If You Invested $5,000 In Vanguard High Dividend Yield VYM 10 Years Ago, This Is How Much Cash From Dividends You Would Have Today

The volatility of the stock market over the past three months has been a roller coaster ride that has left many with a case of nausea. The Dow Jones Industrial Average has ranged from 44,882.13 at the end of January to 40,813.57 in mid-March, plummeting lower to 37,645.59 during the first week of April, then […] The post If You Invested $5,000 In Vanguard High Dividend Yield VYM 10 Years Ago, This Is How Much Cash From Dividends You Would Have Today appeared first on 24/7 Wall St..

Key Points

-

Higher than normal volatility in the stock market has left many investors unaccustomed to wide intraday market swings reeling.

-

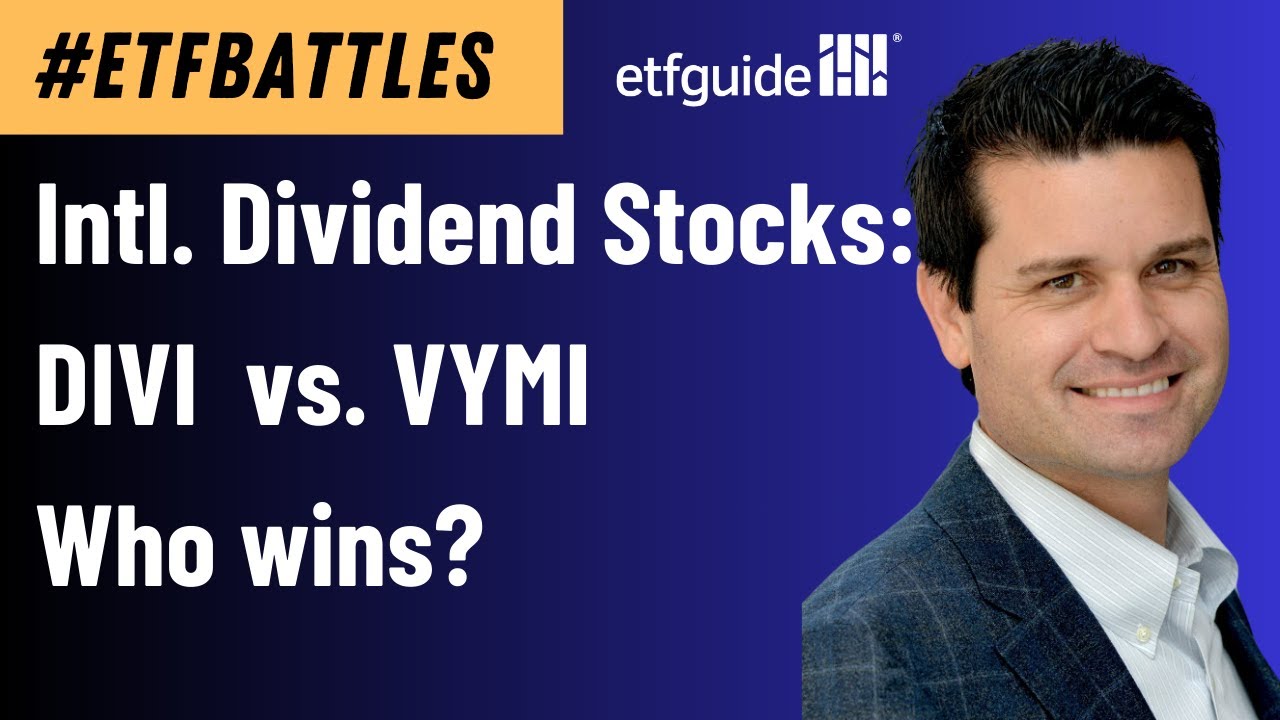

The Vanguard High Dividend Yield Index Fund ETF offers a nice combination of growth, income, and diversification risk management along with lower volatility in a highly liquid ETF format.

-

Dividend Reinvestment Plans (DRIP) can be an excellent way to build wealth through compounding, but doesn’t preclude regular portfolio monitoring.

-

SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer intimidating retirement concerns. Each advisor has been carefully trained to analyze and act in your best interests to deliver on your portfolio requirements. Don’t waste another minute – get started by clicking here.(Sponsor)

The volatility of the stock market over the past three months has been a roller coaster ride that has left many with a case of nausea. The Dow Jones Industrial Average has ranged from 44,882.13 at the end of January to 40,813.57 in mid-March, plummeting lower to 37,645.59 during the first week of April, then to soar back up to 42,410 in mid-May at the time of this writing. People who lack the stomach for such rapid lows and highs often leave the market altogether or seek a less turbulent asset class, while still being able to see gains in some form or fashion.

For those who find bonds too stodgy but like the idea of lower volatility with some growth and an income component, the realm of dividend stocks has long been a popular choice of institutions and retirees. 24/7 Wall Street has a sizeable database of dividend stocks and has published numerous articles on the topic that showcased different sample combinations to meet yield and sector diversity demands. For those seeking the added risk mitigation of diversification through a fund structure, Exchange Traded Funds (ETF) are an excellent way to access dividend stock benefits without single stock risks.

For a solid high dividend yield ETF, one worth serious consideration is the Vanguard High Dividend Yield Index Fund ETF (NYSE: VYM).

The Vanguard High Dividend Yield Index Fund ETF – Dividend Cash in a Decade

Created 19 years ago in 2006, The Vanguard High Dividend Yield Index Fund ETF is Vanguard’s ETF for investors seeking to track the FTSE High Dividend Yield Index. For a quick thumbnail description of VYM as of the tie of this writing:

|

Total Assets |

$70.42 billion |

|

Yield |

2.97% |

|

Average Daily Volume |

1.51 million shares |

|

Expense Ratio |

0.06% |

|

52 Week Range |

112.05-135.10 |

|

Beta |

0.82 |

|

1 year returns |

10.03% |

|

3 year returns |

8.26% |

|

5 year returns |

13.25% |

|

10 year returns |

9.48% |

Composition of the ETF:

| Top 5 Largest holdings: | Top 5 Largest Industrial Sectors: | ||

| Broadcom | 4.0% | Financial Services | 20.61% |

| JP Morgan Chase | 3.58% | Healthcare | 14.71% |

| Exxon Mobil | 2.72% | Technology | 12.77% |

| UnitedHealth Group | 2.51% | Consumer Defensive | 12.58% |

| Procter & Gamble | 2.09% | Industrials | 10.89% |

A $5,000 investment in VYM back in January, 2015 would be worth $12,552.82 today, as of the time of this writing, which equates to a cumulative 155.67% ROI. The total return would be $7,552.85.

The annualized return equates to 9.64%. This calculation also includes compounding through reinvested dividends. The reinvested dividend value equates to $3,379.55. The actual cash dividends paid out from the initial 71.02 shares equates to $2,049.82. If the dividends were not reinvested, the total return would be $4,173.30. Therefore, reinvesting the dividends enabled an additional return of $3,503.73 over a 10-year long stretch. .

Dividend Reinvestment Plans (DRIP) Advantages and Disadvantages

Dividend Reinvestment plans, as the comparison shows, can be a powerful tool for wealth building through compounding. Most DRIP arrangements do not charge additional fees, and the investments are on autopilot, so they eschew the need to place additional buy orders.

Of course, entering into a DRIP arrangement assumes that the investor does not need the dividend income. Additionally, there are two other things that investors need to bear in mind with DRIP arrangement:

- Monitoring portfolio allocation – If a portfolio is being designed to maintain a certain ratio balance between, say 75% growth and 25% income, the ratio can get skewed if the growth portion does not add shares while the income portion continues to do so over time.

- Stock becomes overvalued – While buying on autopilot over the long haul may be a generally good strategy, there are times when market conditions can change to the point where a security or fund can become too expensive and overvalued. In these situations, curtailing DRIP might be prudent, and profit taking might even be a consideration in those circumstances.

The post If You Invested $5,000 In Vanguard High Dividend Yield VYM 10 Years Ago, This Is How Much Cash From Dividends You Would Have Today appeared first on 24/7 Wall St..