Global stocks decline as U.S. imposes ban on Nvidia exports to China

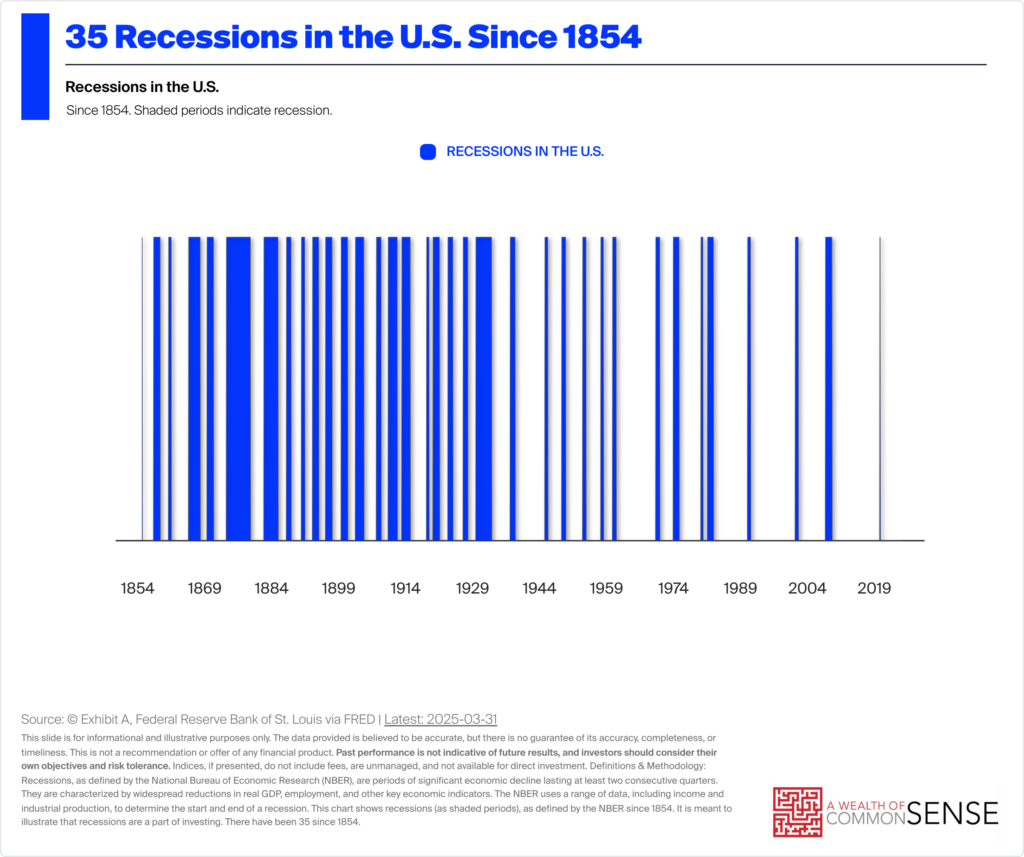

The U.S. bond market could come under further pressure, according to a research note published by JPMorgan.

- U.S. markets were mixed yesterday. Nvidia stock fell 5.7% in after-hours trading after the White House restricted its trade with China. Bank of America, Citigroup, and Netflix all saw gains, while news that China would pause purchases from Boeing caused its shares to fall 2%. The result: Stocks are down across Asia and Europe this morning, and U.S. futures are too.

The S&P 500 closed down 0.17% yesterday; the index is down 8.25% year to date. S&P futures were trading down 0.68% this morning, pre-opening bell.

Asia-Pacific markets fell this morning after the U.S. barred Nvidia from shipping its H20 AI chip to China, intensifying the trade war between Washington and Beijing. Semiconductor companies declined more broadly on Trump's tightened export controls on Nvidia. TSMC and SK Hynix, two major Nvidia suppliers, fell by 2.5% and 3.7% respectively.

Asia fell even as China reported better-than-expected economic data on Wednesday. China’s economy grew by 5.4% in the first quarter of the year, ahead of consensus expectations of 5.1%.

Europe followed suit, with its major indexes trending down in morning trading.

Here’s a snapshot of the action from Fortune’s CEO Daily:

- The S&P 500 closed down 0.17% last night. The index is down 8.25% YTD.

- S&P futures were trading down 0.68% this morning, pre-opening bell.

- Hong Kong’s Hang Seng closed down 1.9%

- Taiwan’s TAIEX index dropped by 2%.

- Japan’s Nikkei 225 dropped by 1%.

- South Korea’s KOSPI fell by 1.2%.

- The Stoxx Europe 600 was down 0.9% in early trading.

- The UK’s FTSE 100 was down 0.5% this morning.

The U.S. bond market could come under further pressure, according to a research note published by JPMorgan’s Joyce Chang and her team. The Trump Administration wants the yield on 10-year Treasuries to fall, in order to make consumer credit cheaper. But the 2025 budget, currently passing through Congress, “raises concerns about fiscal fallout and debt sustainability,” Chang wrote.

“The CBO’s long-term budget outlook suggests that debt levels could reach 214% of GDP by 2054 if tax cuts are made permanent and rates rise by 1%.” Her conclusion is that 10-year Treasuries will remain at a yield of “4.5% or higher” going forward.

This story was originally featured on Fortune.com