Live Market Update S&P 500 (SPY): Buoyed by Defense Stocks, Markets Try to Rebound from Monday’s Disaster

“Treasury yields climbed. Oil prices slid. Gold hit a new record.” That’s how The Wall Street Journal summed up market action on Monday, a day that saw the Dow Jones Industrial Average plunge a sickening 972 points. As markets reopen Tuesday, investors are looking for a bounce, even if only of the dead cat variety. […] The post Live Market Update S&P 500 (SPY): Buoyed by Defense Stocks, Markets Try to Rebound from Monday’s Disaster appeared first on 24/7 Wall St..

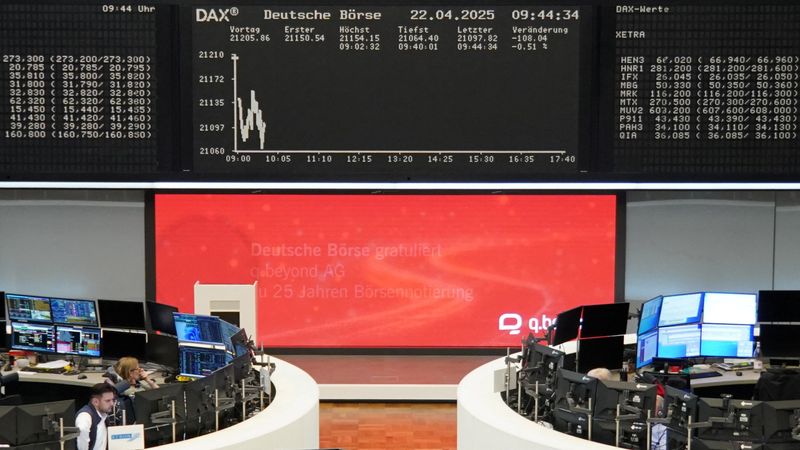

“Treasury yields climbed. Oil prices slid. Gold hit a new record.” That’s how The Wall Street Journal summed up market action on Monday, a day that saw the Dow Jones Industrial Average plunge a sickening 972 points. As markets reopen Tuesday, investors are looking for a bounce, even if only of the dead cat variety.

Here’s how major market indices are performing at the open:

Dow Jones Industrial Average: Up 1%.

Nasdaq Composite: Up 1.2%.

S&P 500: Up 1%.

The Vanguard S&P 500 ETF (NYSEARCA: VOO) is up 1.2%.

Earnings

Earnings season is in full swing, and positive reports from big companies could assist with the rebound. Early reports suggest positive news from aerospace and defense giants GE Aerospace (NYSE: GE), Lockheed Martin (NYSE: LMT), and RTX Corporation (NYSE: RTX).

All three companies reported earnings beats this morning, with GE turning in a $1.48 per share adjusted profit on sales of $9.9 billion, Lockheed reporting $7.28 per share in profit on $18 billion in sales, and RTX saying it earned $1.47 on $20.3 billion. At the same time, all three of these companies also warned that their full-year 2025 earnings could come in a bit below consensus forecasts, potentially spooking forward-looking investors.

Of further concern, fellow Northrop Grumman (NYSE: NOC) missed earnings badly this morning, and lowered its forecast to boot. The company still expects to earn more than $25 per share this year, but Wall Street analysts were hoping for more than $28.

Analyst Calls

Perhaps dismayed by yesterday’s selloff, Wall Street analysts are broadly reining in their optimism this morning, with few upgrades on offer. Among these, Bank of America upgraded Public Storage (NYSE: PSA) to buy on confidence in the personal storage sector, while Citigroup is seeking value south of the border in PagSeguro (NYSE: PAGS) as it shifts from emphasizing revenue growth to profitability.

Less auspiciously, Barclays downgraded Texas Instruments (NYSE: TXN) to underweight on margin concerns. Goldman Sachs cut Macy’s (NYSE: M) to neutral, and HSBC is a bit late to the game in downgrading UnitedHealth Group (NYSE: UNH) after its big earnings disappointment last week.

The post Live Market Update S&P 500 (SPY): Buoyed by Defense Stocks, Markets Try to Rebound from Monday’s Disaster appeared first on 24/7 Wall St..