Lemonade Answering the Biggest Questions

Here's our initial take on Lemonade's (NYSE: LMND) fourth-quarter results.For much of its existence as a public company, Lemonade has steadily delivered solid growth in new customers and policies and increased its per-customer premiums (meaning customers are paying up for multiple policies and more expensive home and auto). However, it has struggled to actually be a good insurance underwriter, regularly reporting gross loss ratios -- a measure of what's left from premiums after claims have been paid -- well above the long-term goal of 75%.Well, it just continued to give us an answer to the "can they fix this" question, reporting a gross loss ratio of 63% in the fourth quarter, marking a continued improvement in this critical metric and even better than the 73% loss ratio it reported in Q3. It also reported a 26% increase in in-force premium to $944 million, a 5% increase in premium per customer, and a 20% increase in its customer count.Continue reading

Here's our initial take on Lemonade's (NYSE: LMND) fourth-quarter results.

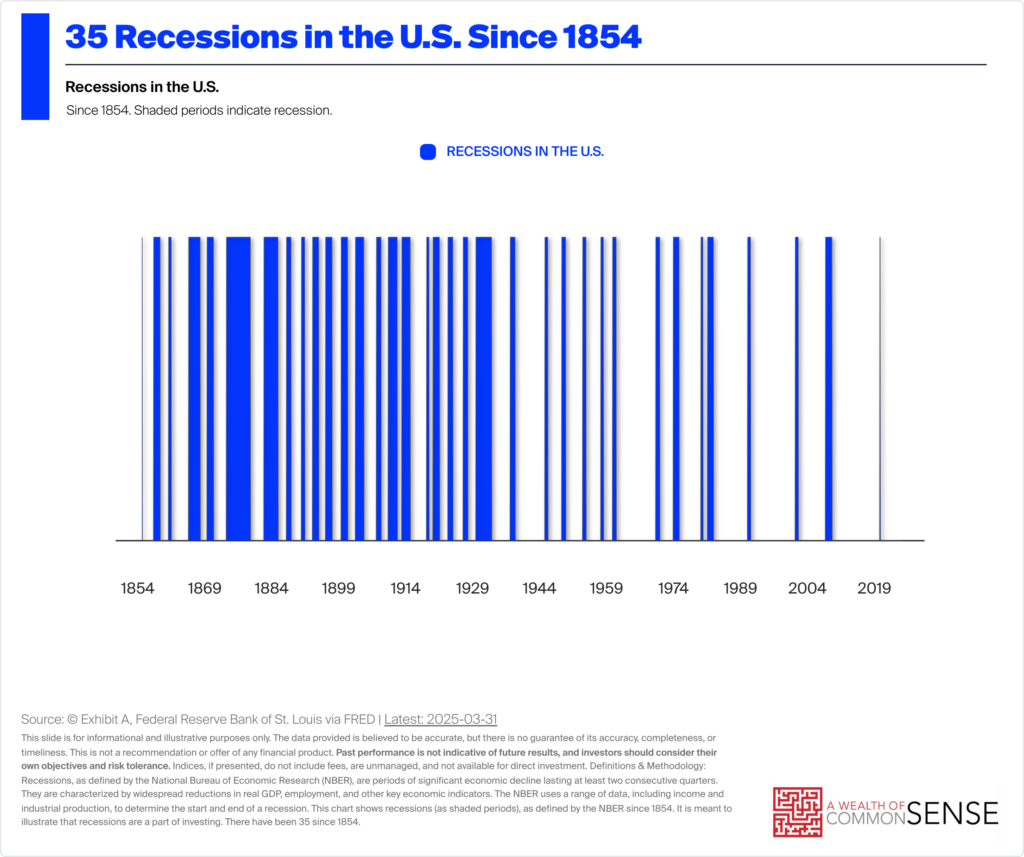

For much of its existence as a public company, Lemonade has steadily delivered solid growth in new customers and policies and increased its per-customer premiums (meaning customers are paying up for multiple policies and more expensive home and auto). However, it has struggled to actually be a good insurance underwriter, regularly reporting gross loss ratios -- a measure of what's left from premiums after claims have been paid -- well above the long-term goal of 75%.

Well, it just continued to give us an answer to the "can they fix this" question, reporting a gross loss ratio of 63% in the fourth quarter, marking a continued improvement in this critical metric and even better than the 73% loss ratio it reported in Q3. It also reported a 26% increase in in-force premium to $944 million, a 5% increase in premium per customer, and a 20% increase in its customer count.