I’m 35 and worried about my retirement – how can I get help reviewing my Roth IRA?

Given the amount of pressure we put on people to save for retirement, and the little support we give retirees to survive during retirement, it’s natural to be just a little stressed about your retirement savings. But what can you do? One person wasn’t sure if they were saving enough for their retirement, and got […] The post I’m 35 and worried about my retirement – how can I get help reviewing my Roth IRA? appeared first on 24/7 Wall St..

Given the amount of pressure we put on people to save for retirement, and the little support we give retirees to survive during retirement, it’s natural to be just a little stressed about your retirement savings. But what can you do?

Key Points

-

Trying out outsmart the market by buying stocks individually is a quick way to lose money.

-

It is generally better to rely on investment portfolios designed to mitigate risk and maximize potential returns as you approach retirement.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

One person wasn’t sure if they were saving enough for their retirement, and got stuck in the trap of comparing their savings to the apparent success of others around them. They took their concerns to the people in r/portfolios on Reddit looking for help. Here is what they said.

Please remember that everything in the original thread, and in this article, are opinions. You should always speak to a financial advisor before making any significant decision regarding your retirement accounts.

The Question

The author of the original post begins by admitting they probably don’t know as much about their existing Roth IRA as they should. They say they’ve been contributing to it regularly, but they are not maximizing their annual contributions and aren’t sure if they’re on the right track for retirement.

The author says they are risk-averse and are looking to balance long-term growth and stability. They want to be able to retire while splitting their time between the United States and a country with more affordable healthcare.

The author provided screenshots of their current investments for context which showed that they have many fractional shares and investments in several companies with only one stock. If you have a mind to dive into the details of where the money is invested, you can see them on the original post.

In the end, the author asked the community for any tips or feedback on how they can better plan for their retirement goals.

The Community Response

Most people who commented agreed that the author’s 401(k) investments were far too spread out and random. They all recommended the author consolidate their investments into a professional investment option like a mutual fund, index fund, ETF, or something similar. Usually, these recommendations involved selling whatever fractional stocks they had.

Some commenters posted links to resources and articles that recommended against having overly-complex investments or savings strategies.

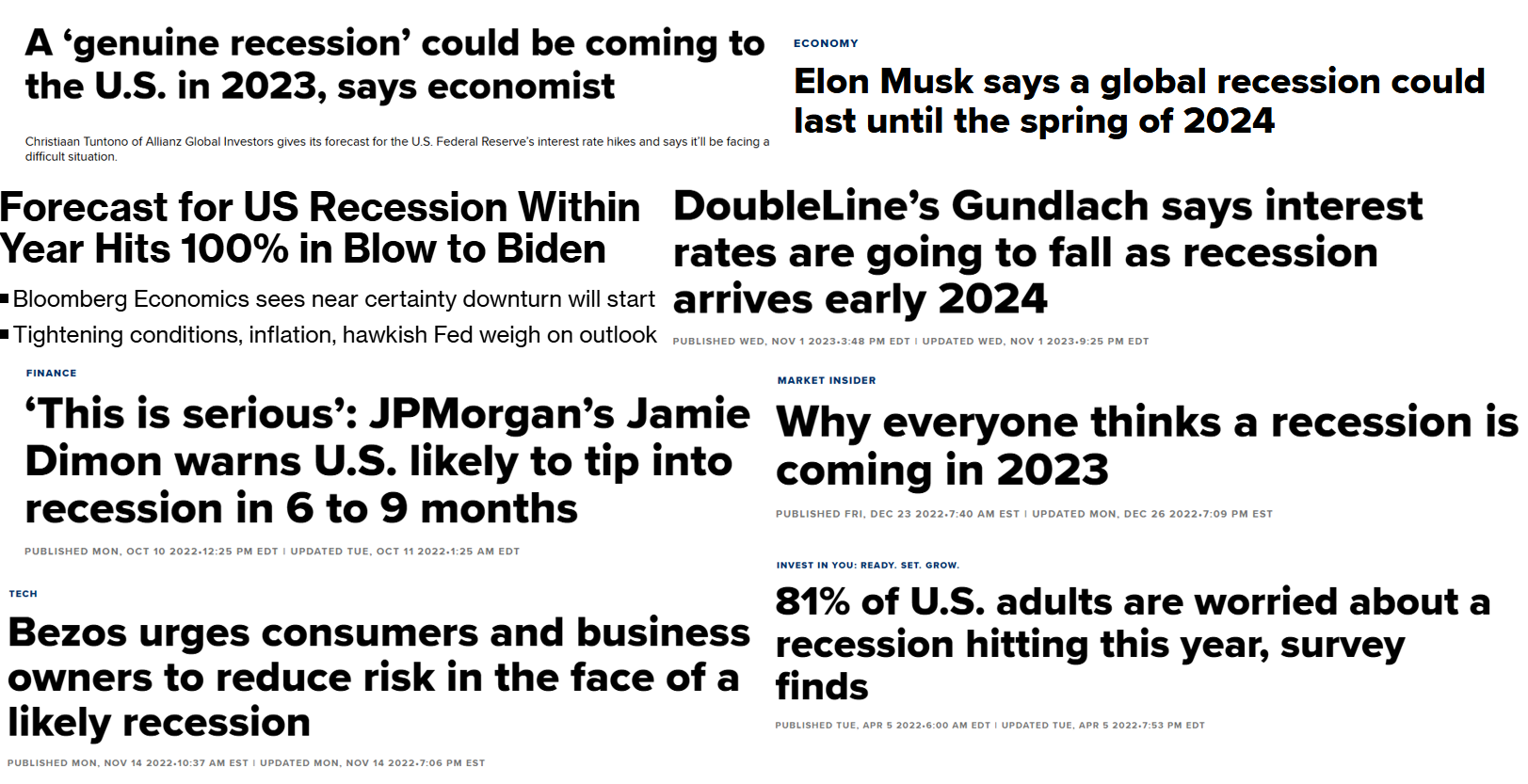

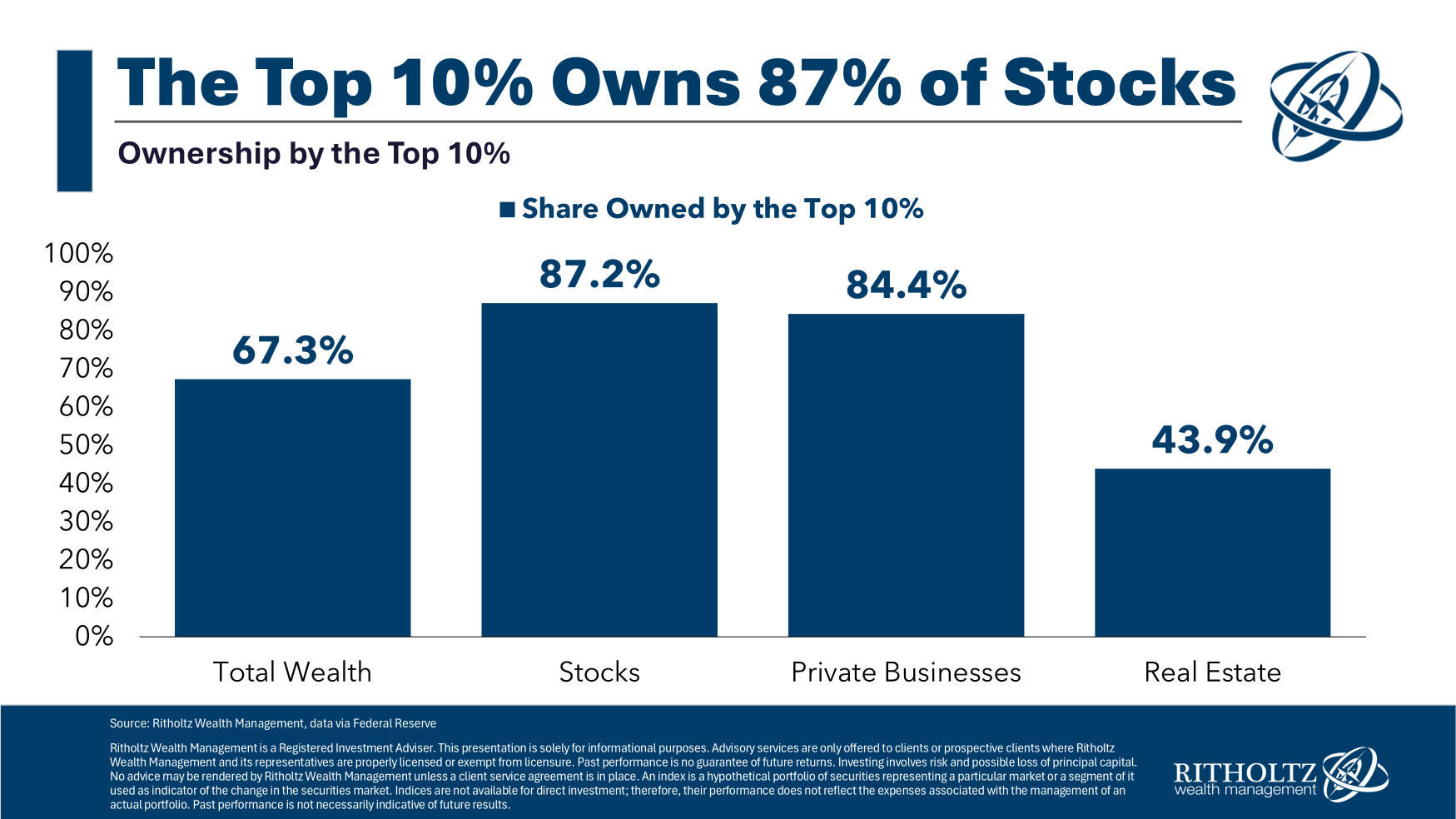

Nobody has every consistently outsmarted the market, and trying to do so is one of the quickest ways to lose a lot of money. Mutual funds and other similar investment options are designed to mitigate risk while still offering long-term returns.

Another helpful suggestion was to look into target date funds which are built to maximize returns and automatically reinvest funds into safer options as you approach the target date (usually retirement).

In the end, the general consensus was that it might be fun to invest in random stocks here and there, or follow the trendy investment advice from time to time, but in order to build a reliable and safe retirement account, you need investments that are proven to generate safe and stable returns over time.

The post I’m 35 and worried about my retirement – how can I get help reviewing my Roth IRA? appeared first on 24/7 Wall St..