostly for Gravity, and its operating expenditures remain a drain, with no clear path to profitability.

Lucid still has thousands of unsold vehicles on dealer lots even as it plans to double production numbers. Despite the better traction it saw in the fourth quarter, which likely was a result of sales being pulled forward due to President Trump promising to eliminate tax credits and other EV subsidies. It’s a performance that will be hard to replicate.

The coming car wreck

Let’s be clear. Lucid’s 20,000-vehicle target for 2025 is a stretch. Production issues, supply chain snags, and dying EV demand could easily derail it, especially with Tesla (NASDAQ:TSLA) cutting prices. Tesla also plans to release the Model Q this year, a low-cost EV starting under $30,000. Lucid also plans to release a new, cheaper model starting under $50,000. That’s better, but still pricey.

Also, Lucid’s liquidity is strong at the moment, but won’t last forever and it will undoubtedly need additional cash infusions by 2026 as losses persist. The Saudi Public Investment Fund (PIF), owns 60% of Lucid, and might push for more funding, but geopolitical tensions or oil price swings could tighten its purse strings.

Ramping up Gravity production will also cause costs to spike in the first half of 2025, while management admits seasonal first-quarter dips could hit hard.

Competition is fierce, too, and Lucid’s niche luxury focus risks alienating buyers if gas prices drop as there will be few if any federal incentives available to lure buyers in

Key takeaway

Lucid’s promising fourth-quarter results are illusory. Scaling Gravity production as demand dries up makes cutting costs hard. Losses, demand uncertainty, and cash burn will lead to another crash if (and when) it stumbles. LCID stock isn’t a sure bet and is at best a high-risk stock that needs a miracle to pay off.

The post Lucid Group Still a Wreck Despite Record Production and Deliveries appeared first on 24/7 Wall St..