L’Oréal posts ‘solid’ +5.1% sales growth in challenging market; acquires minority stake in Amouage

“We delivered solid, broad-based growth of +5.1%, once again outperforming the global beauty market. Excluding North Asia, where the Chinese ecosystem remained challenging, sales advanced in high single digits,” says CEO Nicolas Hieronimus.

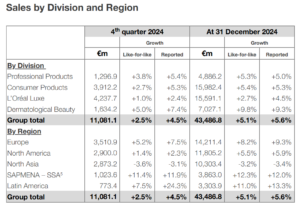

French beauty products group L’Oréal yesterday posted a +5.6% (reported; +5.1% like-for-like) year-on-year sales growth to €43.47 billion in what it called “another year of outperformance in a normalising global beauty market”.

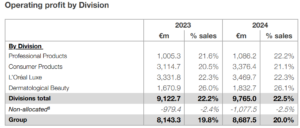

L’Oréal generated like-for-like growth in all divisions with three out of four outperforming the market. The group posted like-for-like growth in all regions except North Asia, which was negatively affected by travel retail challenges in China and South Korea (see below).

In Mainland China, beauty market growth was negative, strongly impacted by the softness in the selective segment. In this challenging context, L’Oréal demonstrated its resilience, posting a low single-digit decline in sales, the company said.

In travel retail, given that sell-out continued to be under significant pressure, notably in Hainan, focus remained on securing healthy inventory levels, the group noted {look out for more details after the L’Oréal earnings call}.

L’Oréal revealed it has recently acquired a minority stake in Omani fragrance Amouage, becoming a long-term minority investor. Following the transaction, SABCO remains Amouage’s majority shareholder.

“Founded in Oman in 1983, to be ‘The Gift of Kings’, Amouage has redefined the Arabian art of perfumery, garnering a global reputation for bringing innovative modernity and true artistry to all its creations, today present in the world’s finest luxury sales points,” said of its new minority interest.

L’Oréal Luxe grew +4.5% reported (+2.7% like-for-like), reinforcing its worldwide leadership in luxury beauty. Outside North Asia, it grew at a “remarkable”, double-digit pace, the company said.

The single largest growth contributor was North America, where it became the number one luxury beauty player for the first time, a position it already holds and further consolidated in China, Europe and emerging markets.

This allowed the division to more than offset the ongoing softness in North Asia, where operating conditions remain “challenging” and where it continued to grow ahead of the market both offline and online. This driven by the successful expansion of couture brands Prada and Valentino – recently launched in the region – and recent acquisitions Aesop and Takami.

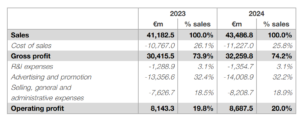

The group achieved a record operating margin at 20.0% (+20bps and +40bps excluding Aesop).

CEO Nicolas Hieronimus said: “We delivered solid, broad-based growth of +5.1%, once again outperforming the global beauty market. Excluding North Asia, where the Chinese ecosystem remained challenging, sales advanced in high single digits. I am particularly proud of the quality of the P&L management as the Group achieved record gross and operating margins. At 20%, the latter increased 20 basis points.

“On a comparable basis, excluding Aesop, our operating margin grew 40 basis points and that after a 10 basis points increase in our brand fuel.

“2024 was a defining year as we made L’Oréal future fit and laid many foundations for our next conquests: we augmented our marketing and R&I capabilities with AI and tech, advanced with the harmonisation of our IT, simplified our organisational structures, and strengthened our industrial and supply chain resilience.

“We also continued to sharpen our portfolio: we acquired the Miu Miu licence and Korean brand Dr.G, and took minority stakes in Galderma and Amouage.

“This will allow us to go ever faster and further in our conquest of new beauty spaces: geographic, demographic and highly promising technologies that offer innovative science-based beauty solutions to the consumer of tomorrow.

“In 2025, as we take the first steps in this conquest, we remain optimistic about the outlook for the global beauty market, and confident in our ability to keep outperforming it and to achieve another year of growth in sales and profit. We expect growth to accelerate progressively, supported by our beauty stimulus plan, which will be driven by an exciting pipeline of new launches and continued strong brand support.”