If You Have Over $1 Million Today, See How Much You Can Make

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. A $1 million nest egg is a game changer, but the assets you choose will impact how much that nest egg grows. Stocks tend to outpace bonds during periods of economic strength, but equities […] The post If You Have Over $1 Million Today, See How Much You Can Make appeared first on 24/7 Wall St..

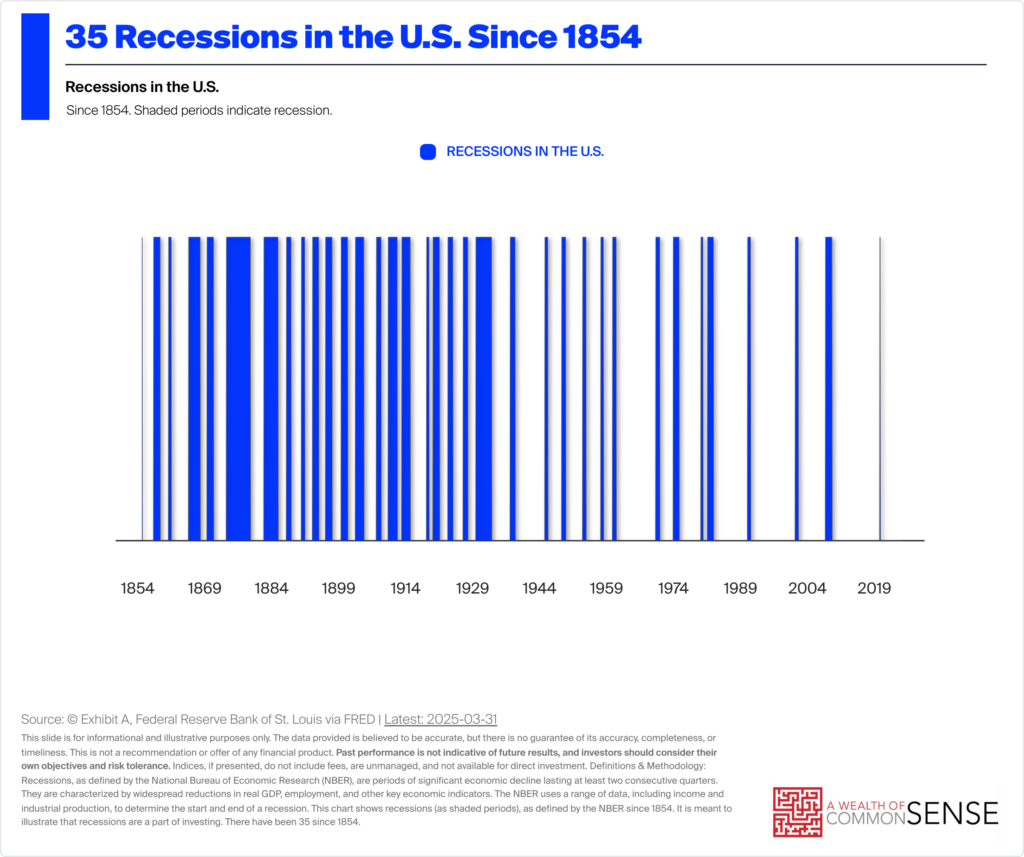

A $1 million nest egg is a game changer, but the assets you choose will impact how much that nest egg grows. Stocks tend to outpace bonds during periods of economic strength, but equities often tumble during contractions. Younger investors don’t think about the risks as much because they have more time to recover. However, people who are approaching retirement tend to get more defensive with their fortunes.

Knowing what you can get out of $1 million can help you construct a portfolio that aligns with your financial goals and risk tolerance. We’ll analyze how far $1 million can go in a high-yield savings account, stocks, crypto, and bonds.

Key Points

-

Investors can grow a $1 million nest egg with a savings account, stocks, bonds, and crypto.

-

Each of those assets has important pros and cons worth exploring before putting down any money.

-

Earn up to 3.8% on your money today (and get a cash bonus); click here to see how. (Sponsored)

How Much Can $1 Million Grow in a High-Yield Savings Account?

High-yield savings accounts aren’t known for generating life-changing returns. The main strength of these financial products is that they produce risk free income. Furthermore, you can access your funds at any point without worrying about penalty fees or market fluctuations.

You can find high yields if you narrow your search to online banks. As you’ll see in the table below, it’s worth some extra research to find the most competitive rate.

|

1 Year |

3 Years |

5 Years |

|

|

2.00% APY on $1m |

$1,020,000 |

$1,061,208 |

$1,104,081 |

|

3.00% APY on $1m |

$1,030,000 |

$1,092,727 |

$1,159,274 |

|

4.00% APY on $1m |

$1,040,000 |

$1,124,864 |

$1,216,653 |

The difference between 2.00% APY and 4.00% APY is more than $100,000 after five years. That’s why it is important to shop around for competitive APYs instead of settling with the first high-yield savings account you find.

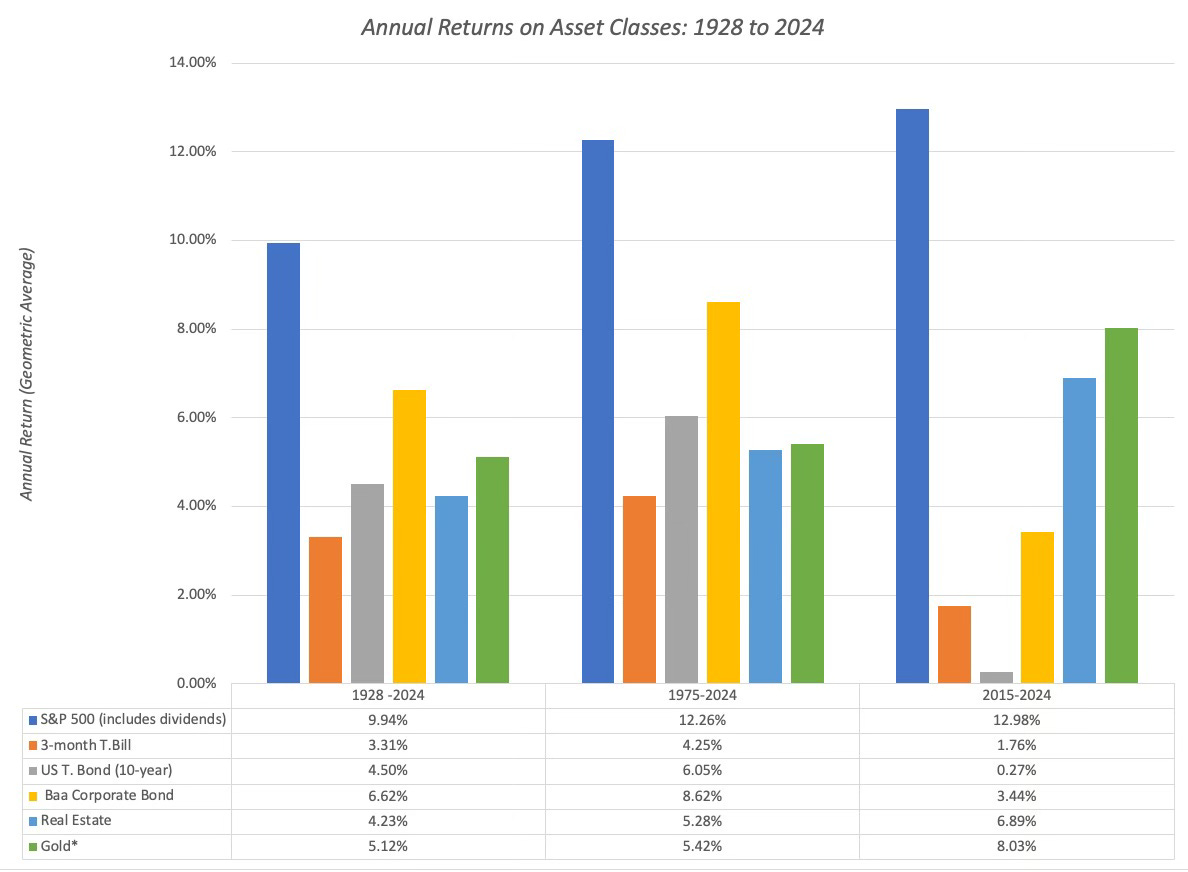

How Much Can $1 Million Grow in the Stock Market?

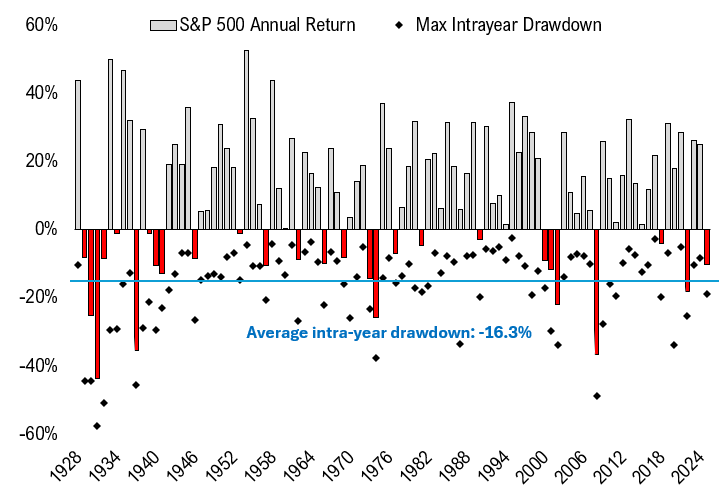

The stock market is a highly liquid way to invest money and earn high returns. The market has produced an annualized 8% return for many years, and investing in stocks has been a common route for long-term wealth.

However, investors have to consider that the stock market can go down. It’s harder for retirees to recover from those dips, especially if those dips turn into corrections and crashes. You’ll see how stock market gains and losses can impact your total returns. The table includes an annualized 5% loss, an annualized 8% gain, and an aggressive annualized 15% gain.

|

1 Year |

3 Years |

5 Years |

|

|

5% loss on $1m |

$950,000 |

$857,375 |

$773,781 |

|

8% gain on $1m |

$1,080,000 |

$1,259,712 |

$1,469,328 |

|

15% gain on $1m |

$1,150,000 |

$1,520,875 |

$2,011,357 |

How Much Can $1 Million Grow in the Bond Market?

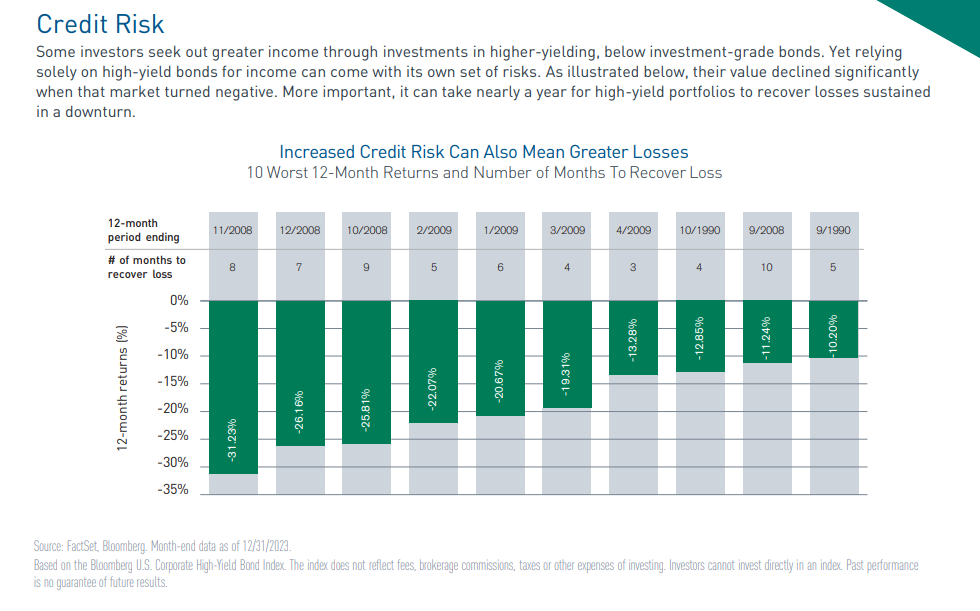

The historical return on bonds has historically ranged between 4% and 6% for almost a century. These assets produce steady cash flow like high-yield savings accounts. You can incur more risk with corporate bonds in exchange for higher yields. Investors can also look at a bond’s rating to assess the level of risk.

Here’s how 4%, 5%, and 6% annualized returns stack up with $1 million as a starting point.

|

1 Year |

3 Years |

5 Years |

|

|

4% gain on $1m |

$1,040,000 |

$1,124,864 |

$1,216,653 |

|

5% gain on $1m |

$1,050,000 |

$1,157,625 |

$1,276,282 |

|

6% gain on $1m |

$1,060,000 |

$1,191,016 |

$1,338,226 |

How Much Can $1 Million Grow in the Crypto?

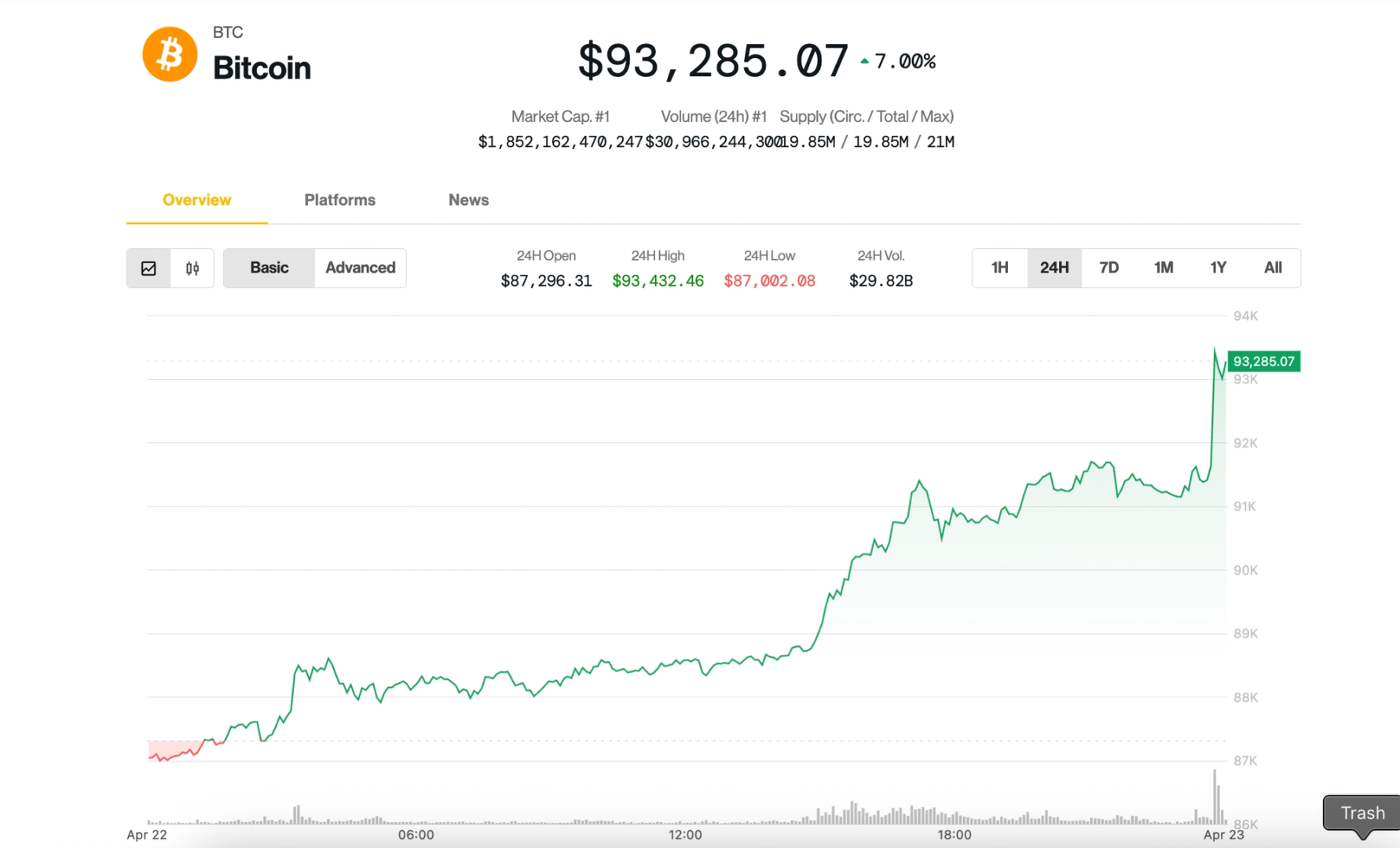

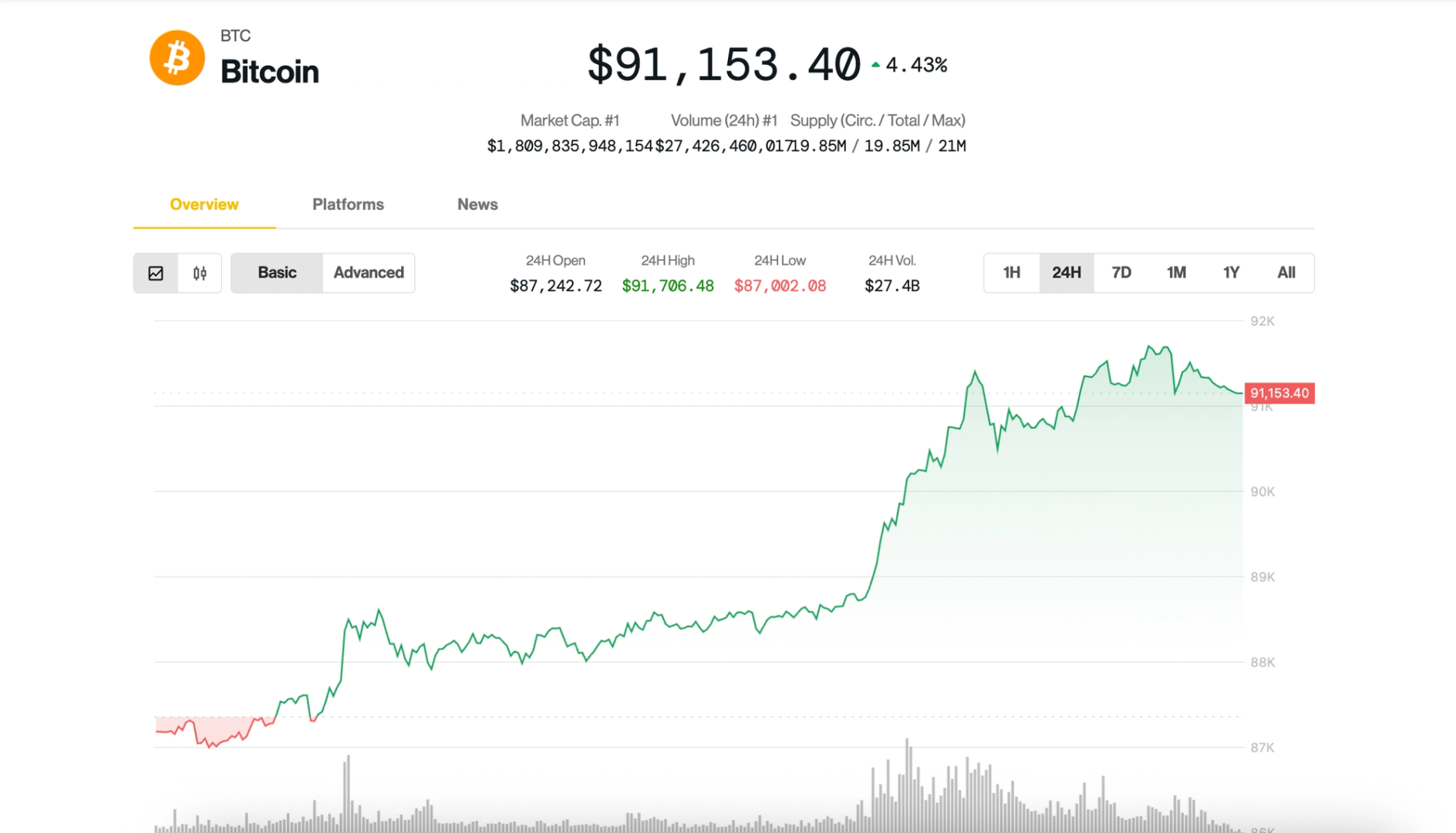

Cryptocurrencies are some of the most volatile assets in the financial market. They can surge by more than 80% in one year and give almost all of it back in the following year. However, the multi-year crypto bull run has been more prolonged if you narrow your focus to Bitcoin.

The digital asset is up by almost 1,000% over the past five years, but it has had some dramatic reversals along the way. We’ll use three percentages to show you how much your fortunes can change with Bitcoin. The asset delivered a 121% return in 2024, a 65% loss in 2022, and a “modest” 35% gain in 2015.

|

1 Year |

3 Years |

5 Years |

|

|

65% loss on $1m |

$350,000 |

$42,875 |

$5,252 |

|

35% gain on $1m |

$1,350,000 |

$2,460,375 |

$4,484,033 |

|

121% gain on $1m |

$2,210,000 |

$10,793,861 |

$52,718,297 |

It’s really hard to gauge Bitcoin’s long-term performance and what can happen within five years. An annualized 65% loss and an annualized 121% gain are both a bit dramatic. A 35% annualized gain is the most likely of the three scenarios, but Bitcoin can experience a sharp decline if financial markets show any weaknesses. Bitcoin usually moves in a similar direction as growth stocks. When the Nasdaq struggled in 2022, Bitcoin crashed.

Grow Your Money With No Risk

It takes a really long time to reach a $1 million net worth. At some point, people shift from accumulating wealth to preserving what they have. People who want to preserve wealth and generate steady, risk free cash flow may want to open a high-yield savings account. These accounts have high yields and let you access your money at any time.

You can choose from several banks, but the SoFi Savings account is one of the top choices. You’ll receive a 3.80% APY on all of the money you put in your account plus a $300 welcome bonus.

The post If You Have Over $1 Million Today, See How Much You Can Make appeared first on 24/7 Wall St..