Critical minerals processing will be the equivalent of 19th-century oil refineries—at a Rockefeller moment

Amid the race to secure mineral deposits—including in Ukraine and Greenland—the smartest players see a different opportunity.

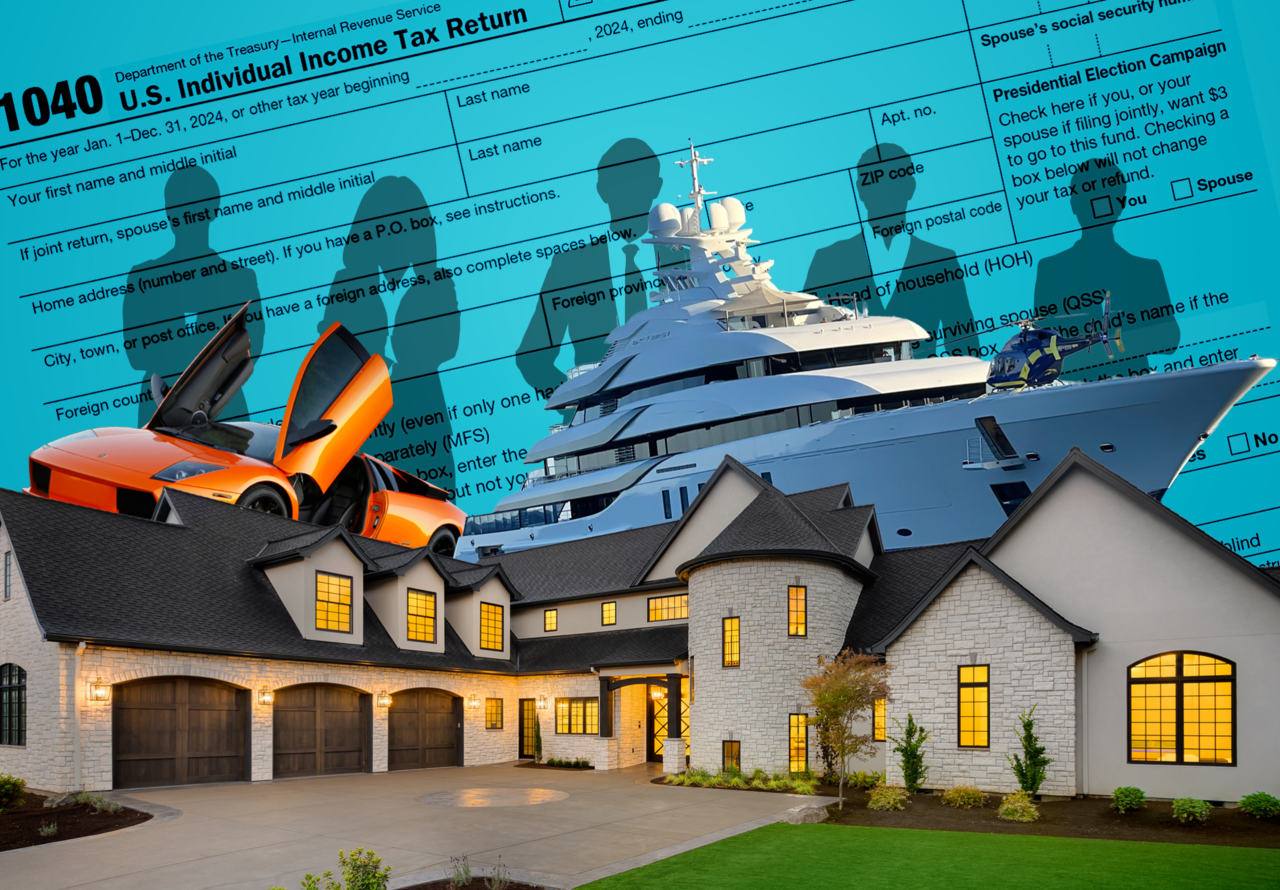

In the 21st century, the most valuable assets aren’t oil wells, factories, data centers, or even AI large language models. The industries of the future require critical minerals. As the world seeks to generate massive amounts of energy, the real money isn’t in mining lithium, nickel, or rare earths—it’s in controlling how they move, process, and scale. A new industrial empire is being built, and just like John D. Rockefeller’s pipelines in the 19th century, the infrastructure behind critical minerals will be an incredible wealth generator.

While most companies race to secure mineral deposits—be they in Greenland, Ukraine, the Democratic Republic of Congo, or Uzbekistan—the smartest players see a different opportunity: controlling the entire supply chain. The real bottleneck isn't finding the necessary and rare minerals—it's refining, processing, and transporting them. China recognized this early. Though it holds only 36% of the world's rare earth reserves, it controls over 85% of global refining capacity. That control isn’t accidental. It’s an infrastructure play—one that has made China a dominant force in electric vehicle batteries, among many other things.

The next Rockefeller won’t be a miner; they’ll be a processing systems builder. Consider:

- Processing facilities: The U.S., EU, and allies have massive deposits of lithium, nickel, and rare earths—but lack the infrastructure to refine them. New processing hubs will be the equivalent of 19th-century oil refineries.

- Supply chain control: Just as Standard Oil dominated through pipelines, the companies that master logistics—raw material transport, battery recycling, and AI-driven resource allocation—will control pricing and profits.

- Waste-to-wealth model: Much like Rockefeller turned petroleum byproducts into valuable products, the future’s biggest opportunities lie in recovering and repurposing "waste"—from extracting minerals from mine tailings to scaling battery recycling.

The fragmented nature of today’s mineral market mirrors oil in the 1860s. Mineral prices are volatile, companies operate in silos and are in distress due to lack of processing options outside China, and inefficiencies abound. But soon, the industry will consolidate. The ones who build infrastructure—rather than simply dig—will acquire competitors, dictate pricing, and create empires. China has already been flexing its monopolistic muscle in mineral supply chains to threaten U.S. investments.

Supply chain control

When governments realize that chasing basic sourcing of critical minerals does not automatically yield national mineral security, demand for localized processing and supply chain control will explode. The result? A private sector wealth creation event that could rival the rise of Standard Oil. The next Standard Oil won’t be an oil company—it’ll be one that controls the arteries of the clean energy economy.

Infrastructure plays generate immense wealth by controlling the essential systems that enable industries to function and scale.

Consider today’s tech giants, which create immense wealth via:

1. Control over distribution and logistics: Amazon's fulfillment and logistics network is comparable to Rockefeller’s pipelines, which controlled how oil moved. Amazon controls how many companies reach customers, making it a backbone of global e-commerce, with nearly two million small businesses using its platform. Over 60% of Amazon’s sales come from third-party sellers.

2. Owning the “toll roads” of industry: Cloud-computing providers (Microsoft Azure, Google Cloud, AWS) power the internet economy, collecting fees from companies that rely on their infrastructure. Similarly, Standard Oil didn't just refine oil—it owned the infrastructure that transported and distributed it, ensuring everyone paid a fee.

3. Investing in adjacent industries: Tesla not only sells cars but also profits from carbon credits, energy storage, and software subscriptions. Rockefeller found value in byproducts such as tar (asphalt), petroleum jelly (Vaseline), and paraffin (candle wax).

4. Scale and network effects: Google controls much of the internet's infrastructure via search, advertising, Android, and YouTube, ensuring that businesses rely on its ecosystem. Standard Oil built a massive refining and transportation network, making it nearly impossible for competitors to operate efficiently without using its services.

5. Ruthless competition on cost: Walmart and Amazon undercut competitors with ultra-low prices, driving rivals out of business before expanding dominance. Rockefeller showed competitors his books, proving he could outlast them financially, then acquired them at discounted prices.

6. Regulatory resilience through complex structuring: If governments move to break up Big Tech companies (e.g., Meta, Google, and Amazon), investors in these firms can still benefit from their individual growth trajectories. Even after Standard Oil was broken into 34 companies, Rockefeller’s wealth multiplied because he retained ownership in each one.

Just as Rockefeller became the richest man of his era by controlling oil’s movement, today’s wealthiest individuals and companies control the infrastructure of AI, cloud computing, e-commerce, and financial systems.

The upshot? The biggest fortunes are made not by chasing commodities, but by building the indispensable infrastructure that industries rely on. The forthcoming revolutions in AI and robotics might commoditize labor, but those who control the compute infrastructure (Nvidia, TSMC, OpenAI, etc.) will profit most. And they, in turn, will ultimately rely on ancient inputs from the earth. As such, the processing infrastructure of critical minerals represents a new frontier of significant wealth creation.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

Read more:

- I’m a mining industry CEO. Let’s talk about Trump and Greenland

- Mining hasn’t evolved in decades. The U.S. must reinvent it as China tightens its grip on critical minerals

- How the U.S.-China trade war’s 90-day pause was 70 years in the making

This story was originally featured on Fortune.com