I’m 27 and make over $200k a year as a mortgage broker, despite rates being where they are

It can be tempting for fairly young financial overachievers to spend all the cash flows that are coming in. Undoubtedly, if you’re still in the earlier years of your career, your prime earnings years may still be ahead. That alone could justify more than just the occasional splurge. While it’s a good thing to be […] The post I’m 27 and make over $200k a year as a mortgage broker, despite rates being where they are appeared first on 24/7 Wall St..

It can be tempting for fairly young financial overachievers to spend all the cash flows that are coming in. Undoubtedly, if you’re still in the earlier years of your career, your prime earnings years may still be ahead. That alone could justify more than just the occasional splurge.

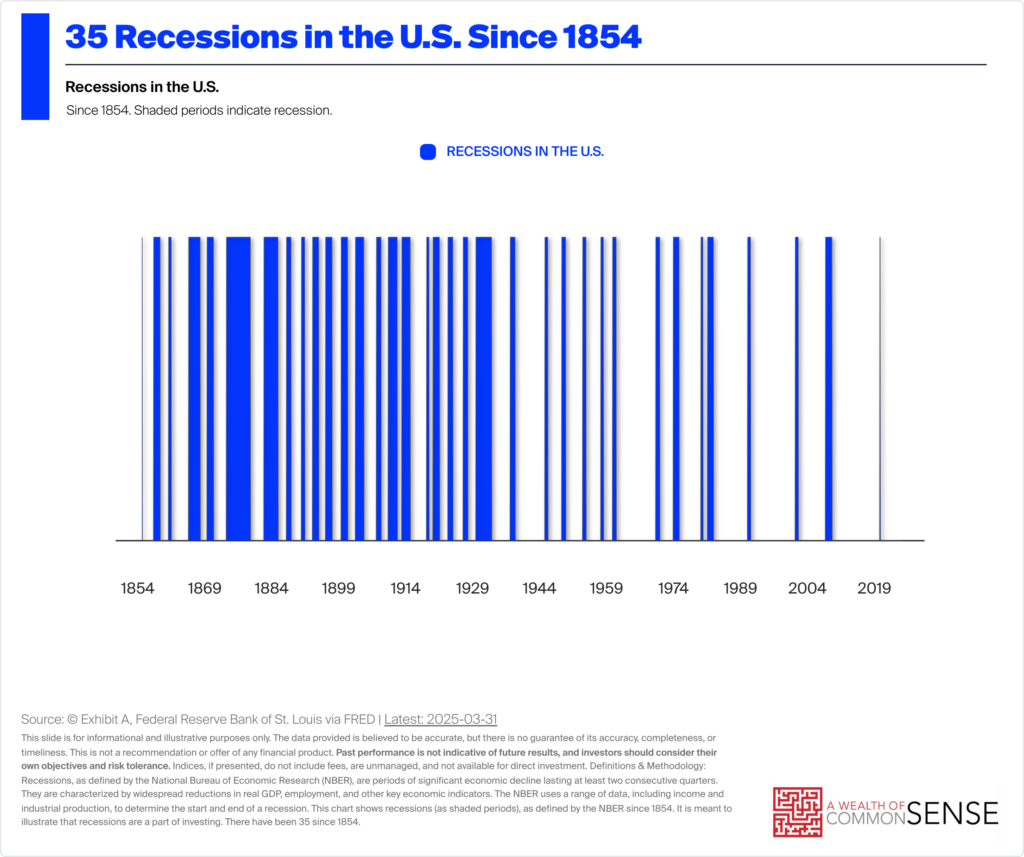

While it’s a good thing to be ambitious and look to keep climbing that income ladder, I do think that careful preparation for turbulence is wise. Indeed, economic recessions and other headwinds can hit one in their career when they least expect it. And while it’s nice to be optimistic and think you’ll land on your feet, I do think that forming a padded cushion of emergency savings and other investments is the best move.

Undoubtedly, giving into “lifestyle creep,” a phenomenon whereby spending increases with money that comes in, can be the formula for disaster once the tides turn. In some instances, it is possible to get a bit ahead of your skis by spending more than you have coming in. More income can mean more access to debt and hefty interest payments that could keep one living paycheck to paycheck even with a high six-figure income.

Key Points

-

Young commissioned brokers should save and invest wisely, as not every year can be a good one.

-

Higher rates and stagflation can impact mortgage demand.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

The curious case of a young mortgage broker making six figures

In this piece, we’ll have a closer look at the case of a Reddit poster who recently pulled in just north of $200,000 as a mortgage broker. That’s a respectable sum, and while it’s tempting for a young person to blow the cash and drastically upgrade one’s lifestyle (if a recent grad recently on a student budget starts pulling in six-figures, you can bet that some lifestyle upgrades are in order), there are some moves one can make to better weather any future rainy days.

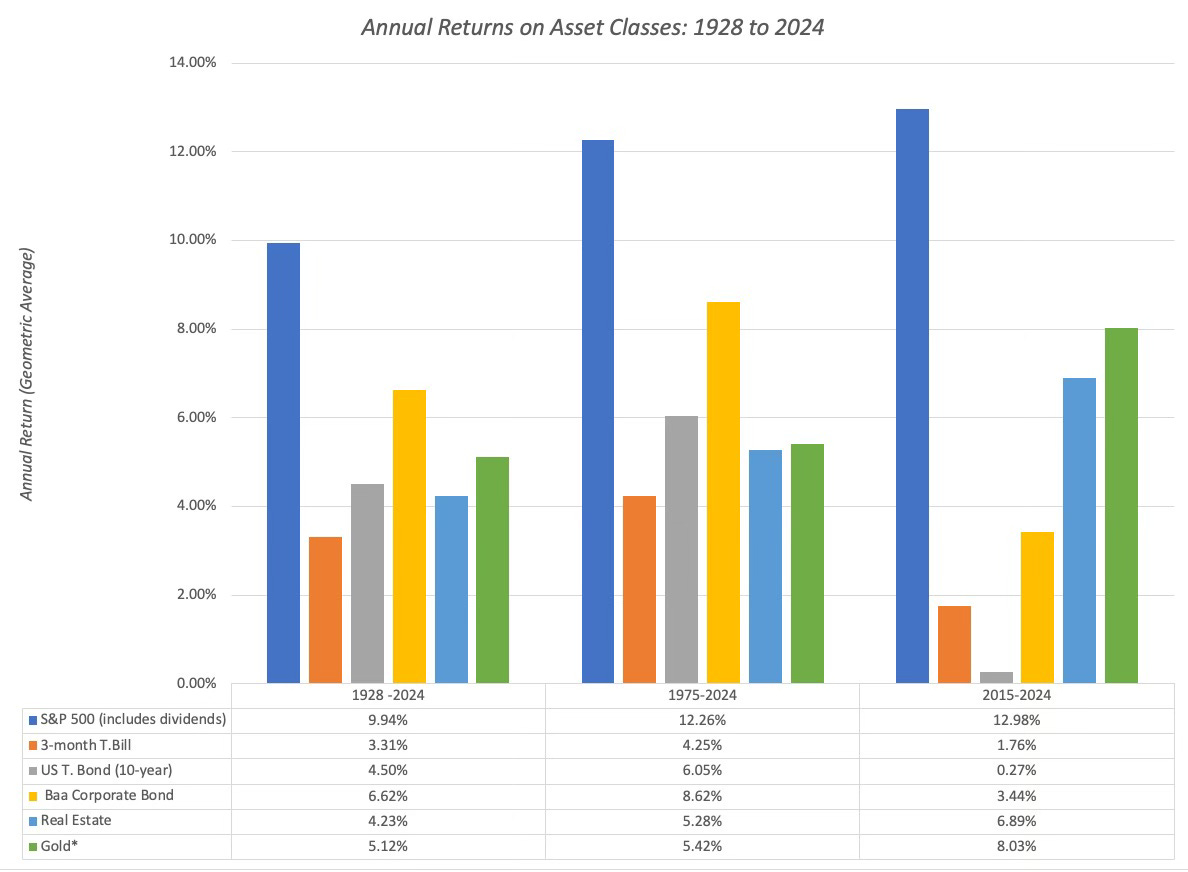

Given the many different environments that can affect one’s income as a mortgage broker (think interest rates, the state of the economy, and other factors), I’d argue it’s only prudent to save and invest most of the sum wisely, rather than expect the good days to last forever.

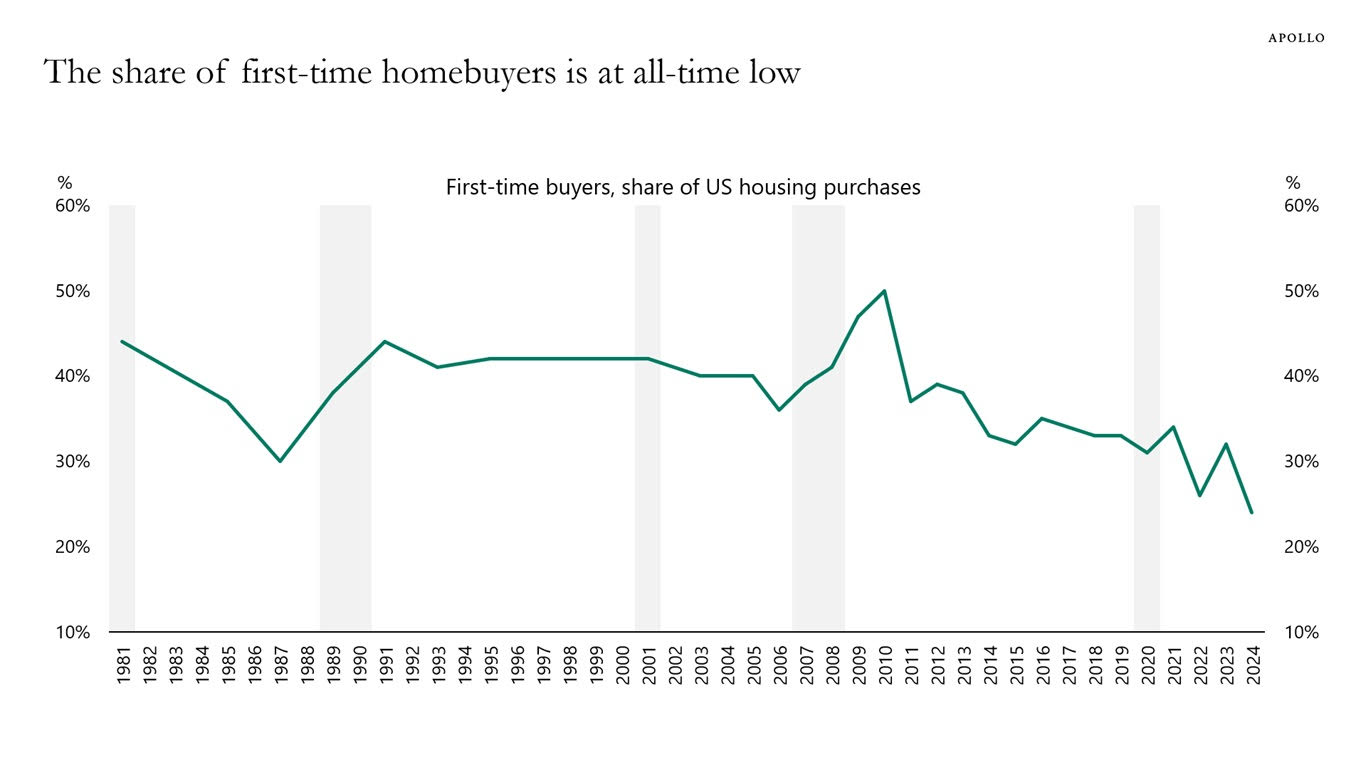

Interest rates may be higher than where they were a few years ago, but they could still move higher

Indeed, the mortgage-broker Reddit user may have something to brag about with their income in today’s higher rate environment. That said, interest rates have been declining lately, and they’re historically not even close to a high point. Undoubtedly, if the trajectory of rates reverses, the mortgage broker may find it a bit tougher to break their high water mark of $200,000 in a year.

Undoubtedly, recently-imposed tariffs or the start of a trade war could cause enough inflationary pressures to warrant rate hikes rather than rate cuts. Indeed, inflation has crept higher in recent months, and the stage could be set for much higher inflation if worse comes to worst. Sometimes, the only medicine to counter such inflation is higher rates. And it’s these potentially higher rates that could be sticking around for longer.

All such risks and the impact on mortgage demand ought to be considered by the young mortgage broker. Rates may be “high” when in reference to recent history (post-financial crisis), but they’re not all too low when looking farther back, when rates north of 5% weren’t out of the ordinary.

Not every year will be a good year if you’re a commissioned mortgage broker

In any case, saving and investing sums in good (low-rate) years just strikes me as a good idea in case bad years (think a climate that has higher-rates, a recession, or stagflation) show up at some point down the road. Indeed, if Reddit users intend to stay in the mortgage broker business for the long haul, they’re bound to see some off years. Not every year can be Reddit post-worthy!

Given uncertainties regarding tariffs, the potential for higher inflation, and rising national debt levels, it’s only smart not to spend every paycheck that comes in.

The post I’m 27 and make over $200k a year as a mortgage broker, despite rates being where they are appeared first on 24/7 Wall St..