I’m in my late 30s with a $14 million net worth and I’m struggling to figure out what comes next

A Reddit user is in his late 30s with around $14 million, and he’s trying to decide what he should do with his life and with his money. He left his job and doesn’t think he wants to work full-time anymore, although he is considering doing some part-time work. He also isn’t sure how best […] The post I’m in my late 30s with a $14 million net worth and I’m struggling to figure out what comes next appeared first on 24/7 Wall St..

Key Points

-

A Reddit poster has $14 million even though he is only in his 30s.

-

He’s not sure what his next move should be, since he doesn’t want to return to work and isn’t sure how to handle his investments.

-

Many Reddit posters suggested that he simplify since his wealth will grow on its own.

-

Want to end up a multi-millionaire but not sure how to get there? SmartAsset’s free tool can match you with a financial advisor in minutes to help you make your goals a reality. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

A Reddit user is in his late 30s with around $14 million, and he’s trying to decide what he should do with his life and with his money. He left his job and doesn’t think he wants to work full-time anymore, although he is considering doing some part-time work. He also isn’t sure how best to manage his investments to make the most of them.

Here’s what the Reddit user has going on, along with some details about the best way to figure out what should come next for him.

Start by looking at the current numbers

Whenever you’re trying to decide your next financial move, it’s helpful to look at your current situation. So, let’s take a closer look at what the Redditor has going on right now.

He explained that he has two children, both of whom are under the age of five. His wife has a steady government job that pays $150K per year, which is enough to cover the couple’s expenses. She also has a pension, and her pay goes up 3% to 4% per year. Her income is high enough that it can meet the couple’s spending needs, as they’ll only have around $100,000 in costs once they can stop paying for daycare.

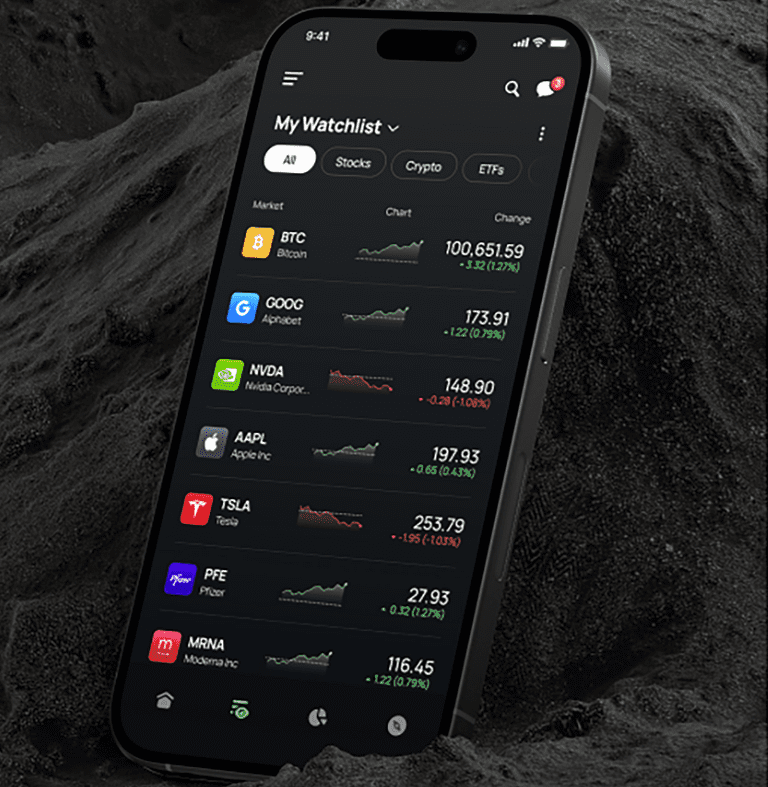

As for the rest of his assets, he has $6 million in taxable equities; $1 million in a Roth and a few hundred thousands in other retirement plans; $3 million in private funds, a $2 million primary home, and a $2 million commerical property that generates $150,000 in gross rental income annually.

So, with his $14 million net worth, he’s obviously doing pretty well. However, he is not certain whether he wants to keep the commercial property, whether it is reasonable to expect his equity investments will earn 8% average annual returns, whether he should look into alternative investments, and what he should do once the private funds become liquid. He also doesn’t think he wants to return to work.

What’s the best move with this much money?

A number of Redditors gave the original poster (OP) some pretty good advice.

Specifically, many said he should think about how much time the commercial property takes to manage in order to decide whether to sell. And, many posters said that since he’s already “won” by amassing so much wealth at such a young age, his focus now should be to simplify things and to protect and grow what he has — while limiting risk and minimizing hassle.

The fact is, since he is only in his 30s with $14 million, his money will compound and grow plenty on its own even if he doesn’t spend a lot of time managing investments or force himself to take on the task of being a commercial landlord. That’s especially true if the couple continues to live off the wife’s income for a while — and if her pension provides enough money to support them in retirement, which there’s a good chance it will, since government pensions tend to be pretty generous.

An 8% average annual return is entirely reasonable to expect given the historic performance of the S&P 500, and a $14 million investment earning an 8% average annual return over just 10 years would turn into around $30.2 million. That should be more than enough for the OP to leave a very generous legacy for the next generation. Of course, this also means he doesn’t have to work — but he should have a plan for how he will spend his days if he doesn’t. With two young children, being a more present parent could be one option, but the OP will need to decide if that’s a path he wants to take because a full-time at-home parent is a major lifestyle decision.

Regardless, while he has enough money, there’s also nothing wrong with being strategic about where you invest your money and trying to grow it as much as possible, even once you are already rich. Since the OP has said he doesn’t know what to do next, simplifying things could relieve some of the stress of trying to figure it out. Of course, the OP could also turn to a financial advisor for help.

A trusted advisor can help with money management decisions for the OP, providing him with comprehensive solutions that expose him to the right level of risk, minimize his tax burden, and ensure he and his kids will be well taken care of for life. The sooner the OP gets an advisor involved, the easier his life becomes, so he can begin enjoying his wealth while the advisor makes sure it’s growing for him.

The post I’m in my late 30s with a $14 million net worth and I’m struggling to figure out what comes next appeared first on 24/7 Wall St..