If There's Ever a Recession, Should You Buy XRP or Bitcoin?

If you hold cryptocurrencies like XRP (CRYPTO: XRP) or Bitcoin, (CRYPTO: BTC) you're probably not sure how they'd hold up in the event of an economic recession. Whether it would make sense to buy more of either asset in such a scenario is an even bigger question, as a timely purchase during hard times might pay off significantly when conditions improve down the line.Are either of these assets worth buying if the economy starts to recede? Or would it make more sense to dump both? Let's unpack this issue and make a game plan so that you'll be prepared if something happens in the coming years.In the U.S., an economic recession is generally defined as a period of at least two consecutive quarters in which the gross domestic product (GDP) decreases rather than increases as normal. Usually recessions are accompanied by higher unemployment, reduced consumption of goods and services, reduced international trade volume, and falling asset prices, particularly in more liquid assets like stocks and cryptocurrencies, but often in harder assets like real estate as well.Continue reading

If you hold cryptocurrencies like XRP (CRYPTO: XRP) or Bitcoin, (CRYPTO: BTC) you're probably not sure how they'd hold up in the event of an economic recession. Whether it would make sense to buy more of either asset in such a scenario is an even bigger question, as a timely purchase during hard times might pay off significantly when conditions improve down the line.

Are either of these assets worth buying if the economy starts to recede? Or would it make more sense to dump both? Let's unpack this issue and make a game plan so that you'll be prepared if something happens in the coming years.

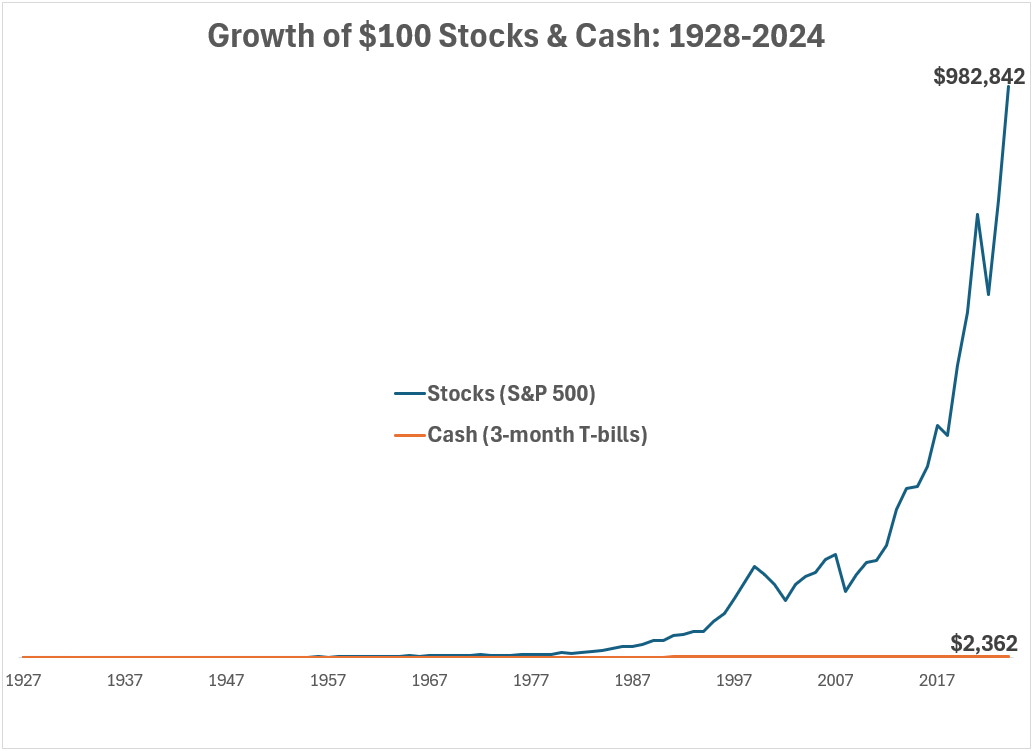

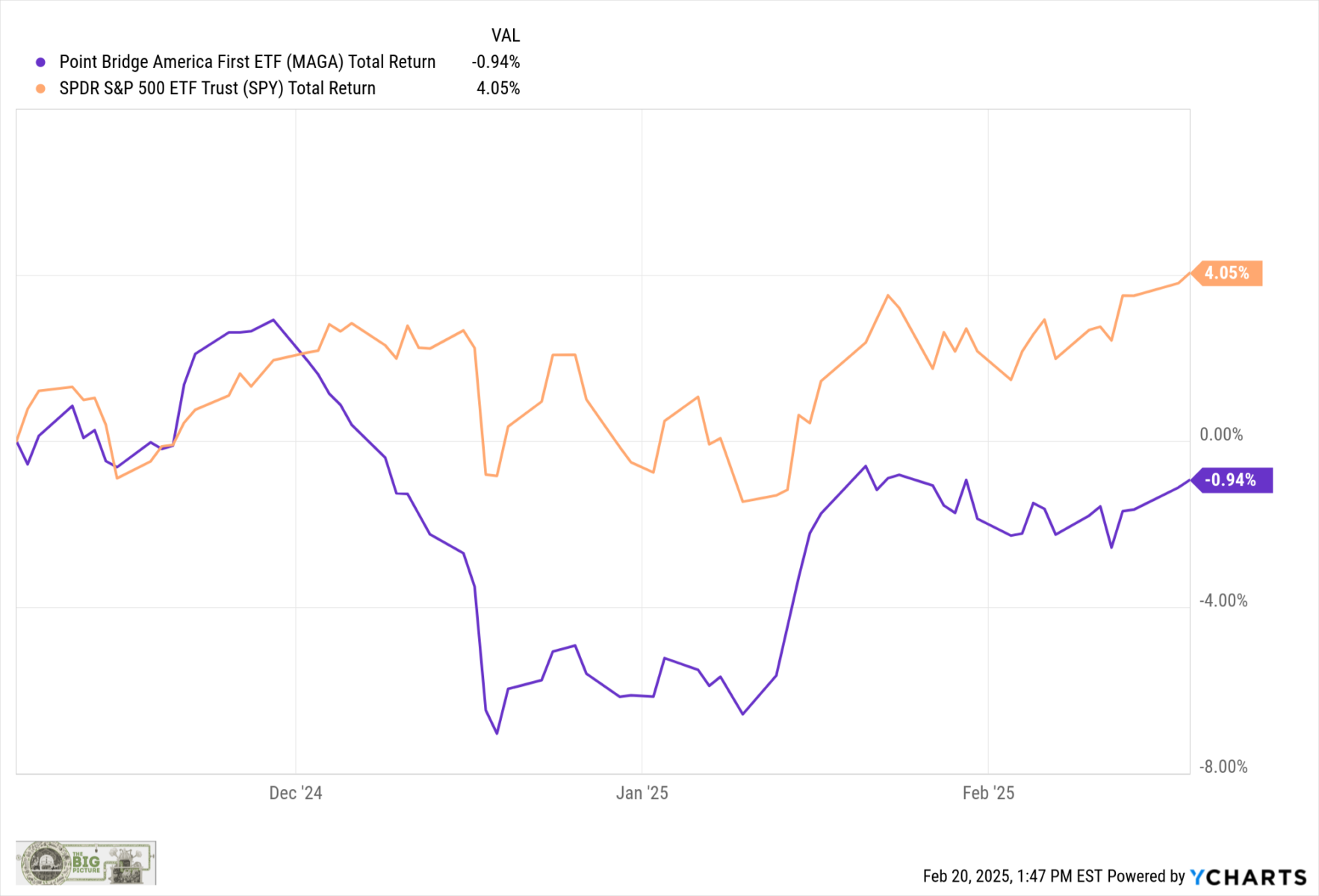

In the U.S., an economic recession is generally defined as a period of at least two consecutive quarters in which the gross domestic product (GDP) decreases rather than increases as normal. Usually recessions are accompanied by higher unemployment, reduced consumption of goods and services, reduced international trade volume, and falling asset prices, particularly in more liquid assets like stocks and cryptocurrencies, but often in harder assets like real estate as well.