Did Microsoft Just Make Quantum Computing Stocks a Buy?

Quantum computing stocks were all the rage in 2024 with shares of some of the most popular companies rising 1,000% or more. But they crashed pretty hard in January after Nvidia (NASDAQ:NVDA) CEO Jensen Huang said quantum computing was still two decades away from viability and Meta Platforms (NASDAQ:META) CEO Mark Zuckerberg chimed in a […] The post Did Microsoft Just Make Quantum Computing Stocks a Buy? appeared first on 24/7 Wall St..

Quantum computing stocks were all the rage in 2024 with shares of some of the most popular companies rising 1,000% or more.

24/7 Wall St. Insights:

-

Microsoft (MSFT) shook up the quantum computing world with the announcement it had created a new kind of matter that was not solid, liquid, or gas.

-

Most leading quantum computing stocks jumped on the news, as it could mean the viability of their business model can be achieved in years, not decades.

-

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

But they crashed pretty hard in January after Nvidia (NASDAQ:NVDA) CEO Jensen Huang said quantum computing was still two decades away from viability and Meta Platforms (NASDAQ:META) CEO Mark Zuckerberg chimed in a week later with similar comments.

Although quantum computing stocks have since regained some of the lost ground, they have failed to spark any real momentum.

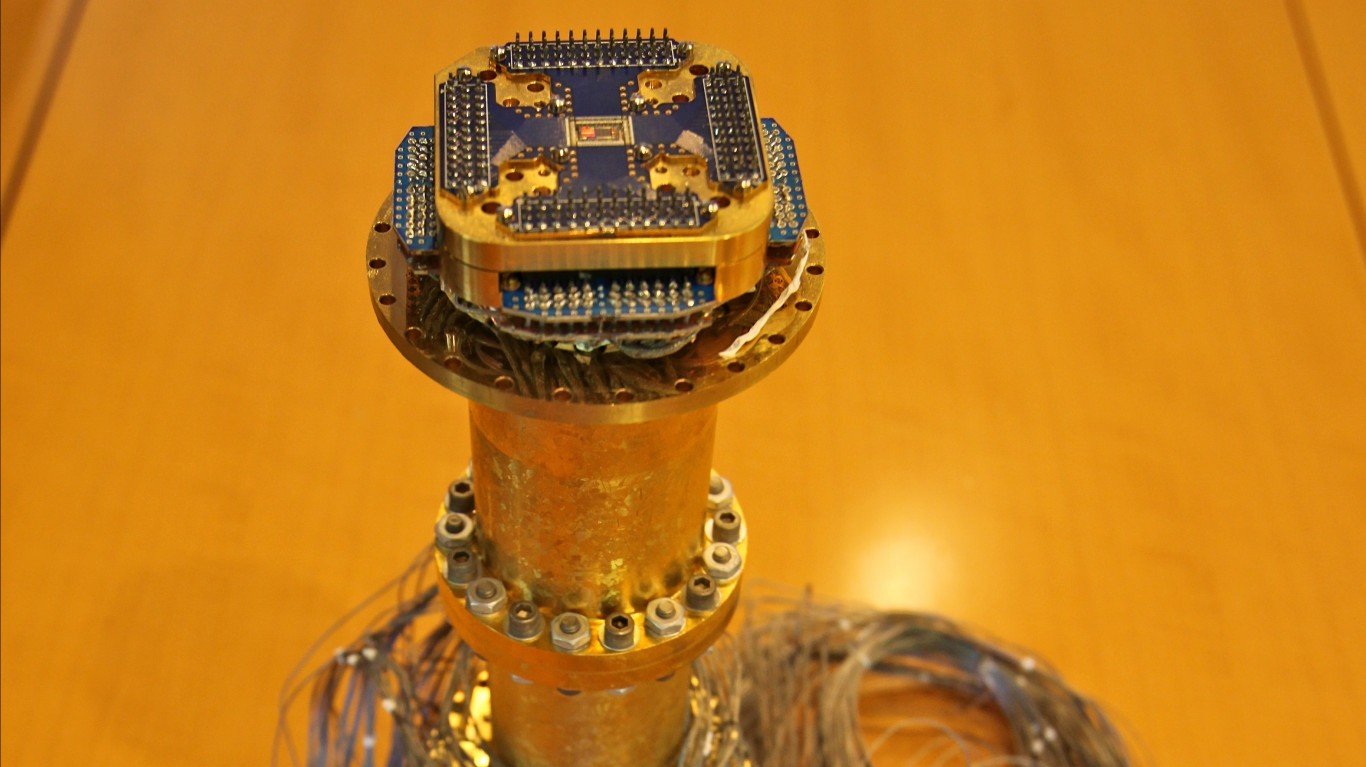

The biggest problem is today’s quantum computers are especially sensitive to environmental conditions, which makes them unstable and error prone. All that, however, may have just changed.

A major quantum computing breakthrough

Microsoft (NASDAQ:MSFT) just announced it made a quantum computing breakthrough. It claims to have created a whole new type of material called topoconductors, which is different from solids, liquids, or gases.

This material uses something called Majorana particles, or special particles that exist in pairs and are very stable, to build a new kind of quantum bit, or qubit, which is the basic building block of quantum computers.

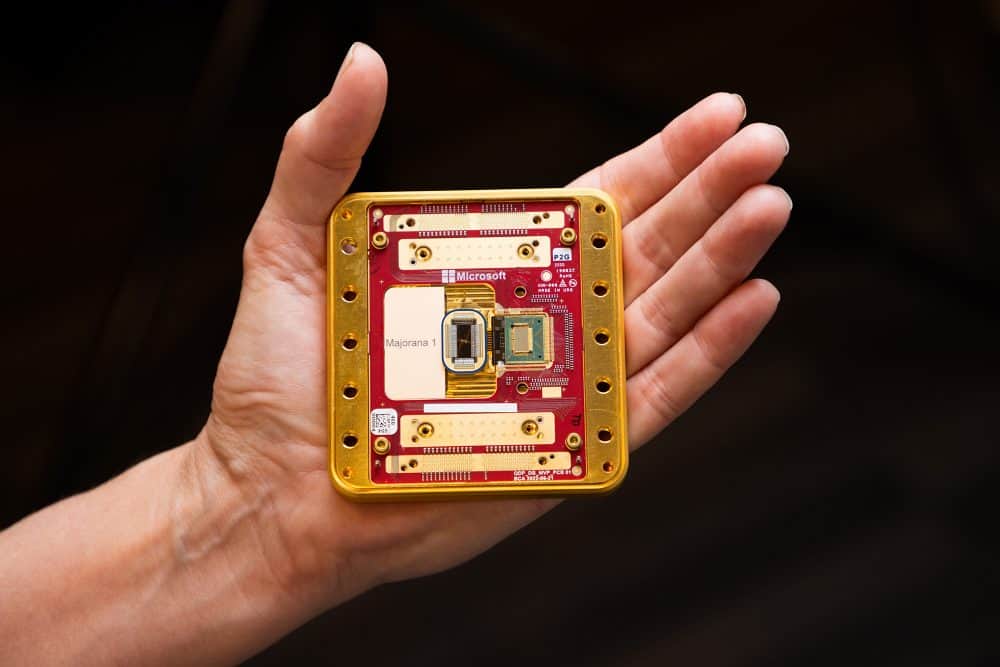

Using this topoconductor, Microsoft built a quantum processing unit (QPU) called Majorana 1. This chip uses “topological qubits,” which are designed to be more stable and less prone to errors compared to the qubits in typical quantum computers.

These qubits can hold quantum information for longer and are easier to manage, which is significant because quantum computers are notoriously tricky to control. Moreover, they typically only use dozens or hundreds of qubits, but Microsoft says its breakthrough could lead to building quantum computers with up to a million qubits on a single chip, a tremendous leap forward.

A strange new world

Now I’ll admit to not completely understanding the science behind it and more testing and proof will be needed to confirm these claims fully. But should it prove true, it suggests quantum computers will become a reality in years, not decades.

To paraphrase former President Biden, this is a big freaking deal. Coupled with the developments made by Alphabet‘s (NASDAQ:GOOG)(NASDAQ:GOOGL) Google in designing its quantum computing chip, and it could make these three quantum computing stocks ones to put on your radar.

Rigetti Computing (RGTI)

Rigetti Computing (NASDAQ:RGTI) designs and fabricates QPUs and other types of hardware at its Fab-1 facility. In December it debuted its innovative Novera quantum processor, a 9-qubit QPU along with the launch of its 84-qubit Ankaa-3 system.

Its roadmap calls for releasing a 36 qubit system by the middle of this year, a 100 qubit system by the end of 2025, and a 336 qubit system after that. It is understandable why a million-qubit system by Microsoft would be a massive achievement and helps explain why RGTI stock jumped 4% on the news.

Rigetti claims its Fab-1 facility is the only dedicated quantum computing fab, which could give it first-mover status if production scales up quickly. The company is also vertically integrated and says it takes “a full-stack product development approach,” moving from quantum chip design and manufacturing through delivering it to the cloud.

RGTI stock is up over 1,200% in the last six months as quantum computing became the next big thing after artificial intelligence. Shares are more than 1,600% above their lowest point, although they have been cut in half from the highs hit last month.

D-Wave Quantum (QBTS)

D-Wave Quantum (NASDAQ:QBTS) was the biggest beneficiary of the Microsoft announcement as its stock soared 13%. Its claim of being the world’s first commercial supplier of quantum computers would benefit from the creation of topological qubits that move the technology toward more commercial mainstream adoption.

D-Wave had also recently announced its own development of a commercial hybrid-quantum application that simulates the movements of autonomous agriculture vehicles at scale. Built in partnership with Staque, it would be one of the first commercially available customer-facing services built around quantum computing.

QBTS stock did generate the same type of movement Rigetti’s stock did, rising only 700% in the past six months, but it stands to be a primary recipient of any potential gains in the industry.

IonQ (IONQ)

IonQ (NASDAQ:IONQ) is among the only quantum computing stocks that didn’t gain anything as a result of the Microsoft announcement. IONQ stock fell 1.1% and has been heading lower for most of February.

Despite readying the launch of a 64-qubit computer this year, IonQ was recently overshadowed by the debut of a competing Chinese machine, Wukong, from Origin Quantum Computing Technology.

Yet IonQ has a competitive advantage of many others in the field as its technology is a bit more proven than its rivals. It has won significant government contracts for its technology, which also it to continue funding its research in quantum computers, but it also means it goes up against some larger rivals, too, such as IBM (NYSE:IBM).

IONQ stock is up 360% in the past half-year and stands almost 450% above its lows. As another quantum computing stock standing ready to reap the rewards of powerful new quantum chips, investors would do well to keep an eye on IonQ.

The post Did Microsoft Just Make Quantum Computing Stocks a Buy? appeared first on 24/7 Wall St..