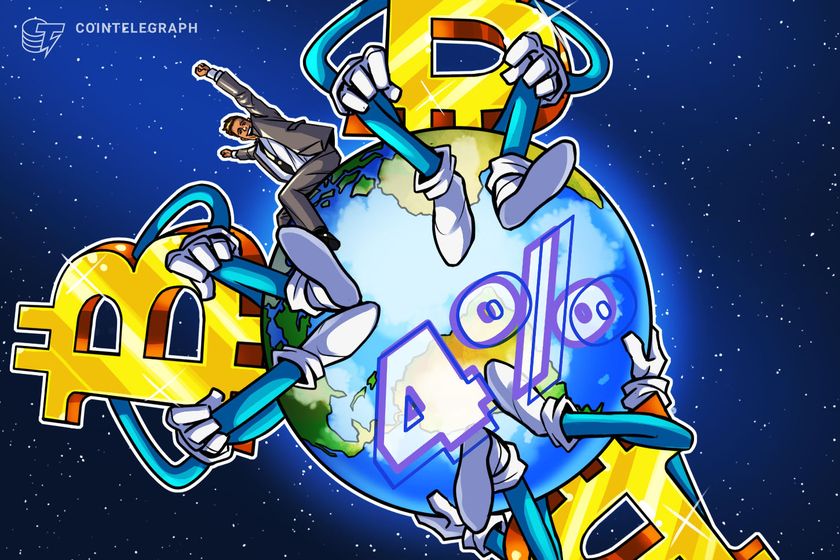

Ditch the 4% Rule, This Retirement Withdrawal Strategy Is Better

The 4% Withdrawal Rule for retirement funds celebrated its 30th anniversary this past October. Financial advice professionals have used it as a benchmark for advising their clients in scheduling their retirement account withdrawals throughout that time. It has now become a regular part of the F.I.R.E. (Financial Independence Retire Early) lexicon, and many Millennials and […] The post Ditch the 4% Rule, This Retirement Withdrawal Strategy Is Better appeared first on 24/7 Wall St..

The 4% Withdrawal Rule for retirement funds celebrated its 30th anniversary this past October. Financial advice professionals have used it as a benchmark for advising their clients in scheduling their retirement account withdrawals throughout that time. It has now become a regular part of the F.I.R.E. (Financial Independence Retire Early) lexicon, and many Millennials and even Gen-Z members have adopted it into their calculations for their early retirement income drawdowns.

However, a fixation on the 4% Rule can become a potential detriment for some retirees’ accounts, depending on the assets they have, their age and RMD liability, and other factors. Luckily, there are modifications of the 4% Rule that can be applied to a wide range of accounts and situations.

Key Points

-

The 4% withdrawal rule was first created by William Bengen in 1994 as a general percentage of retirement funds that would last an average retiree for 30 years, even in worst case situations.

-

In 2025, greater flexibility needs to be factored into the withdrawal equation, as inflation, interest rate changes, and a slowdown in an anomalously strong bull market for equities are more likely than not to change in the near future.

-

The Guardrails Approach can offer a simple system to tweak an annual retirement withdrawal rate to better protect against a future shortfall.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Second Thoughts and Bigger Risks

Ironically, Bengen himself stated a number of years later in 2012 that his analysis and calculations to arrive at the 4% Withdrawal Rule were based on several flawed assumptions. These points included:

- “The 4% Rule” was based on a worst-case scenario for those retirees circa 1968. This was before the Bear Market and double-digit interest rates and inflation of the 1970s and the Carter Administration.

- The 4% Rule was Bengen’s calculated SAFEMAX rate, i.e., the maximum safe rate of withdrawal based on economic conditions at that time (1968). The SAFEMAX rate would later be revised to 4.5% if tax-free and 4.1% for taxable.

- The 18% annual gains of the S&P 500 from 1982 to 1999 were historically abnormal and could skew projections to be over optimistic in the future.

- Over a longer period, Bengen stated that history leaned closer to a 7% average SAFEMAX rate, again factoring inflation and prevailing interest rates into the equation.

One of the primary criticisms of The 4% Rule was that blind dedication to it could leave a portfolio short if a prolonged Bear Market eroded gains, or with excess funds during extended Bull Markets like during the 1980s and 1990s. Additionally, abnormally volatile markets could spook some investors into panic selling. F.I.R.E. adherents can be at even more severe risk, since their portfolios will be exposed for over a longer period of time. Their retirements may start as much as 10-20 years earlier than the average age of 65.

Customizing the Recipe With Guardrails

In an effort to encourage children to enjoy bowling, several bowling alleys have designated lanes for children under age 12. These lanes have guardrails on either length of the lane that keep bowling balls from falling into the gutter. This greatly enhances the chance of hitting pins, scoring points, and building children’s self-esteem and sense of accomplishment.

The Guyton-Klinger Guardrails Approach was created by Jonathan Guyton and William Klinger in 2006. It takes a figurative guardrail approach towards an arbitrary 4% – 7% annual withdrawal rate that can drastically reduce the chances of an unpleasant shortfall or oversupply surprise. Obviously, a shortfall can be a major problem in one’s golden years, if they can no longer afford basic necessities due to lack of funds. An overage, which is less of a problem, can still be an issue if RMD and tax calculation considerations are strategized to stay below specified brackets, and the overage triggers a bigger tax bill. Additionally, longer life expectancies may need to factor a requirement of funds to last longer than the average 30 year calculation.

For example, a 20% guardrails approach could place a 10% floor and a 10% ceiling on a withdrawal rate. Mechanically, it could take shape as follows:

If a target withdrawal rate is 5%, the lower guardrail is 4% and the upper guardrail is 6%. The target withdrawal range thus sits between 4% and 6%.

After adjusting for inflation, the withdrawal rate would take a 10% increase or reduction in the withdrawal amount. After taking the 10% adjustment, the withdrawal rate should be between the upper and lower guardrails. For example, if the retirement withdrawal rate is above 6% next year, adjust the withdrawal amount for inflation and then reduce it by 10% so the new withdrawal rate falls below 6%.

In a Bear Market downturn example:

- Year 1: The portfolio is worth $1 million and the withdrawal rate is 5%. Retiree withdraws $50,000.

- Year 2: The portfolio decreased to $800,000 and the withdrawal of $50,000, with an adjustment for inflation, would be more than 6% of the portfolio. This hits a guardrail. By calculating the inflation-adjusted withdrawal amount (assuming 4% inflation) of $52,000, reducing it by 10% would result in a $46,800 withdrawal, which would be less than 6% of the portfolio.

The use of a guardrails strategy during a Bear Market does not automatically compel the retiree to cut spending commensurately. For example, with traditional IRA or 401-K accounts, the decreased withdrawal calculation could also factor in the corresponding income tax reduction that would be owed.

While the Guardrails Approach is certainly a handy strategy to deploy, it does not replace the need for regular portfolio monitoring, keeping abreast of news that will impact one’s investments, and on legislative changes that will require proactive steps to avoid any new or modified tax levies.

The post Ditch the 4% Rule, This Retirement Withdrawal Strategy Is Better appeared first on 24/7 Wall St..