How to Take Profits at Bitcoin Cycle Peaks

Selling Bitcoin doesn’t have to be an emotional decision—learn how to use key market indicators to take profits strategically and reaccumulate at lower prices.

Discussing when and how to sell Bitcoin can be controversial, but if you’re planning to take profits this cycle, it’s essential to do it strategically. While holding Bitcoin indefinitely is an option for some, many investors aim to capture gains, cover living expenses, or reinvest at lower prices. Historical trends show that Bitcoin often experiences drawdowns of 70-80%, providing opportunities to reaccumulate at reduced valuations.

For a more in-depth look into this topic, check out a recent YouTube video here: Proven Strategy To Sell The Bitcoin Price Peak

Why Selling Isn’t Always Taboo

While some, like Michael Saylor, advocate never selling Bitcoin, this stance doesn’t always suit individual investors. For those not managing billions, taking partial profits can offer flexibility and peace of mind. If Bitcoin peaks at, say, $250,000 and faces a fairly conservative 60% correction, it would revisit $100,000, creating a chance to reenter at lower levels than we’ve already seen.

The goal isn’t to sell everything but to strategically scale out of positions, maximizing returns and managing risks. Achieving this requires pragmatic, data-driven decisions, not emotional reactions. But again, if you never want to sell, then don’t! Do whatever works best for you.

Key Timing Tools

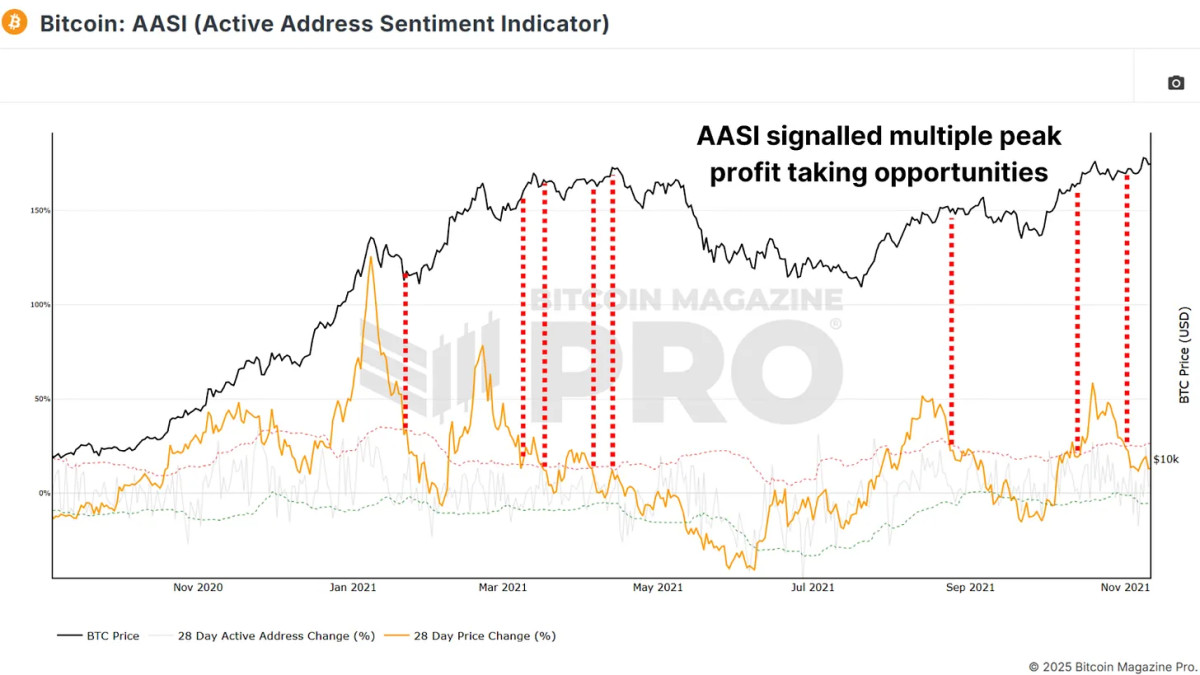

This Active Address Sentiment Indicator (AASI) compares changes in network activity to Bitcoin’s price movement. It measures deviations between price (orange line) and network activity, shown by green and red deviation bands.