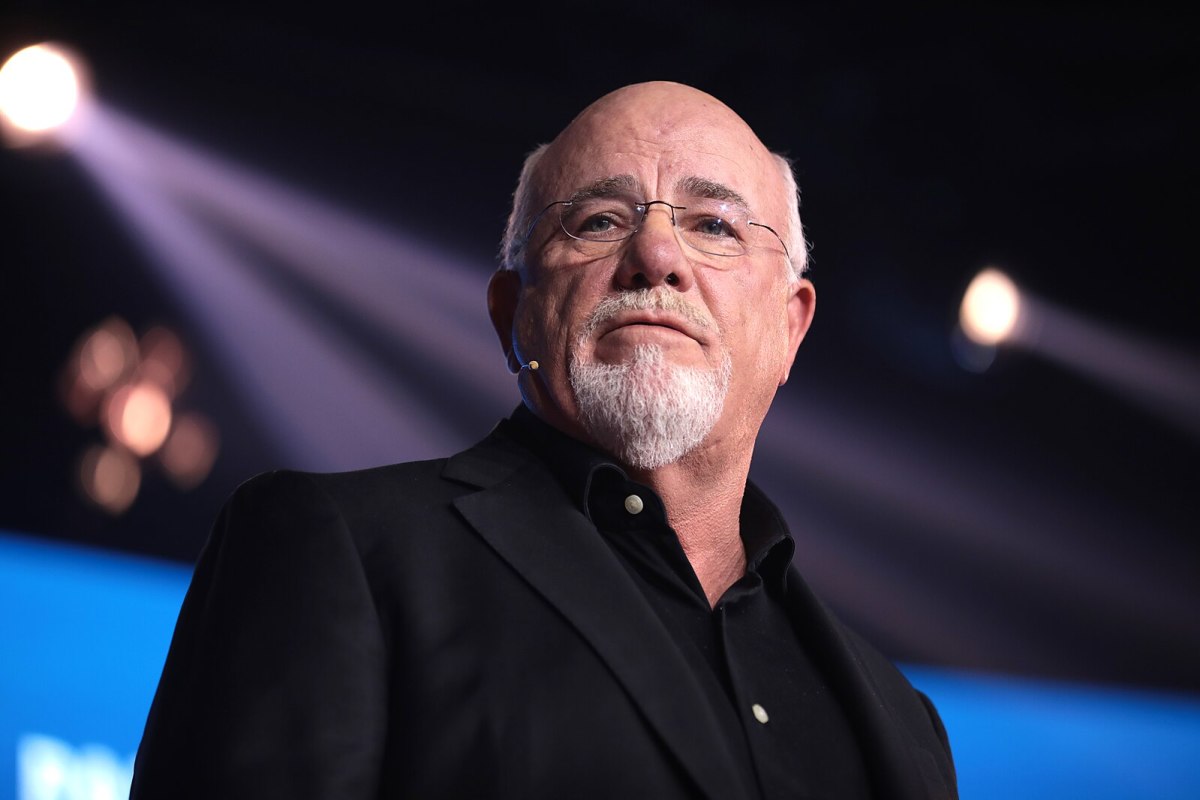

Dave Ramsey’s net worth: The personal finance pundit’s wealth in 2025

Dave Ramsey has made a living dishing out advice on personal finance since the late 80s, but just how much has he managed to put away for himself in the process? Here’s what the pop-finance pundit is worth in 2025.

Dave Ramsey — like his pop-finance peer Suze Orman — has built a career as a public authority in personal money management. Average Americans look to the likes of these personal finance pundits for practical ways to get out of debt, plan for retirement, build nest eggs, and reach other financial benchmarks.

Over the course of his decades-long career in financial media, Ramsey has built a reputation as a hard-nosed, no-nonsense consultant who dispenses actionable financial advice to the everyman via his books and radio show.

Despite his considerable success, however, Ramsey has a bankruptcy in his past, and some of his advice has been criticized by other money-management authorities for being too general, too biblical, and failing to take individual circumstances into account.

Nevertheless, he remains one of the most popular voices in personal finance, with 5.7 million followers on Instagram and nearly a million followers on X.

“He is your daddy, your accountant, your minister all in one.”

—Susan Drury of The Nashville Scene, 2007

Here’s how the author of “The Total Money Makeover” and host of the syndicated radio program “The Ramsey Show” built his wealth and what he’s worth today.

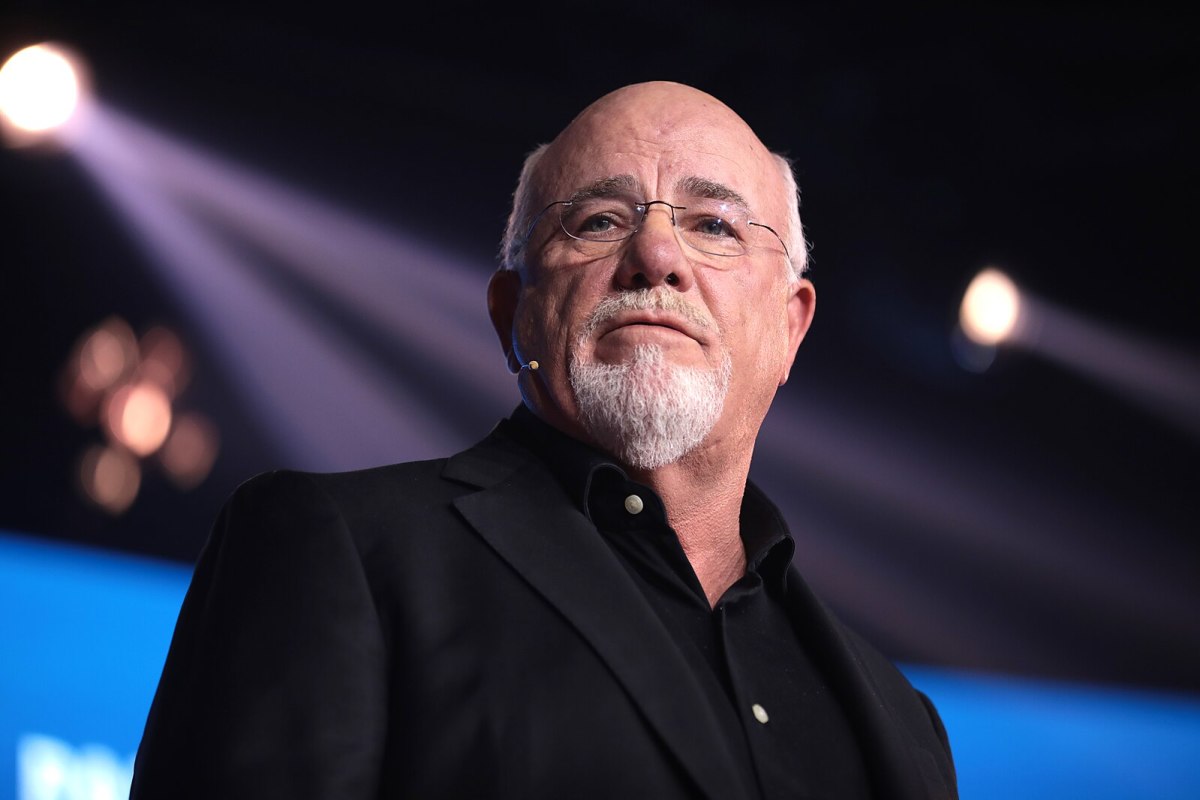

What is Dave Ramsey’s net worth in 2025? Is he a billionaire?

As of early 2025, Ramsey’s net worth is estimated to be around $200 million. Most outlets reporting this figure cite CelebrityNetWorth — a popular celebrity wealth site that doesn’t disclose its estimation methodology or cite its sources — as the source for this number. In October 2024, The Daily Beast cited his net worth 25% lower at $150 million.

Because much of Ramsey’s wealth is held in the form of real estate, his true net worth is much more difficult to estimate than that of, say, a CEO of a public company, whose wealth is closely tied to their ownership stake in that company’s stock.

Related: Mark Cuban’s net worth: 'Shark Tank' investments, Dallas Mavericks & more

A 2018 article in Politico claimed Ramsey’s net worth was around $55 million at the time, which would mean that if the current $200 million figure is correct, the radio host has managed to almost quadruple his wealth in just six years — an impressive feat, especially given the financial impact of the COVID-19 pandemic and the period of high inflation that followed in the interim.

Listeners of Ramsey’s have wondered if his net worth might be even higher than commonly estimated due to the value of his real estate holdings. One Reddit user shared a post in 2024 wondering whether Ramsey might be approaching billionaire status and claiming that Ramsey himself valued his property portfolio at $500 million on air:

View the original article to see embedded media.

How did Dave Ramsey make his money? His early life & career

Ramsey dove head-first into finance and real estate at a relatively young age, which is no surprise, considering his upbringing. Both of Dave’s parents were successful and driven real estate agents and developers, and they instilled an attitude of self-motivation, goal-setting, and ambition in their children from a young age.

Youth & early real estate career

Ramsey ran a small business manicuring lawns in his hometown of Antioch, Tennessee, while in high school, but as soon as he turned 18, he took his real estate licensure exam. Once he was of age and licensed, Ramsey wasted no time sliding seamlessly into the family industry, selling real estate full-time while completing a four-year undergraduate education in finance at the University of Tennessee Knoxville.

Ramsey graduated and dove full-tilt into his real estate career, enlisting the help of local banks his family had working relationships with to take out loans to finance larger projects. According to a 2003 issue of the Ocala Star-Banner newspaper, by 1986, Ramsey was “26, driving a Jaguar and carrying a $4 million real estate portfolio.”

Unfortunately for the young upstart, his financial footing was about to crumble beneath him, providing a first-hand education in the risk of leverage. This is something that he would carry with him for the rest of his career — and that would become the basis of much of his financial advice.

“Debt is not a tool; it is a method to make banks wealthy, not you. The borrower truly is slave to the lender.”

—Dave Ramsey

Bankruptcy

One of the smaller banks to which Ramsey owed about $1.2 million in short-term debt was sold to a larger institution, and the new owners were keen to collect. Ramsey suddenly needed to repay a massive amount of money, which led to a “chain reaction in which he lost everything but his house and his wife, Sharon,” according to the Star-Banner.

Ramsey filed for bankruptcy protection in 1988 and spent three years paying back his remaining debts as he attempted to start anew. During this period, he famously studied the Bible for nuggets of religious financial wisdom. He particularly liked Proverbs 22:7, which states, “The rich rule over the poor, and the borrower is slave to the lender.”

To this day, Ramsey continues to advise his listeners to engage in “plastic surgery” — i.e., cut up their credit cards and spend no more than they actually have.

More net worth:

- Joe Rogan’s net worth: The controversial podcaster’s income & investments

- Justin Baldoni’s net worth amid Blake Lively harassment lawsuit

- Home Depot founder Arthur Blank’s net worth: Investments, Atlanta Falcons & ranches

First book and career pivot into financial advice

As he navigated his bankruptcy, Ramsey continued to sell real estate, but he also began offering financial counseling to members of his church community based on his own experience. This led him to a pivotal turning point in his career — in 1992, Ramsey took his passion for personal finance advice to the professional level by self-publishing his first book, “Financial Peace” and launching The Lampo Group, the financial consultancy that would eventually become Ramsey Solutions.

That same year, he also got his first radio gig, appearing as a guest on Nashville radio station WWTN 99.7. Coincidentally, the station was undergoing a bankruptcy of its own, and Ramsey was asked if he would host a show for free. The result was the personal finance show “The Money Game,” which Ramsey originally co-hosted with his friend and associate, Roy Matlock, according to The Nashville Scene.

Within just a few years, the show, which was renamed “The Dave Ramsey Show” after Matlock’s departure, had exploded in popularity. It was broadcast for three hours daily, with listeners calling in to chat with Ramsey about their individual financial predicaments. Ramsey syndicated the show in 1996, and it eventually ran on over 550 individual radio stations across the country, according to the Radio Hall of Fame.

As his radio show grew in popularity, Ramsey launched Financial Peace University — a video-based personal finance course sold through the Lampo Group/Ramsey Solutions — in 1994.

Related: Kevin O’Leary’s net worth ahead of possible TikTok purchase

“Total Money Makeover” & Ramsey’s ongoing career

Since the late 90s, Ramsey’s listenership, along with the popularity of his financial courses, books, and other products, has continued to grow. In 2003, he published his most popular book to date — “The Total Money Makeover.” This personal finance tome emphasizes Ramsey’s seven famous “baby steps” toward financial stability, which are geared toward home-owning, mortgage-paying families with children.

The book was an immediate hit, enjoying a place on the Wall Street Journal’s bestseller list for over 500 weeks and racking up over 5 million sales by 2017, according to PR Newswire.

From 2007 to 2010, The Dave Ramsey Show became a television production, airing on the conservative broadcast channel Fox Business Network. Ramsey’s popularity and influence continued to grow, but as time marched on toward the present, Ramsey increasingly became the subject of various criticisms and controversies.

Is Dave Ramsey a Republican?

Ramsey has always been vocally conservative, both culturally and financially speaking.

Ahead of the 2024 presidential election, Ramsey endorsed previous president and Republican candidate Donald Trump after interviewing him at Trump Tower.

Americans deserve to know what their presidential candidates will do about real issues that matter to real people. So, we reached out to both candidates to give them the opportunity to sit down and share their ideas. I took everyday Americans’ questions about the economy to… pic.twitter.com/axSDNJqFbu— Dave Ramsey (@DaveRamsey) October 2, 2024

Despite his endorsement of Trump over Harris, Ramsey expressed some abivalence about the election, telling listeners that both campaigns were "figuring out different ways they're going to spend our money and send us further over the abyss. Neither one of them are supposing that we're going to turn this deficit around."

Criticisms of Ramsey’s financial advice

Ramsey’s financial advice has drawn plenty of criticism over the years — largely due to its non-individualistic approach to financial stability. While in reality, everyone’s situation is different, Ramsey’s approach tends to focus on the idea of a typical nuclear family — a married couple with children paying a mortgage on a home.

Additionally, Ramsey is a huge advocate of swearing off short-term debt instruments like credit cards, despite the fact that these types of tools, if used responsibly, can allow low-income individuals to earn free introductory cash bonuses, earn cash back on their purchases, and build a credit score good enough to secure larger loans (like a mortgage or auto loan) later on.

Ramsey is a fierce advocate of the snowball method of paying off debt, which advises that smaller debts be paid off first, then larger debts, in order of size. And while this method does seem to produce positive psychological effects like a sense of progress and increased motivation, it ignores important factors like interest rates and the possibility of debt consolidation.

Dave Ramsey’s controversies

Criticisms of Ramsey go beyond the efficacy of his financial advice. He’s been the subject of a number of controversies over the years, and some take issue with his conservative politics and the incorporation of his evangelical Christian faith into his financial advice.

In 2014, Ramsey got into hot water for his strange conduct after finding out that former employees of his firm were airing complaints about the workplace in a private Facebook group. One former employee and member of the group described it as “a safe place for people to express themselves freely, which is something we didn’t get to do very often while working at Lampo,” according to The Daily Beast.

After infiltrating the private group, Ramsey reportedly became enraged and offered his current employees bounties of thousands of dollars to expose the identities of the members of the Facebook group. Ramsey went on to fire two current employees he mistakenly suspected of being a part of the group.

In another widely publicized incident, Ramsey reportedly pulled out a gun while lecturing employees about the evils of gossip in 2011.

More recently, Ramsey drew criticism for repeatedly violating COVID-19 safety protocols during the pandemic. Ramsey allegedly fired a former employee for taking pandemic-related precautions, according to a lawsuit filed by the ex-Lampo-employee.

According to a complaint filed with the Williamson County Health Department, catering workers hired by Ramsey’s company to serve at a holiday party in December 2020 were instructed not to use masks or gloves while working. The company denies these allegations.

Related: Veteran fund manager issues dire S&P 500 warning for 2025