This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies.

Trump orders investigation into Biden’s presi...

Jun 5, 2025 0

Where to Buy Trusted Toyota Used Engines for ...

May 17, 2025 0

Trump orders investigation into Biden’s presi...

Jun 5, 2025 0

Trump signs order banning travellers from 12 ...

Jun 5, 2025 0

Trump losing patience with Musk’s criticism o...

Jun 5, 2025 0

M2 Hits Record Highs: What The Return Of Easy...

Jun 4, 2025 0

Enbridge: "Quintuple Vortex" Exemplified

Jun 4, 2025 0

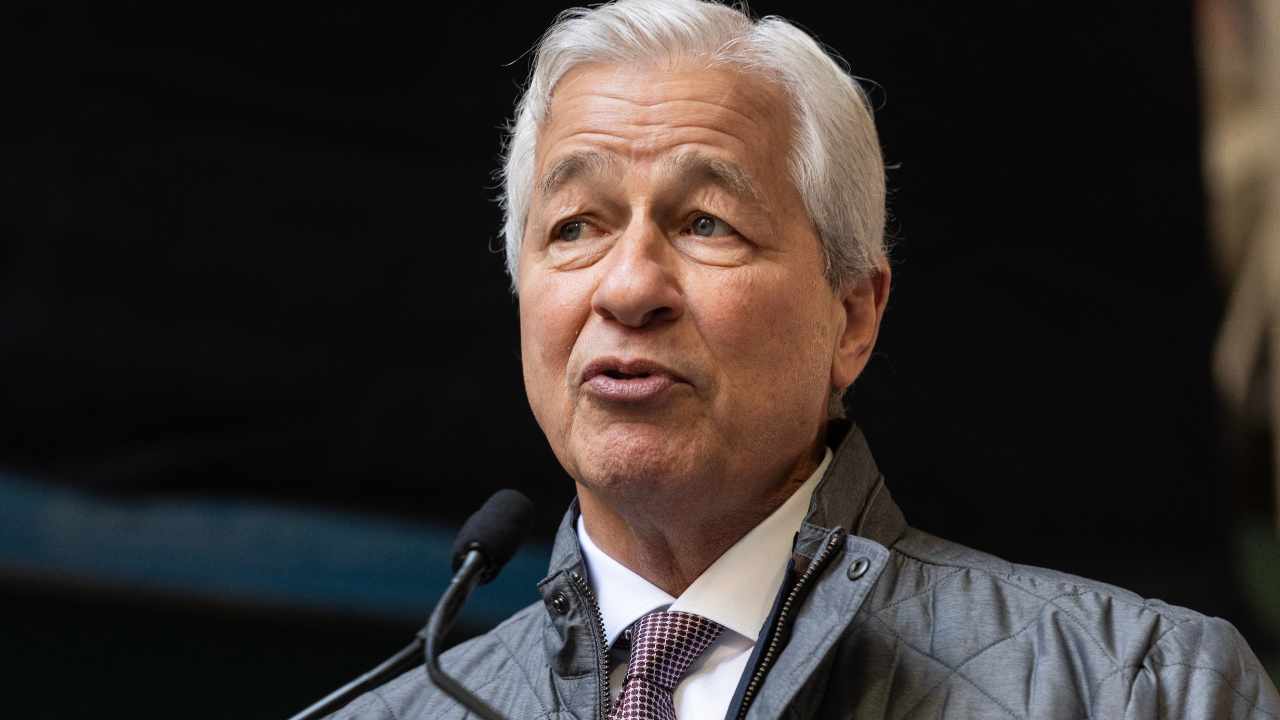

Trump Adds Fuel to Claims That Big Banks Disc...

May 12, 2025 0

One House, Three Owners: The Ballooning Cost ...

May 12, 2025 0

In China, a Cat-and-Mouse Game to Rein In Crypto

May 12, 2025 0

Now Wanted in Silicon Valley: Ho-Hum Business...

May 12, 2025 0

Service side of the U.S. economy contracts fo...

Jun 4, 2025 0

Trade wars dent hiring: ADP says businesses c...

Jun 4, 2025 0

Job openings rise in middle of trade wars, bu...

Jun 3, 2025 0

Dollar General stock soars on better-than-exp...

Jun 3, 2025 0

Applied Materials, Inc. (AMAT) Presents at Bo...

Jun 5, 2025 0

Day One Biopharmaceuticals: Strong Ojemda Pot...

Jun 5, 2025 0

Personal finance links: money as optionality

Jun 4, 2025 0

Research links: taking comfort

Jun 3, 2025 0

Day One Biopharmaceuticals: Strong Ojemda Pot...

Jun 5, 2025 0

Nutanix: Growth Beyond The Hype

Jun 4, 2025 0

Ferrari: The Underrated Potential Of Non-Car ...

Jun 4, 2025 0

Exxon Mobil Corporation: Substantial Value

Jun 4, 2025 0

New Zealand ANZ Commodity Price up to 1.9% in...

Jun 5, 2025 0

U.S. Dollar Stabilizes But Hardly Turns Around

Jun 3, 2025 0

Dollar Under Pressure - Multi-Timeframe USD B...

Jun 2, 2025 0

Markets Rattled To Start The New Month Amid H...

Jun 2, 2025 0

New Zealand ANZ Commodity Price up to 1.9% in...

Jun 5, 2025 0

HFRO: Controversial Fund, But May Be Too Chea...

Jun 4, 2025 0

HFGO: Active And Focused Mega-Cap Growth ETF ...

Jun 4, 2025 0

HFRO: Controversial Fund, But May Be Too Chea...

Jun 4, 2025 0

HFGO: Active And Focused Mega-Cap Growth ETF ...

Jun 4, 2025 0

RSPD: Reasons To Pursue And Reasons To Avoid

Jun 4, 2025 0

DGRO: Dividend Growth Is A Good Strategy, But...

Jun 4, 2025 0

Why are crude oil prices rising? Check reason...

Jun 4, 2025 0

Gold price climbs ₹10 to ₹99,070; silver rise...

Jun 4, 2025 0

Gold price climbs ₹10 to ₹98,850; silver rise...

Jun 3, 2025 0

Oil companies cut commercial LPG price by ₹24...

May 31, 2025 0

4 Reasons Agnico Eagle Mines Stock Can Rise F...

Jun 4, 2025 0

Chart Of The Day: The Big Metals And Mining S...

Jun 4, 2025 0

Central Bank Gold Buying Slowed In April

Jun 4, 2025 0

Silver (XAG/USD) Cools From 7-Month High On P...

Jun 4, 2025 0

Open Thread Non-Petroleum, May 27, 2025

May 27, 2025 0

Open Thread Non-Petroleum, May 19, 2025

May 20, 2025 0

Open Thread Non-Petroleum May 10, 2025

May 18, 2025 0

- Contact

- LIVE TV

-

Finance & Economics

- All

- Business & Finance | Reuters News Agency

- Business Insider

- Economy News

- Editors' Picks Articles on Seeking Alpha

- Finance CNBC

- Financial Times: Markets

- Fortune » - Fortune

- MarketWatch.com - Top Stories

- Quartz

- The Economist: Finance and economics

- The Motley Fool

- WSJ.com: Markets

- Yahoo! Finance: Top Stories

- Markets

- Investing

- Crypto

- Forex

- ETFs

- Commodities