I’m a 41 Year Old Guy Who Drives For UPS And Finally Broke $150k a Year

Finding a job that can pay someone without a college degree $150,000 a year sounds like a dream come true. Yet they exist. United Parcel Service (NYSE:UPS), for example, offers just such an opportunity. Full-time delivery drivers earn an average total compensation package of $145,000 per year. Tractor-trailer drivers earn even more, up to $162,000 […] The post I’m a 41 Year Old Guy Who Drives For UPS And Finally Broke $150k a Year appeared first on 24/7 Wall St..

Many people think making a high salary of $150,000 or more without a college degree is impossible.

Yet jobs do exist that offer just that, which opens up unique savings and investment opportunities for motivated individuals.

Earn up to 3.8% on your money today (and get a cash bonus), click here to see how. (Sponsored)

24/7 Wall St. Insights:

Finding a job that can pay someone without a college degree $150,000 a year sounds like a dream come true. Yet they exist.

United Parcel Service (NYSE:UPS), for example, offers just such an opportunity. Full-time delivery drivers earn an average total compensation package of $145,000 per year. Tractor-trailer drivers earn even more, up to $162,000 a year. And both positions come with a host of benefits.

For example, management-paid healthcare means there are no premiums to pay, drivers can earn up to seven weeks of paid vacation, plus an additional 18 days off for holidays, sick leave, and what they call option days. UPS also contributes to a defined-benefit pension plan for each employee.

It’s not exactly easy work, and you’re on the move all day long, but it shows a motivated person can make a better-than-decent living working at Big Brown.

Quickly scaling higher

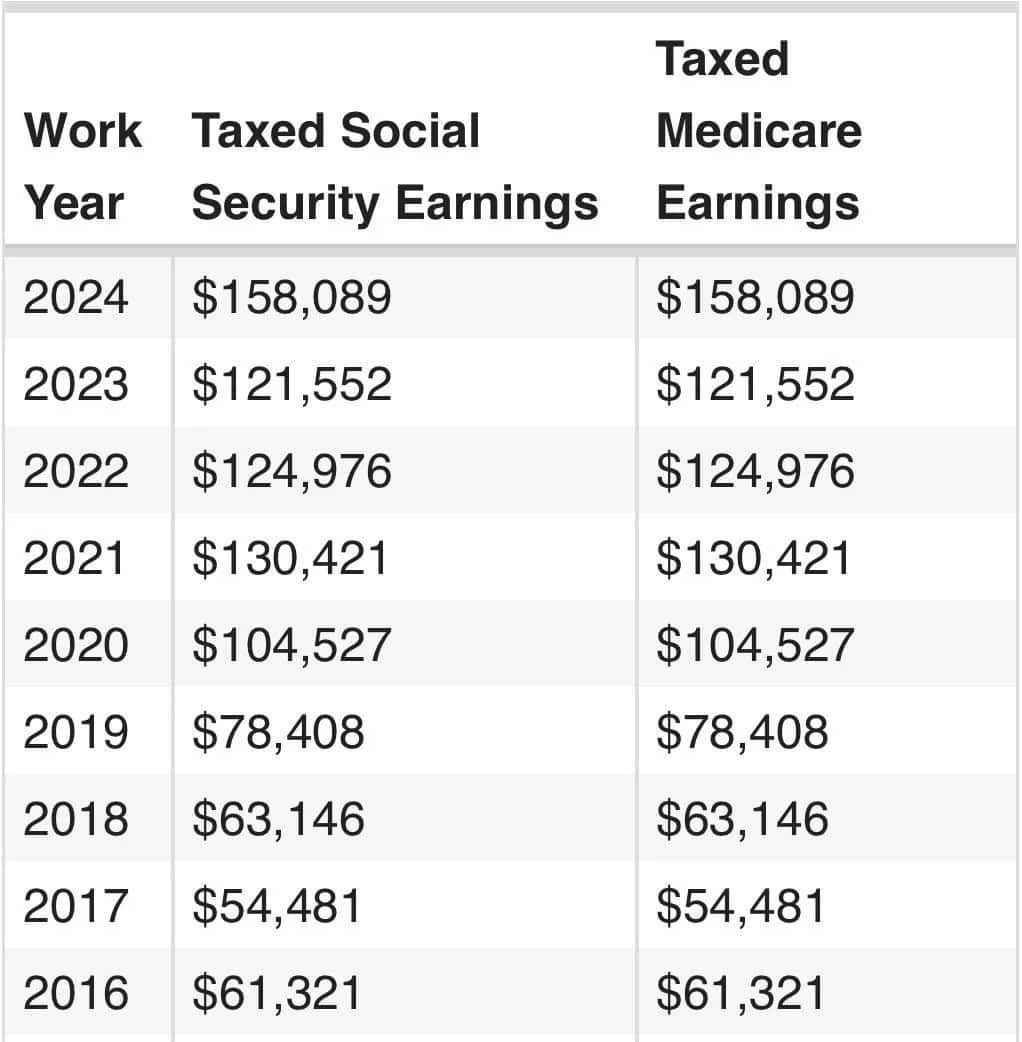

I began looking into this more closely after a Redditor posted a picture of his salary on r/Salary subreddit for the past nine years. It showed that between 2016 and 2024, the tractor-trailer driver’s income experienced remarkable financial growth, as reflected in his taxed Social Security and Medicare earnings.

Starting at $61,321 in 2016, which was in line with national averages at the time, this person’s income surged to $158,089 by 2024, a staggering increase of approximately 2.58 times over this period. That is the equivalent to an average annual growth rate of about 12.5%, which far exceeds typical U.S. wage growth of 2% to 3% annually when adjusted for inflation. This trajectory positions the UPS driver well above the average American earner.

To put this in perspective, the average U.S. salary in 2025 hasn’t increased all the much over the same time frame. Depending upon location and industry, of course, the average U.S. salary is only $60,000 to $65,000.

Where the driver’s income was just above average in 2016, eight years later his earnings placed him in the 91st percentile of U.S. wage earners, where individual incomes start around $140,000 to $150,000.

This leap indicates not only financial success, but also the potential for substantial wealth-building opportunities, though it may come with higher tax burdens and lifestyle pressures.

Watch out below!

There are some anomalies, too. For example, the driver’s salary fell in 2022 and 2023, falling from around $130,000 a year to $121,000. While the decline is unexplained, it could be due to the so-called “freight recession” that occurred around that time.

Freight rates plummeted causing trucking companies to make less money on each load they delivered.Inflation was also gripping the country sending fuel costs soaring. Other expenses like maintenance and insurance also rose.

The rebound in his salary in 2024, a 30% increase from the prior year, could be related to the generous contract the Teamsters union hammered out with UPS management in late-2023.

Whatever the reason, this income growth opens doors for significant savings and investment opportunities, particularly for retirement.

Where the rubber meets the road

Assuming a combined federal and state tax rate of 30%, not unreasonable for a high wage earner, his 2024 after-tax income would be around $110,662. Adopting a conservative savings rate of 25%, he could set aside $27,666 annually for investments or retirement accounts. At 30%, that figure would rise to $33,199.

For retirement, he could maximize contributions to a 401(k), with the 2024 limit at $23,000 for those under 50 (the driver is 41 years old). With his income, he could easily meet this cap, leaving additional funds for other vehicles like IRAs, brokerage accounts, or real estate.

Looking at averages for someone in their financial situation, high earners often save 20% to 30% of their after-tax income, depending on lifestyle. Over time, averaging his income from 2016 to 2024 at about $108,000 annually, after a 30% tax rate, he would have $75,600 after taxes. Saving 25% of that, or $18,900 per year, and investing it at a 7% average annual return (a typical long-term stock market rate), his savings could grow substantially.

Over eight years, without additional contributions, this would accumulate to roughly $259,792, factoring in compound growth. This demonstrates the power of his income to build long-term wealth, provided he maintains disciplined saving habits.

Key takeaways

However, challenges remain. High income brings higher taxes, potential lifestyle inflation, and economic risks like job loss or market downturns. He seems to have experienced that already.

That means he should prioritize diversification, maintain an emergency fund of three to six months of expenses, or $33,000 to $66,000, and leverage tax-advantaged accounts.

Overall, this individual’s financial situation reflects the opportunity to secure a comfortable financial future, but only if he manages it wisely.

The post I’m a 41 Year Old Guy Who Drives For UPS And Finally Broke $150k a Year appeared first on 24/7 Wall St..