Is Kinsale Capital Group a Stock to Buy and Hold Forever? Here's Why It Could Be.

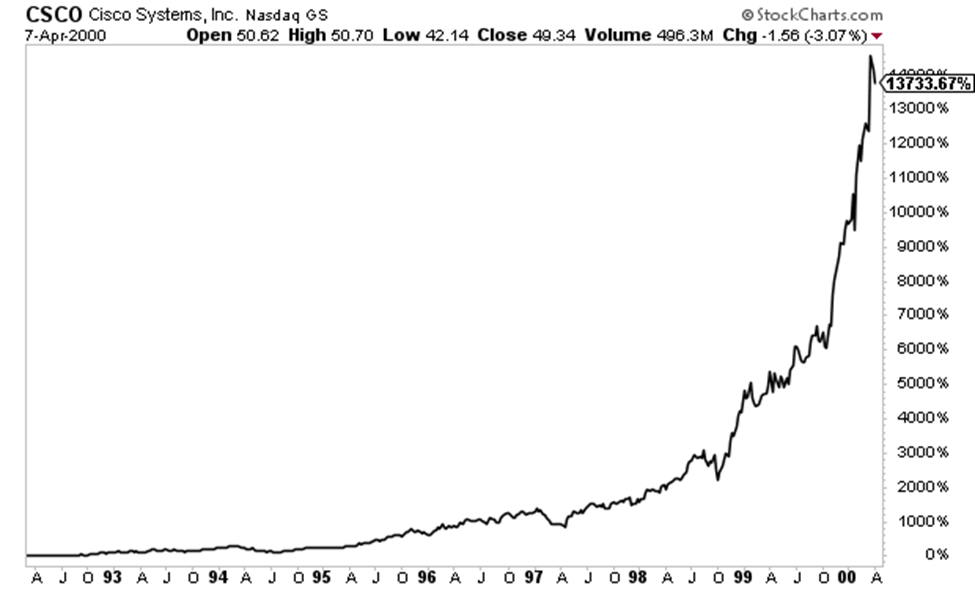

Kinsale Capital Group (NYSE: KNSL) isn't your everyday insurance company. Instead of specializing in auto insurance, life insurance, or other common types, Kinsale specializes in the unusual. It is the only pure-play specialty insurance company that is publicly traded, and it focuses on insurance for unusual situations and hard-to-assess risks.Specialty insurance -- formally known as excess and surplus lines (E&S) in insurance terms -- is a difficult business. But it can be highly lucrative for companies that are good at it, and Kinsale certainly is. It has unheard-of profitability metrics, with impressively low loss ratios and expense ratios, driven by the company's proprietary technology platform.Kinsale went public in 2016 and has produced a positive return for shareholders every year since then. It continues to grow rapidly more than 15 years after its inception, with 30% revenue growth over the past 12 months. In all, investors have been handsomely rewarded with a total return of more than 2,300% since the 2016 initial public offering, better than 10 times the total return of the S&P 500 in the same period.Continue reading

Kinsale Capital Group (NYSE: KNSL) isn't your everyday insurance company. Instead of specializing in auto insurance, life insurance, or other common types, Kinsale specializes in the unusual. It is the only pure-play specialty insurance company that is publicly traded, and it focuses on insurance for unusual situations and hard-to-assess risks.

Specialty insurance -- formally known as excess and surplus lines (E&S) in insurance terms -- is a difficult business. But it can be highly lucrative for companies that are good at it, and Kinsale certainly is. It has unheard-of profitability metrics, with impressively low loss ratios and expense ratios, driven by the company's proprietary technology platform.

Kinsale went public in 2016 and has produced a positive return for shareholders every year since then. It continues to grow rapidly more than 15 years after its inception, with 30% revenue growth over the past 12 months. In all, investors have been handsomely rewarded with a total return of more than 2,300% since the 2016 initial public offering, better than 10 times the total return of the S&P 500 in the same period.