If You Invested $15,000 In JEPQ 3 Years Ago, This Is How Much Cash From Dividends You Would Have Today

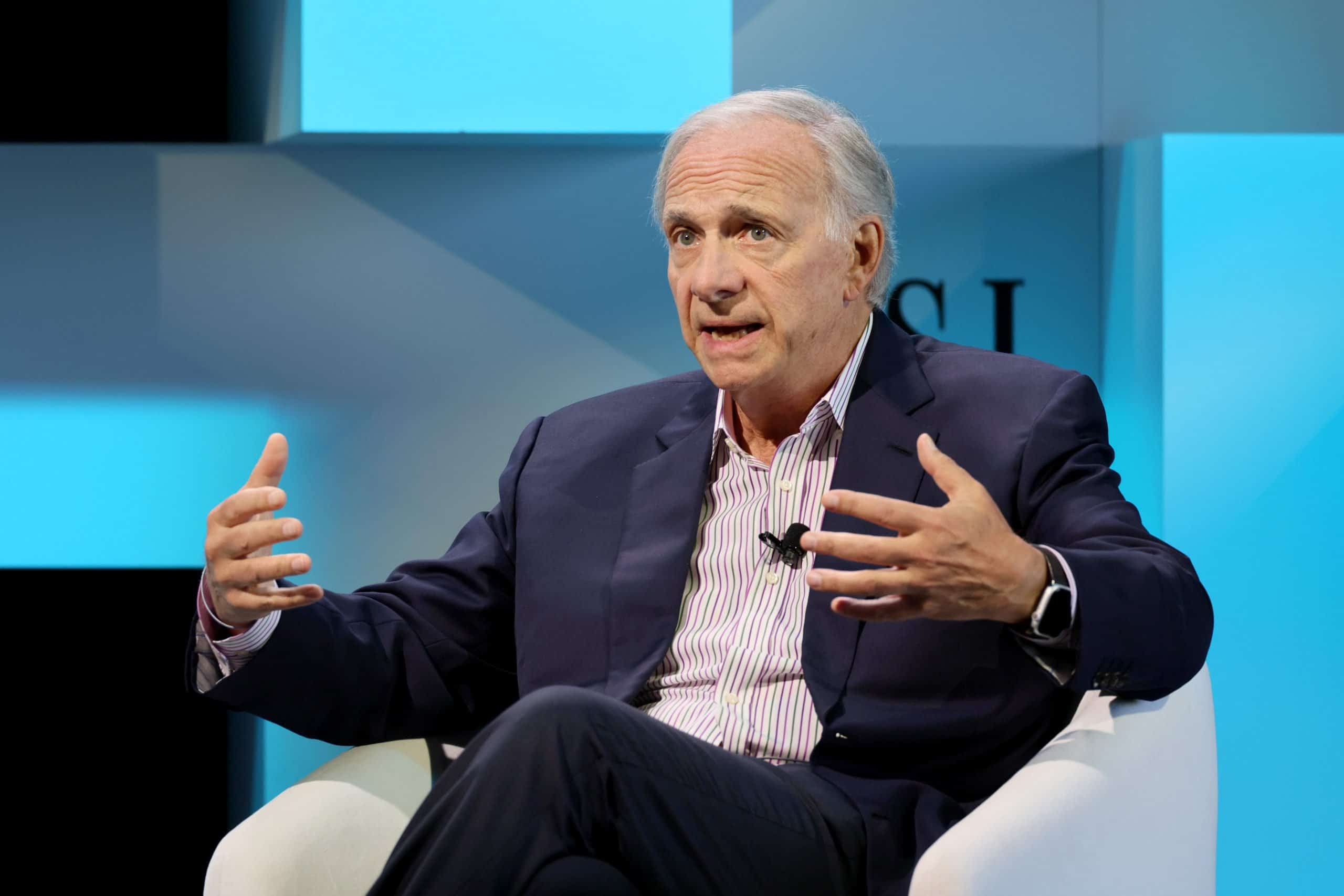

Ray Dalio’s phenomenal success at the help of hedge fund Bridgewater Capital has garnered legions of followers who read his blogs and watch his interviews to mine kernels of investing wisdom. Dalio, Tony Robbins, and other success gurus have mentioned their ideal “Holy Grail” investment – a portfolio of strong returns with mitigated risks. Since […] The post If You Invested $15,000 In JEPQ 3 Years Ago, This Is How Much Cash From Dividends You Would Have Today appeared first on 24/7 Wall St..

Key Points

-

ETFs that can deliver strong growth with a large dividend and mitigated risk are the ideal “Holy Grail” investment for many.

-

Although it isn’t perfect, JP Morgan Chase’s JEPQ comes close to meeting those parameters, due to the use of derivative strategies to create a dividend component for a growth index ETF.

-

The dividend aspect makes a significant difference in a DRIP scenario when pursuing a wealth building compounding strategy.

-

Are you ahead or behind on retirement? Do you find strategies and research overwhelming and are intimidated about discussing your investing goals? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer those questions and more today. Each advisor has been carefully vetted to assess and analyze your objectives and strategies, and will advise actions to best serve your portfolio interests. Don’t waste another minute – get started by clicking here.(Sponsor)

Ray Dalio’s phenomenal success at the help of hedge fund Bridgewater Capital has garnered legions of followers who read his blogs and watch his interviews to mine kernels of investing wisdom. Dalio, Tony Robbins, and other success gurus have mentioned their ideal “Holy Grail” investment – a portfolio of strong returns with mitigated risks.

Since assembling a customized portfolio can take an inordinate amount of research time and monitoring for most individual investors, following selected indexes and investing in Exchange Traded Funds (ETFs) that track those indexes is often the most expeditious way for them to gain market exposure. Although its history is still relatively young, one ETF garnering attention that embraces Dalio’s “Holy Grail” characteristic is the JP Morgan Nasdaq Equity Premium Income ETF (NASDAQ: JEPQ).

JEPQ, an ETF that tracks the technology-favoring NASDAQ-100 index, only debuted in May 2022, but so far has registered a total return of 36.23% in 2023 and 24.89% in 2024. The added component to JEPQ’s value, especially if one is using a compounding strategy for wealth building, is its hefty dividend, which is yielding 11.23% – 13% at the time of this writing. JEPQ achieves these yields through the use of Equity Linked Notes (ELNs), which are synthetic financial products created by financial institutions. ELNs can be likened to customized options with a principal protection component, a relatively short expiration date, and are linked to a specified underlying stock or index. Due to the short expiration dates the call premiums accrue monthly, and are paid out as dividends accordingly.

The Dividend Advantage

Since the Nasdaq-100 Index is led by the famous Magnificent 7 tech stocks (Apple, Amazon, Alphabet (Google), Microsoft, Meta Platforms (Facebook), Nvidia, and Tesla), the overall growth trajectory of JEPQ is not a surprise. JEPQ manager Hamilton Reiner staggers one-month calls into multiple weekly buckets and then diversifies the expiration dates and strike prices. Instead of direct covered call writing, Reiner purchases ELNs that give JEPQ exposure to the profits on those call options without the risk of any of the top tech stock holdings being subject to calls if the market takes off and the calls go in-the-money. Thus, there is an added risk mitigation component exercised, fulfilling the other leg of the Dalio “Holy Grail” description.

As the calculator demonstrates, a $15,000 investment in JEPQ back on May 4, 2022 would be worth $21,570.33 today, at the time of this writing, which equates to a 43.80% ROI. The total return would be $6,570.33.

The annualized return equates to 12.54%. This calculation also includes compounding through reinvested dividends. The reinvested dividend value equates to $6,119.67. The cash dividends paid out from the initial 293.57 shares equates to $4,806.91. If the dividends were not reinvested, the total return would be $450.66. Therefore, reinvesting the dividends enabled an additional return difference of $6,119.67 over the 3 year span, resulting in a current total of 409.85 shares.

The Benefits of Compounding

When high dividends such as those of JEPQ are deployed in a Dividend Reinvestment Plan (DRIP) that takes advantage of a monthly dividend pay out, the power of compounding and dollar cost averaging factors are increased proportionately and over time, exponentially. The fact that the sample investment above added 40% more shares in only 3 years demonstrates how JEPQ takes advantage of the continual monthly high dividend generation to augment buying power.

It’s important to bear in mind that JEPQ dividends are a result of actively managed trading, rather than intrinsic profits from a specific business operation. Option premiums have been exceptionally high due to the extra volatility in the markets since President Trump’s tariff strategy announcements began. JEPQ’s dividend payout per share for ex-dividend shareholders as of March 1st was $0.482. For April 1st, it was $0.54, and for May 1st, it was $0.597. This is just shy of 25% dividend growth in a mere 60 days.

Nevertheless, even if the average dividend payout returns to March levels, the long term Nasdaq-100 upside and a DRIP arrangement would provide for continued aggressive returns, if the current trends continue as analysts anticipate.

The post If You Invested $15,000 In JEPQ 3 Years Ago, This Is How Much Cash From Dividends You Would Have Today appeared first on 24/7 Wall St..