I Used to Believe Gold Was an Outdated Investment, but These 8 Factors Show It’s Still Valuable

We live in strange times, the United States government, the stock market, international trade, and even our everyday lives are all controlled at the whim of rich, selfish billionaires, and many people are looking for a way to invest safely, responsibly, and quickly to protect what little money they’ve managed to save against what is […] The post I Used to Believe Gold Was an Outdated Investment, but These 8 Factors Show It’s Still Valuable appeared first on 24/7 Wall St..

We live in strange times, the United States government, the stock market, international trade, and even our everyday lives are all controlled at the whim of rich, selfish billionaires, and many people are looking for a way to invest safely, responsibly, and quickly to protect what little money they’ve managed to save against what is quickly becoming an unpredictable and uncertain future. If you’ve looked into buying gold to protect your savings, you’re not alone, it’s a trend that has seen significant growth in interest over the last few months.

Key Points

-

Gold is a popular choice for stable and safe investments.

-

China has been investing heavily in gold as the U.S. Dollar weakens and the Chinese markets look to overtake the U.S. economy.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

We took some time to look into the reasons why some people might be flocking to gold as an investment alternative and picked our favorites and the best ones. If you’re looking for a good reason to invest in gold, look no further.

#1 Permanent Value

First and foremost, unless human civilization completely crumbles and returns to pre-agricultural levels of technology, gold will have some kind of utilitarian value. This means it isn’t just used for coins and currency.

Gold is used in phones, computers, technology, science equipment, medication, and many other industries with various applications. It is unlikely that gold will see a drop in value of any significant amount, unlike other fad investments like NFT, cryptocurrency, or artificial intelligence.

Gold’s Value

Around 50% of all the gold mined in the world is used in jewelry, with 40% for investments, and 10% in industry. It is highly malleable, resistant to corrosion and other chemicals, and highly conductive, which makes it a favored metal for infrared shielding, tooth restoration, and much more. As long as technology continues to improve and the adoption of modern devices increases, gold will continue to increase in value.

#2 Stable History

People know what gold is and they know its value and what it’s used for. You don’t have to explain gold to anyone or even speak the same language to trade with gold. It has been the base of human commerce for thousands of years and was the standard for national currency until the 1900s.

The History of Gold

With such a long history, there is no doubt or speculation about the value of gold. Especially in modern markets, gold has enjoyed a long and stable increase in value and is often the most reliable and near-guaranteed investments anyone can make. If you are extremely risk-averse and find even government bonds too risky, gold might be the best option for you.

#3 Physical or Stock Options

You can buy gold in either physical form or invest in gold on the stock market, and for each option, there are a handful of different paths available to you. There is no need to settle for just one way, and you can diversify your gold holdings with technology investments, gold bars at home, gold jewelry in a safe, and more.

Buying Gold

You can buy gold to match whatever your investment strategy is. If you want to bet that gold will increase in value, there are options to invest heavily in that prediction. If you foresee the American Dollar losing all value soon and don’t trust the banks to keep your money safe, you can buy physical gold bars. The wide variety of gold investment options makes it a popular choice.

#4 Protection Against Downturns

Gold has typically weathered the volatility of international markets with unsurprising resilience. The supply of gold is finite and the production of it is not easily reduced or increased while the demand for it is also comparably inelastic, meaning market forces don’t have much control over its value.

Gold’s Downturn Protection

This stability and protection against depression and recessions makes gold a go-to investment for market experts and conservative investors. For example, during the 2008 financial crisis, almost every single investment lost value while gold increased its value by 100% between 2008 and 2012.

#5 Hyperinflation Protection

Investors and market analysts typically call gold an “inflation hedge” meaning that it can help protect your savings against inflation, however, this protection is most applicable and most apparent against hyperinflation. According to experts, there is a 16% move in gold for every 100% increase in the US Dollar.

Avoiding Hyperinflation

Because of its strong protection against hyperinflation, gold has become a valuable investment in places like South America and some countries in Africa that are experiencing hyperinflation. With recent upheavals in the United States government and international markets caused by Donald Trump and Elon Musk, it is unlikely that markets will find any kind of stability and inflation is likely to increase, making gold even more attractive.

#6 Diversification

Financial experts will always recommend you diversify your investments, as it is not usually wise to put all your eggs in one basket. Some might give recommendations as to what form that diversification might take, but it will usually include some stable and low-return investments like bonds, large-company stocks, or physical metals like gold.

The Diversity of Gold

If you recently realized that you need to start diversifying your portfolio, or want to add safer or more reliable investments to your already-diversified portfolio, gold is a great place to start. It is unlikely that every investment will suffer by the same amount during a recession or downturn, and in the case of gold, you might actually make higher returns.

#7 Hard to Manipulate

As mentioned earlier, gold can’t be manufactured and there are accurate ways to measure the purity of metal. Mining gold in large quantities is expensive and slow. There are no large-scale scams or rug-pulls like there have been with crypto, NFTs, or other technology companies. The value of gold is reliable and trusted around the world, and you don’t have to trust your friend’s cousin when he says “Trust me”.

Reliability of the Gold Market

This reliability translates across countries and between markets. The price of gold is just as reliable as the material itself is reliable for science and art and is often used as a barometer for the status of international trade and currencies in general.

#8 Recent Price Increases

Gold typically has a low yield, underperforming compared to government bonds, but in the latter half of 2024, it grew by 8%, and increased by 30% over the entire year, beating projections and surprising investors.

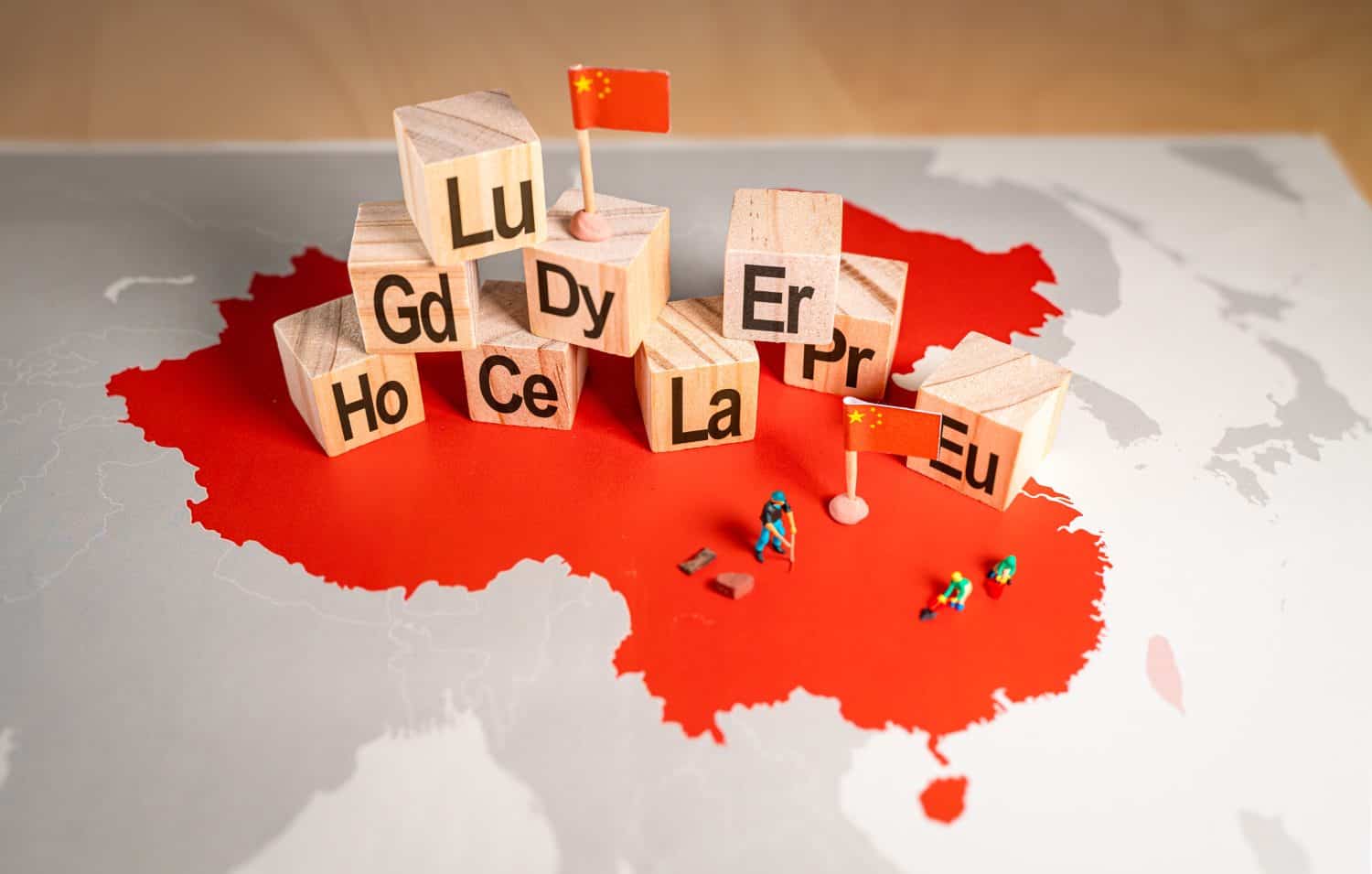

Gold Prices: Bet on China

Most of the gold in the world is mined in China and the Chinese central government undertook a gold-buying spree over the last two years that only paused in the middle of 2024 after the gold price skyrocketed.

China is slowly moving away from the US Dollar and is finding alternative investments as the American economy weakens and the Chinese market grows. Additionally, Chinese investors and companies have been investing in gold at higher levels. While domestic experts are left wondering what China will do with its massive gold reserves, betting on China’s growth is a safe bet as they know what they’re doing and they are clearly winning.

The post I Used to Believe Gold Was an Outdated Investment, but These 8 Factors Show It’s Still Valuable appeared first on 24/7 Wall St..