I’ve got $37k in savings and Dave Ramsey thinks I should use it to pay these 2 things off

Popular podcast host and money management advisor Dave Ramsey made his own fortune many years ago. More than from any personal possessions, he admittedly derives his greatest satisfaction from providing advice and help to others if he can bring his experience and knowledge to bear. While a good many callers to Ramsey’s show are people […] The post I’ve got $37k in savings and Dave Ramsey thinks I should use it to pay these 2 things off appeared first on 24/7 Wall St..

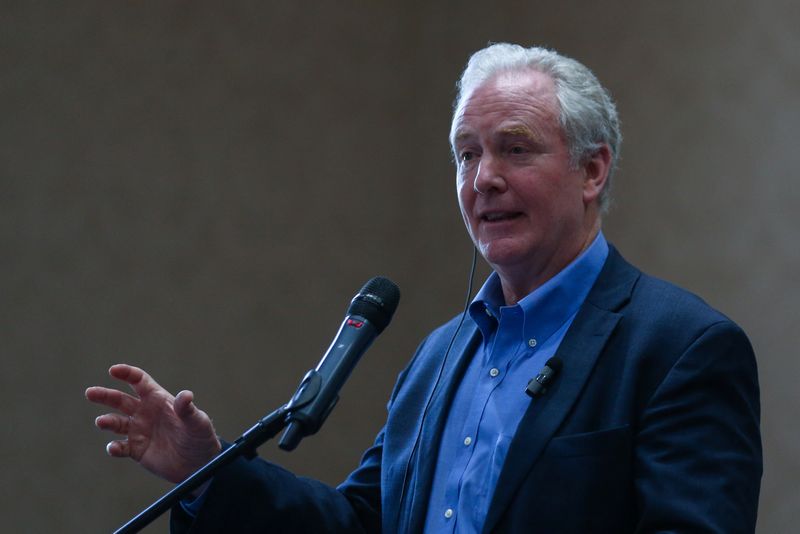

Popular podcast host and money management advisor Dave Ramsey made his own fortune many years ago. More than from any personal possessions, he admittedly derives his greatest satisfaction from providing advice and help to others if he can bring his experience and knowledge to bear.

While a good many callers to Ramsey’s show are people with questions regarding retirement fund management, paying for kids’ education, and other money management questions, an overarching principle and cornerstone of his strategies is the elimination and avoidance of debt. Ramsey shares the opinion of many of his peers in that regard. The accrual of debt and interest on the debt is the single most barrier towards building wealth.

Dave Ramsey’s principles don’t only apply to those managing a medium to large nest egg. Even student aged people with meagre savings who are just starting out and looking to get married can benefit from his advice. A young caller to his show, still a college student, was also a beneficiary.

Key Points

-

Popular financial advisor and podcast host Dave Ramsey specializes in money management tips and in helping people with multi-layered financial issues.

-

One of Ramsey’s fundamental principles in building wealth is to avoid incurring debt in all forms, as accrued interest owed can become a perpetual obstruction towards any wealth accumulation goals.

-

Dave Ramsey’s precepts can help young people with minimal savings and assets equally as well as wealthier people with larger amounts of funds.

-

4 million Americans are set to retire this year. If you want to join them, click here now to see if you’re behind, or ahead. It only takes a minute. (Sponsor)

The Car Lease Debt Trap

The caller, who was likely in her early 20’s, was planning to get married. She had married to build up some savings, and she wanted to ask Dave Ramsey for advice on the best use of her savings, based on her and her fiance’s financial situation. The details included:

- She had $37,000 in savings.

- The caller was engaged to be married.

- She leases her car for $300 per month.

- The lease on the car still has 18 months to go.

- The caller is a sophomore in school and has 2 years left to graduate.

- She plans to use $15,000 of savings for the remainder of her school tuition.

- The fiance also has college debt outstanding of $40,000.

- The prospective in-laws and their son are paying for the wedding

- Both the caller and her fiance each earn $35-40,000 annually for a combined $70,000-$80,000 joint income.

Sage Advice

Ramsey identified the most crucial targets to tackle first as the car loan and the fiance’s student loan debt. He noted that car leases are one of the biggest obstacles to wealth building, and it’s better to buy the car than to lease it and not own it as an asset at the end of the day.

- Any extra money that the fiance has or earns above the cost of his share of the wedding should be focused on the student loan debt, after they are officially married.

- The balance on the buyout value of the car left on the lease is $13,000, after rental fees up to date are factored into the total cost. Ramsey suggests exercising that from the remaining $22,000 in savings after her $15,000 of college fees are deducted.

- Once the caller owns her car free and clear, she can then offer her remaining $9.000 to her new husband to help pay off his student loan.

The Broader Perspective

Dave Ramsey’s answers to questions are usually delivered in a no-nonsense, “things to do” checklist fashion that contains a bit of humor and a paternal touch. However, he doesn’t often elaborate on the bigger principles and philosophies that inform his advice suggestions, saving those for the moments when he can articulate his Christian faith and anecdotes from his own life.

The advice that he gives to the caller, which could effectively wipe out her current savings, is predicated on several factors:

- Due to her young age and that of her fiance, they have plenty of years left to rebuild their savings as they build their wedded life together;

- Both of them are gainfully employed, with a joint $80,000 income – more than sufficient to restore and grow a new nest egg;

- Debt overhangs pose a bigger problem for the couple down the road than any other financial threat, so elimination of any current debt before it can escalate higher is the most urgent priority.

The post I’ve got $37k in savings and Dave Ramsey thinks I should use it to pay these 2 things off appeared first on 24/7 Wall St..