How I Discovered the Bank Balance Needed to Retire at 67 with Zero Contributions

Investing money for the future is important. The earlier you start investing, and the more you invest at a young age, the easier it will be to build your desired nest egg. In fact, if you have enough invested when you are younger, your money can grow on its own and provide you with the […] The post How I Discovered the Bank Balance Needed to Retire at 67 with Zero Contributions appeared first on 24/7 Wall St..

Key Points

-

A Redditor has calculated how much you need invested at different ages to end up with $1.2 million.

-

Once you hit these investment targets, you don’t need to keep investing to achieve your goal.

-

Your money can earn enough money to give you your desired nest egg thanks to compound growth.

-

Earn up to 3.8% on your money today (and get a cash bonus); click here to see how. (Sponsored)

Investing money for the future is important. The earlier you start investing, and the more you invest at a young age, the easier it will be to build your desired nest egg. In fact, if you have enough invested when you are younger, your money can grow on its own and provide you with the wealth you need as a retiree.

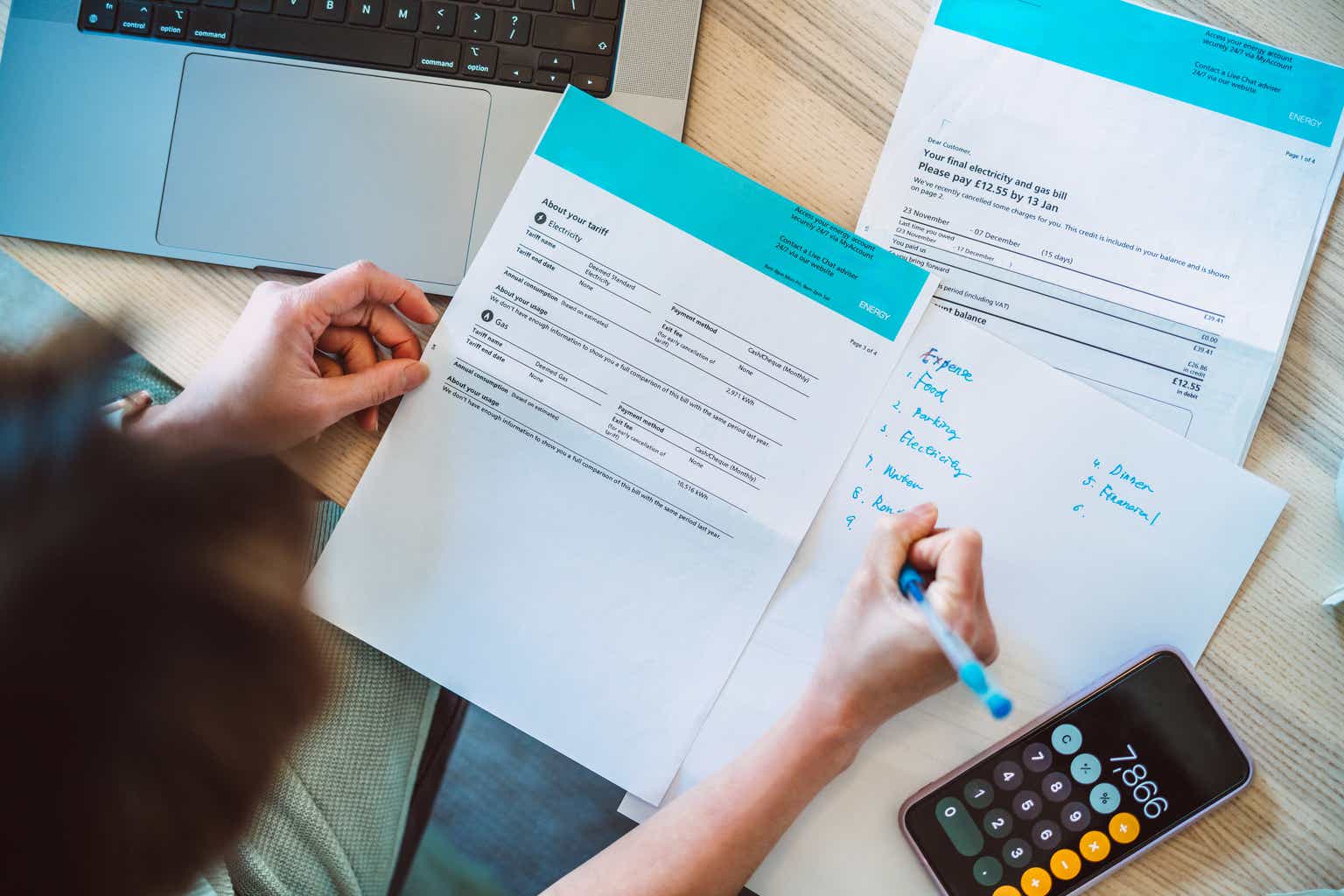

One Reddit user did the math to determine the amount of money that you would need to have invested at different ages in order for your account balance to grow to a large enough amount to support you.

Specifically, if you have this target balance at the target age, the growth of your money would lead to you ending up with $1.2 million by age 67 — even if you never made another contribution. That $1.2 million would give you $48,000 to spend each year if you followed the 4% rule.

So, how much do you need at each age?

Here’s what your balance would need to be to end up with a $1.2 nest egg at 67?

Based on the Reddit poster’s data, if you had $39,500 by age 18 and earned a 7% inflation-adjusted return each year, you’d end up with $1.2 million at 67. The compound interest calculator below confirms he is correct, assuming your returns compound monthly.

The poster also provided the amounts that you would need to have saved by other ages to his this target:

-

22: $52,000

-

25: $64,000

-

30: $91,000

-

35: $129,000

-

40: $183,000

-

45: $259,000

-

50: $367,000

-

55: $520,000

-

60: $737,000

-

65: $1,050,000

He also provided a method of calculating your target amount if your annual expenses are less than $48k. He said to divide that number by $48,000 and then take the result and multiply it by the target number above.

So, for example, if you want to spend $60,000 in retirement, $60,000 / $48,000 is 1.25. So, if you’re 40, you’d multiply $183K times 1.25 to see that you need $228,750 invested at 40 to amass the $1.5 million needed to give you 60K in annual income as a retiree.

Why do these numbers work?

The big question you may have is, why do these numbers work? How is it possible that if you have $183K by 40 or $259K by 45, you’ll end up with $1.2 million at 67? And the answer is because your money can work for you — and once you have a certain amount invested, the compound growth that results can be very powerful.

As your invested balance earns returns, those returns are reinvested. That increases the amount of your principal balance. So, next time you earn returns, you earn higher returns because you are starting with a higher balance. As this happens over and over for 10, 20, 30, 40, or 50 years, it gathers momentum — kind of like a snowball running down a hill.

The more time you have for your returns to be reinvested — or the more times the snowball goes down the hill — the more powerful this effect is and the more that your money will grow. You can use our compound interest calculator to help you see how much you need to invest to build the future you need based on your current age, and you can work hard to hit that goal so you have the security you deserve.

A financial advisor can also help you to make a personalized plan to set both your final target number as well as your monthly investing goals to ensure that you are on track for a secure future.

The post How I Discovered the Bank Balance Needed to Retire at 67 with Zero Contributions appeared first on 24/7 Wall St..