Elon Musk’s little brother and one other Tesla board director sell stock worth nearly $200 million

Tesla insiders' frequent stock sales have been a source of frustration for shareholders in recent months.

- Ira Ehrenpreis, chair of Tesla’s compensation committee, and Kimbal Musk liquidated all the stock they converted from call options on Tuesday, in transactions that yielded $162 million and $31 million respectively. Tesla insiders’ frequent stock sales have been a source of frustration for shareholders in recent months.

Two major Tesla insiders have exercised tens of millions of dollars worth of stock options, pocketing the cash rather than holding onto the shares like CEO Elon Musk.

On Tuesday, the company published SEC filings proposing the sale of securities under trading plans by members of the board of directors estimated to be worth nearly $200 million. All stock converted from options were subsequently sold within that very same day.

While in past months most stock sales have stemmed from board chair Robyn Denholm, this time it was Musk confidante Ira Ehrenpreis, who sold over 477,500 shares worth $162 million, according to a Form 144.

Ehrenpreis is one of Tesla’s longest serving directors, having joined the board 18 years ago. He chairs the compensation committee tasked with proposing to shareholders a new pay package for their CEO.

The other director to cash out is Kimbal Musk, the CEO’s younger brother. His 144 indicated nearly 91,600 shares were liquidated to yield a little over $31 million. The Musk sibling, who doesn’t sit in any board committee because he is not officially independent, had last sold a substantial amount of Tesla stock in early February.

The sales have prompted controversy, especially when they were conducted during a time when the stock was already under pressure, such as when James Murdoch liquidated some of his shares. By comparison, CEO Elon Musk continues to hold onto all of his stock, having sold most recently in late 2022 around the time he was acquiring Twitter.

Importantly, Tuesday’s transactions are no indication of concern over the current quarter as the timing was not of their own volition. The trades were executed under separate 10b5-1 plans arranged last year by Ehrenpreis and Musk.

Stock continues rally as Musk leaves Washington

Tesla directors weren’t the only ones selling shares in the EV maker. Cathie Wood, a Tesla bull with a $2,600 price target long-term price target, offloaded 27,377 shares in Tesla from her funds at ARK Invest.

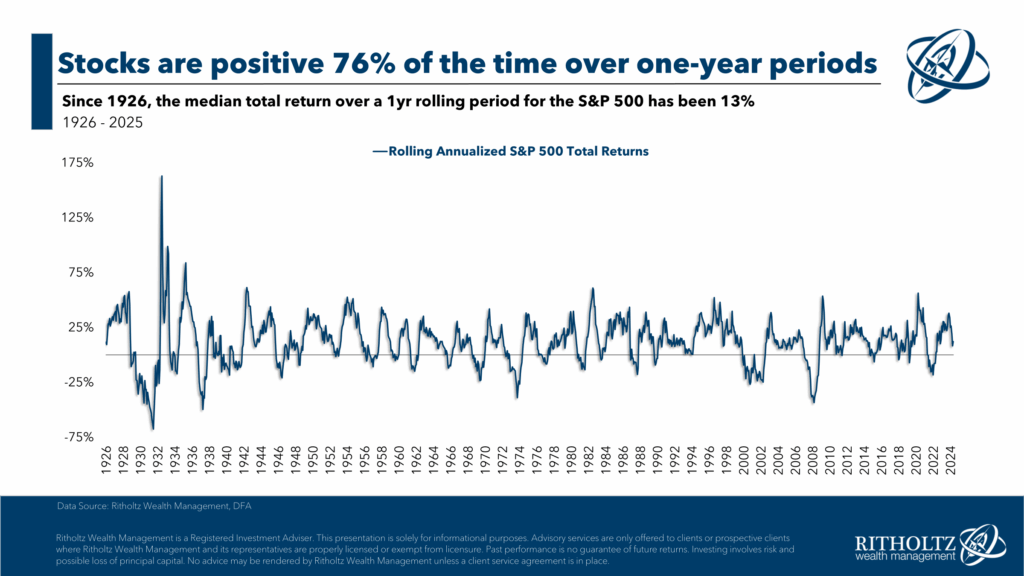

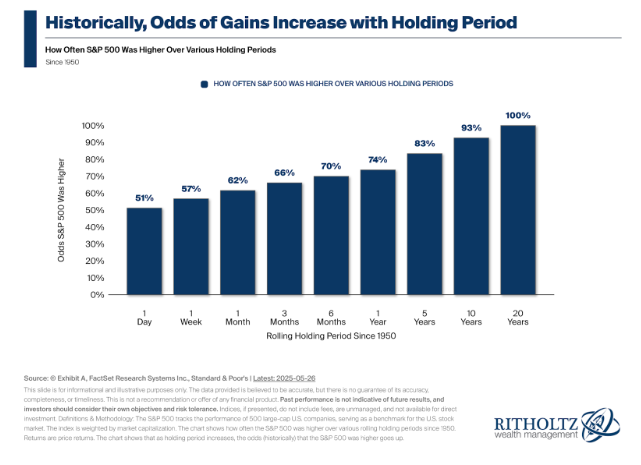

The timing proved highly advantageous. The stock has rallied by more than 50% since April 22nd’s first-quarter earnings, when Musk pledged to dial back his time commitments with President Trump.

Tesla’s last closing price of $362.89 implies investors are willing to pay 125 times next year’s consensus earnings to own stock. On Tuesday, when the trades were executed, the stock soared 6.9% with reports attributing the gains to comments from Musk stating he would now be devoting all his waking time to his business interests rather than invest further time in politics.

In an interview, the Tesla CEO further cemented perceptions that his time in Washington was all but done after lamenting his Republican allies in DC for failing to make his DOGE cuts permanent.

This story was originally featured on Fortune.com