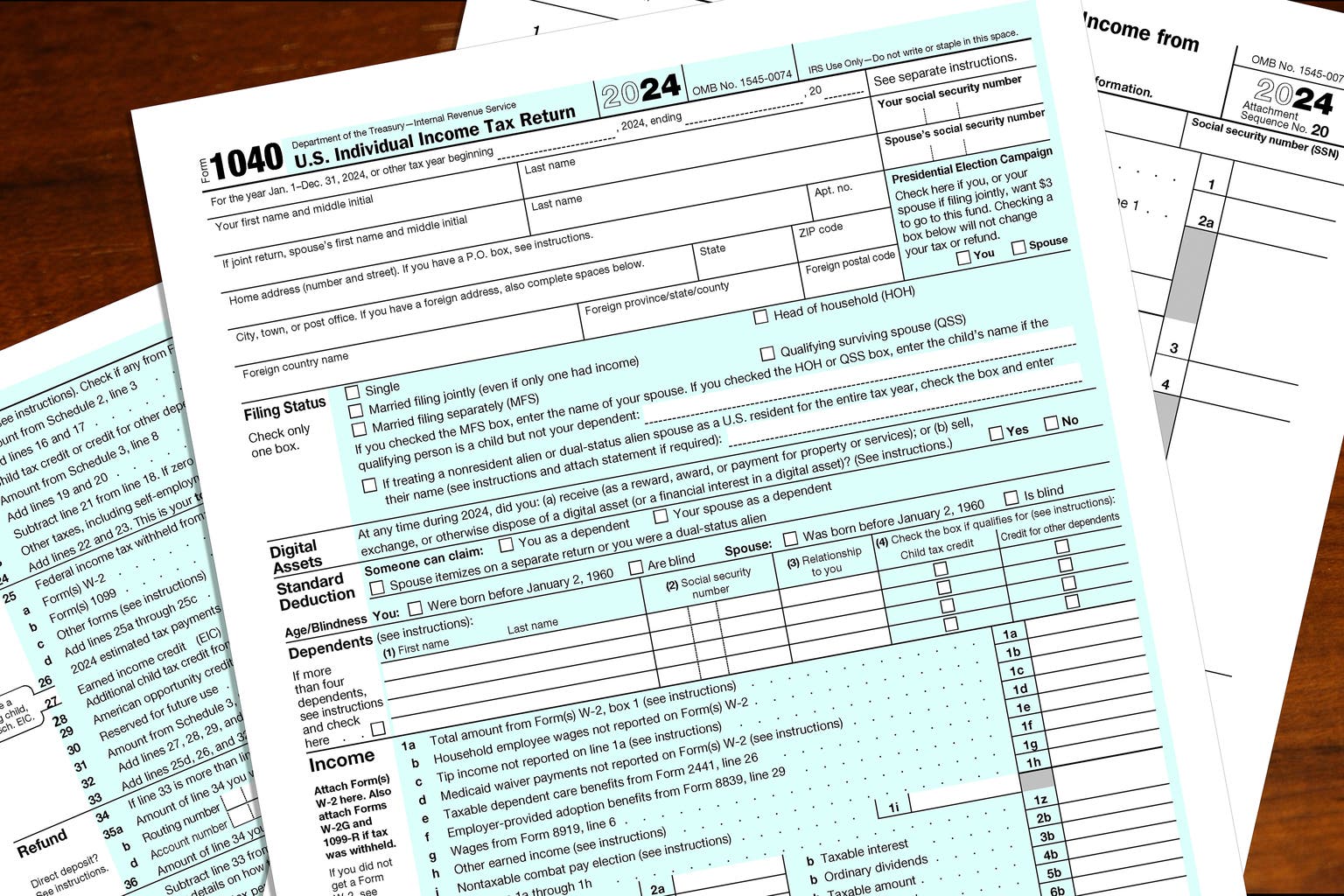

How to Find an IRS Refund You Didn’t Know You Had

The IRS issued an important warning in April of 2025, alerting Americans to the fact that around $1 billion in refunds remain outstanding from the 2021 tax filing year. Those refunds are owed because many people did not file their taxes that year who would have been eligible for a refund if they had submitted […] The post How to Find an IRS Refund You Didn’t Know You Had appeared first on 24/7 Wall St..

Key Points

-

Taxpayers are owed a lot of money in unclaimed refunds.

-

You have three years from the tax filing deadline to submit a return and claim a refund before losing the opportunity.

-

You can also use the Where’s My Refund tool to track down refunds you already claimed.

-

Are you struggling with tax issues? SmartAsset’s free tool can match you with a financial advisor in minutes to help you develop a tax plan to minimize what you owe the IRS . Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

The IRS issued an important warning in April of 2025, alerting Americans to the fact that around $1 billion in refunds remain outstanding from the 2021 tax filing year. Those refunds are owed because many people did not file their taxes that year who would have been eligible for a refund if they had submitted their paperwork. Time is running out for them to file, and the IRS has urged those who might be affected to act quickly and submit their returns.

These individuals are just some of the many who are owed IRS refunds they may not know about. Anyone who fails to file a return in a year when they are due money is missing out.

It’s also possible to be missing a refund if you did file a return and if you had the wrong account information or contact details on your form — but if you submitted your tax forms and were owed money, you’d probably notice if it didn’t show up.

If you are owed an IRS refund you didn’t know you had, you should take action to get it, as you have a limited time to do so. Here’s what you need to know about finding a refund you were unaware of.

How to determine if you’re owed a refund you didn’t know about

As mentioned above, you may be owed a refund you didn’t know about if you failed to file a tax return when you were eligible to get money back. The only way to find this out is to go through the process of doing your taxes. You can use free or low-cost online programs to complete your tax forms to see if you’re owed a refund. If you are, you should submit your forms to the IRS (which you can do using that same program).

If you discover that you are owed a refund, you can submit old returns to claim it without worrying about being penalized. While you’re charged fees for late filing when you owe taxes, there’s no penalty for late filing when the IRS owes you money. The catch is, you have only a three-year window from the time the tax forms were due in order to be able to collect your unclaimed refund.

After three years, the statute of limitations prevents you from getting repaid. Any credits, overpayments of estimated taxes, or amounts withheld from your check will be transferred to the U.S. Treasury and will be lost to you forever. You don’t want this to happen, so you should act swiftly if you have unfiled returns from the past few years that you haven’t yet submitted.

The law does require that you’re caught up on tax forms before the IRS sends your refund, though. So if you didn’t submit returns in any of the past few years, you may have to get them all in to claim your money — and if you owe the IRS, have unpaid child support, or are delinquent on other federal or state debts, your tax refund might be offset (which means a portion of it would be taken to satisfy your debt).

Tracking down missing refunds

If you did file a return and you haven’t received an anticipated refund, then it might not have arrived if the IRS had the wrong info. You can try to find out the status of your refund online using the Where’s My Refund?” tool at irs.gov/refunds, or you can call the IRS at 1-800-829-0115.

If you have limited income or are elderly or don’t speak English, you might also qualify for free tax help from the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. The professionals there can help you determine if you have unclaimed refunds that you should file taxes to get your hands on.

A financial advisor can also help you with tax issues, including determining if you are owed a refund and how to claim it, or track it down. Be sure to get this assistance if you need it, so you don’t leave money on the table.

The post How to Find an IRS Refund You Didn’t Know You Had appeared first on 24/7 Wall St..