Dave Ramsey warns retired Americans to avoid one mortgage mistake

The personal finance author explains why seniors should steer clear of this type of loan.

Most financial professionals strongly recommend paying off all debt before retiring on a limited fixed income.

Though low-interest debt like a mortgage is more manageable than high-interest credit card debt, it’s difficult for many retirees to make ends meet while paying a monthly mortgage.

According to Harvard’s Joint Center for Housing Studies, 40% of seniors over 64 carry mortgage debt into retirement. The rising cost of living has prompted some to consider alternative solutions to reduce or pause monthly mortgage payments.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

A reverse mortgage is a financial tool that allows older homeowners to access their home equity if they need emergency financing without having to sell their house.

However, a reverse mortgage can create financial hardship when seniors have limited income during their golden years.

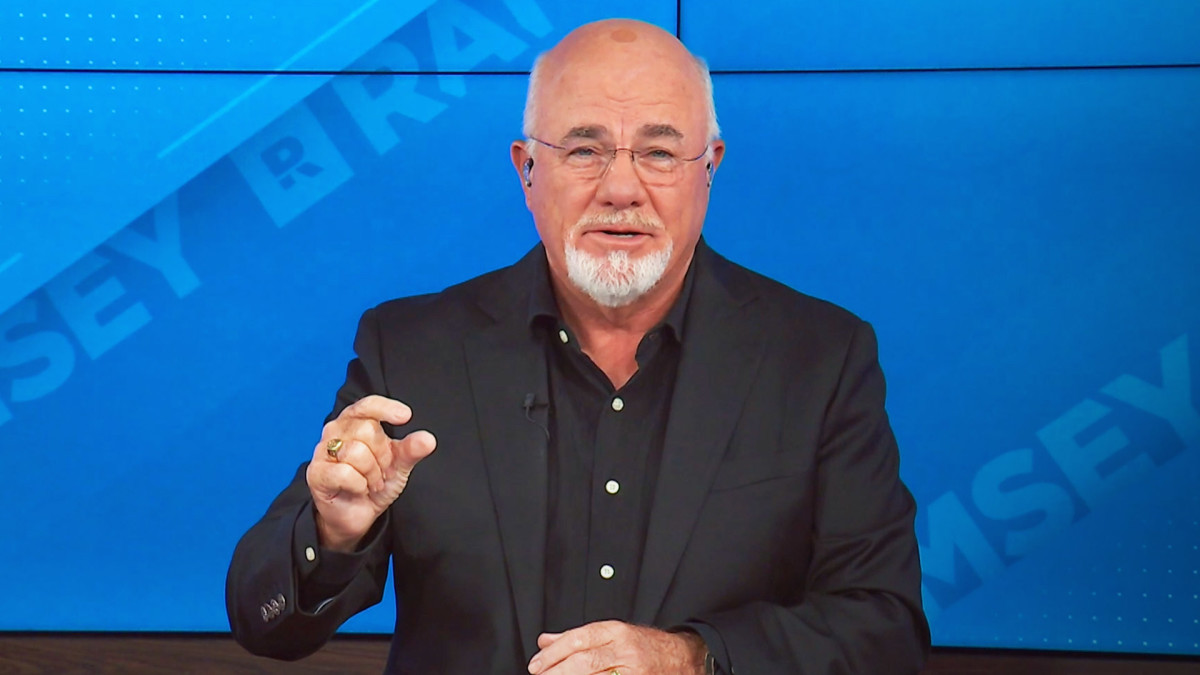

Financial expert Dave Ramsey explains what a reverse mortgage is and has bold words on why seniors should avoid the temptation of applying for one. Shutterstock

Dave Ramsey explains the details of a reverse mortgage

Seniors often consider a reverse mortgage if they are trying to age in place, have expensive long-term care costs, or have limited accessible funds.

There are three types of reverse mortgages seniors can apply for.

- Home Equity Conversion Mortgage (HCEM): HCEMs were created in 1988 to allow seniors to access home equity without selling their homes. They are similar to home equity loans, but there are no restrictions on how and where the money can be used. The Federal Housing Administration monitors lending standards closely, but those who do qualify will pay a significant mortgage insurance premium to protect the lender against any losses.

- Single-Purpose Reverse Mortgage: These loans are offered by nonprofits, local governments, and state governments, and there are restrictions on how the money can be spent. Homeowners typically use this to cover costs for home repairs or property taxes, but the loans aren’t federally insured.

- Proprietary Reverse Mortgage: These loans aren’t federally regulated like HCEMs but are offered by private lending companies. The lack of government regulation means that proprietary reverse mortgages offer higher loan principals but at a much higher interest rate.

While reverse mortgages were created to help seniors make ends meet without needing to sell their homes, they often have unintended negative consequences for the homeowner and their family.

More on homebuying:

- Dave Ramsey warns Americans on a homebuying mistake to avoid

- Housing expert reveals surprising ways to reduce your mortgage rate

- Americans buying homes may see major housing cost changes in 2025

- Finance veteran has a warning for Americans purchasing a home now

“Thinking of getting a reverse mortgage? Bad idea,” Ramsey wrote. “Reverse mortgages sound like a good plan — after all, who wouldn’t want a dream retirement funded entirely by their house! But here’s the truth: Reverse mortgages are major rip-offs.”

Though they sound like a great way to borrow against one of your biggest assets, reverse mortgages are expensive and can snowball quickly — especially for older Americans.

“Homeowners who take out a reverse mortgage put up their house as collateral for the loan — that means you lose your house if you don’t live up to the terms of the loan,” Ramsey continued.

Dave Ramsey warns retirees on the downsides of reverse mortgages

Reverse mortgages are especially risky for seniors because they carry high interest rates. Accruing debt could easily lead to defaulting on the loan and house foreclosure.

As of 2023, there are 480,000 outstanding reverse mortgages, all held by homeowners 62 and older. However, 10% of all reverse mortgage loans will become delinquent and potentially end in foreclosure, making the risks of lending far outweigh any of the positives.

“Why in the world would you want to risk losing your home—the most valuable thing you own—in your senior years? And talk about stress!” Ramsey wrote. “Try getting a good night’s sleep when the future of your home is up in the air.”

Related: Dave Ramsey warns Americans on a homebuying mistake to avoid now

“Oh, and did we mention that interest on your reverse mortgage starts building from the moment you take it out and doesn’t stop until it’s paid back?” he continued. “Reverse mortgages also always come with a bunch of ridiculous fees.”

Ramsey highlights a little-known fact about reverse mortgages: If the borrower passes away with any part of the loan outstanding, their family is responsible for paying off that high-interest debt in full. Otherwise, it will default, and the home will be foreclosed.

“Here’s how lenders get their money back on reverse mortgages: As long as you keep paying your property taxes, homeowners insurance, and other expenses related to your home, you won’t owe the mortgage company anything while you still live in your home,” he explained.

“But when you stop living in your home, either because you move out or — yep — die, the balance on your reverse mortgage becomes due in full. Yes, that means your family will be on the hook for paying your loan back if you die unless they decide to let the bank have your home.”

Related: Veteran fund manager issues dire S&P 500 warning for 2025