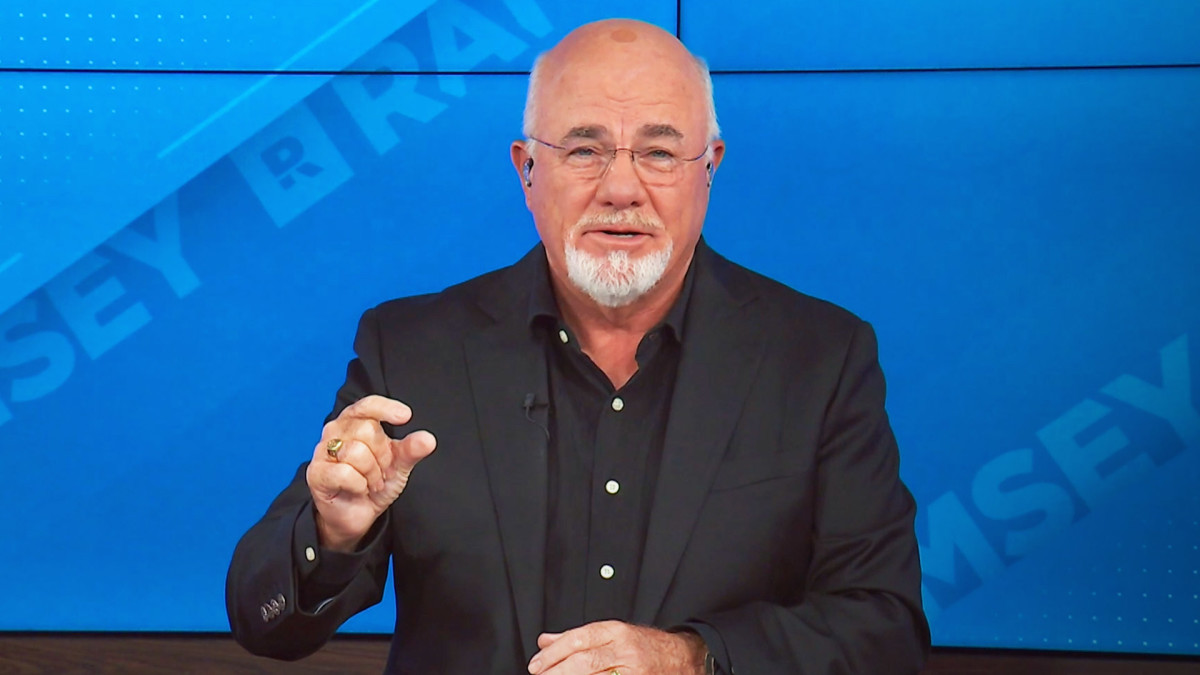

I put 20% down and went with a 30-year loan at 6.375% – would Dave Ramsey say I made a mistake?

A Reddit user who follows the finance guru Dave Ramsey recently purchased a home. The poster explained that he put 20% down on the property. However, since he was trying to cap his monthly payments at $3,000 per month, he opted for a 30-year mortgage instead of a 15-year mortgage that would have put his […] The post I put 20% down and went with a 30-year loan at 6.375% – would Dave Ramsey say I made a mistake? appeared first on 24/7 Wall St..

Key Points

-

A Reddit user bought a home with a 30-year mortgage.

-

As a Dave Ramsey follower, he’s worried he made a mistake because Ramsey recommends 15-year loans.

-

Since his payments are affordable and he’s paying extra anyway, he likely didn’t make an error.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

A Reddit user who follows the finance guru Dave Ramsey recently purchased a home.

The poster explained that he put 20% down on the property. However, since he was trying to cap his monthly payments at $3,000 per month, he opted for a 30-year mortgage instead of a 15-year mortgage that would have put his monthly mortgage costs at around $4,000.

Dave Ramsey is very anti-debt, and he said the ideal thing is to buy a house in cash. However, since most people can’t do that, Ramsey also said that getting a mortgage is OK as long as you aren’t spending more than 25% of your take-home pay on the house and as long as you get a 15-year mortgage.

Since the original poster (OP) broke the 15-year mortgage rule, he’s wondering if he made a mistake.

Buying a house leads to financial concerns

According to the Redditor, he is supporting himself on his own, so he was scared about committing to such a large payment.

His interest rate is 6.375%, and he makes $16K in gross income, but after his 401(k) contributions, taxes, and other deductions, he ends up taking home $9K per month. He also has an emergency fund with a full year’s worth of living expenses.

While the poster’s loan rate is higher than the ideal, it’s also not too bad given the current mortgage interest rate market. His home payments are also relatively reasonable. Now, it is true that the 25% rule applies to net income, or income you bring home after taxes. But, the OP said he is also having 401(k) contributions taken out of his pay. If the poster’s after-tax income is at least $12,000, then he’s within the 25% limits Ramsey set out– which are lower than the limits most banks and many experts recommend anyway.

The poster also indicated he is paying an extra $1,000 in principal on the loan, even though many people say it is better to invest in the stock market than to pay extra on a home.

Since the poster says he is anxious and feels a lot of anxiety, he’s really concerned that he messed up on his efforts to live a financially stable life as a result of taking such a long-term mortgage.

Did the poster make a mistake?

The reality is, while the Redditor may be nervous about what he has done, he did not make a mistake. Ramsey’s advice on getting a 15-year mortgage is just, simply, not great advice.

A 15-year loan has one real benefit: It can come with a slightly lower interest rate than a 30-year loan. However, it also has big downsides. As the Redditor noted, when you commit to a 15-year loan, your payment becomes much higher because you are paying off so much more of the loan balance so fast.

Although it’s nice to be debt-free sooner, committing to a much higher payment can increase the chance of foreclosure or at least falling behind if something goes wrong.

When you choose a 30-year loan, you can always choose to pay extra as the OP is doing, but you aren’t forced to — and that’s an important distinction because people lose their jobs and face all kinds of life circumstances where they could use more flexibility in their mortgage payments. You don’t want to be trapped with a huge monthly bill you can’t easily pay when you could have avoided it.

It also usually doesn’t make sense to pay off a home loan early because you can claim a mortgage interest deduction if you itemize on your taxes, and because you can usually earn a better ROI by putting money into investments like an S&P 500 index fund. The S&P 500 has fairly consistently produced 10% average annual returns over the long haul, which is a better ROI than the ROI you get from saving on interest.

By investing and enjoying compound growth instead of paying down your home loan early or opting for a loan with a short-term and high payments, your net worth should end up larger in the long run.

So, as long as your housing costs do eat up less than around 25% (or 30% as most recommend) of your income and as long as you’re going to stay put for a while, there’s nothing wrong with buying a house. And, there’s a lot right with it, as you’ll begin building equity and end up with a very valuable asset in the end.

The post I put 20% down and went with a 30-year loan at 6.375% – would Dave Ramsey say I made a mistake? appeared first on 24/7 Wall St..