Hedge Funds Just Loaded Up on This ETF That Could Skyrocket 723%, According to BlackRock's CEO

Institutional investors more than doubled their positions in this single-asset ETF last quarter.

Professional fund managers and proprietary traders are some of the brightest minds on Wall Street. They study the markets closely and pounce on opportunities whenever they present themselves. They don't always stick to traditional stocks and bonds, and when a large group of them all look to capitalize on an asset it can signal a big opportunity for investors.

That's exactly what we saw in the fourth quarter.

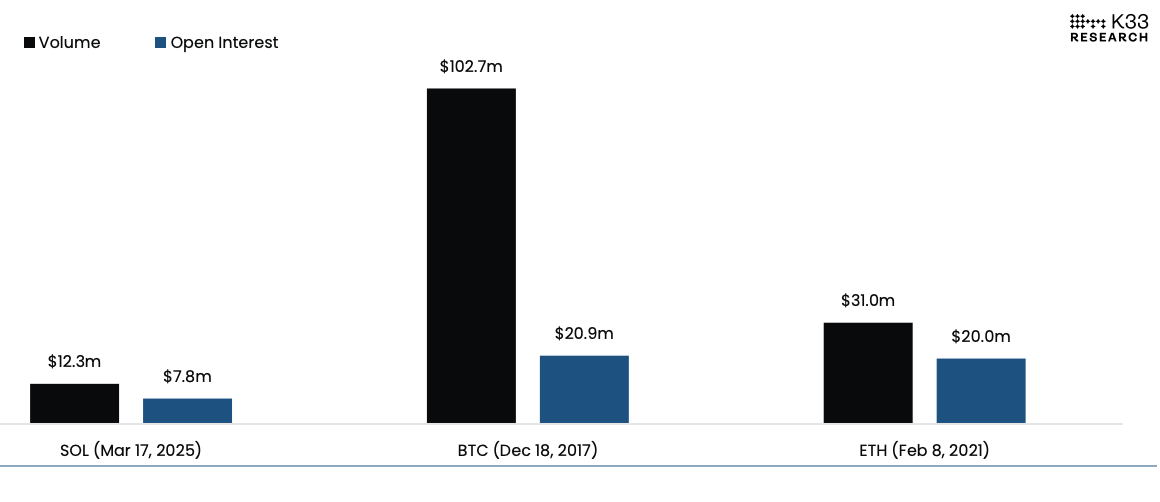

Hundreds of institutional investors started new positions or added to their investments in the iShares Bitcoin Trust ETF (NASDAQ: IBIT) from BlackRock (NYSE: BLK) last quarter. A total of 1,149 13F filings with the Securities and Exchange Commission included the ETF in their disclosure, up from 673 in the third quarter, and the total number of shares owned by institutional investors more than doubled.