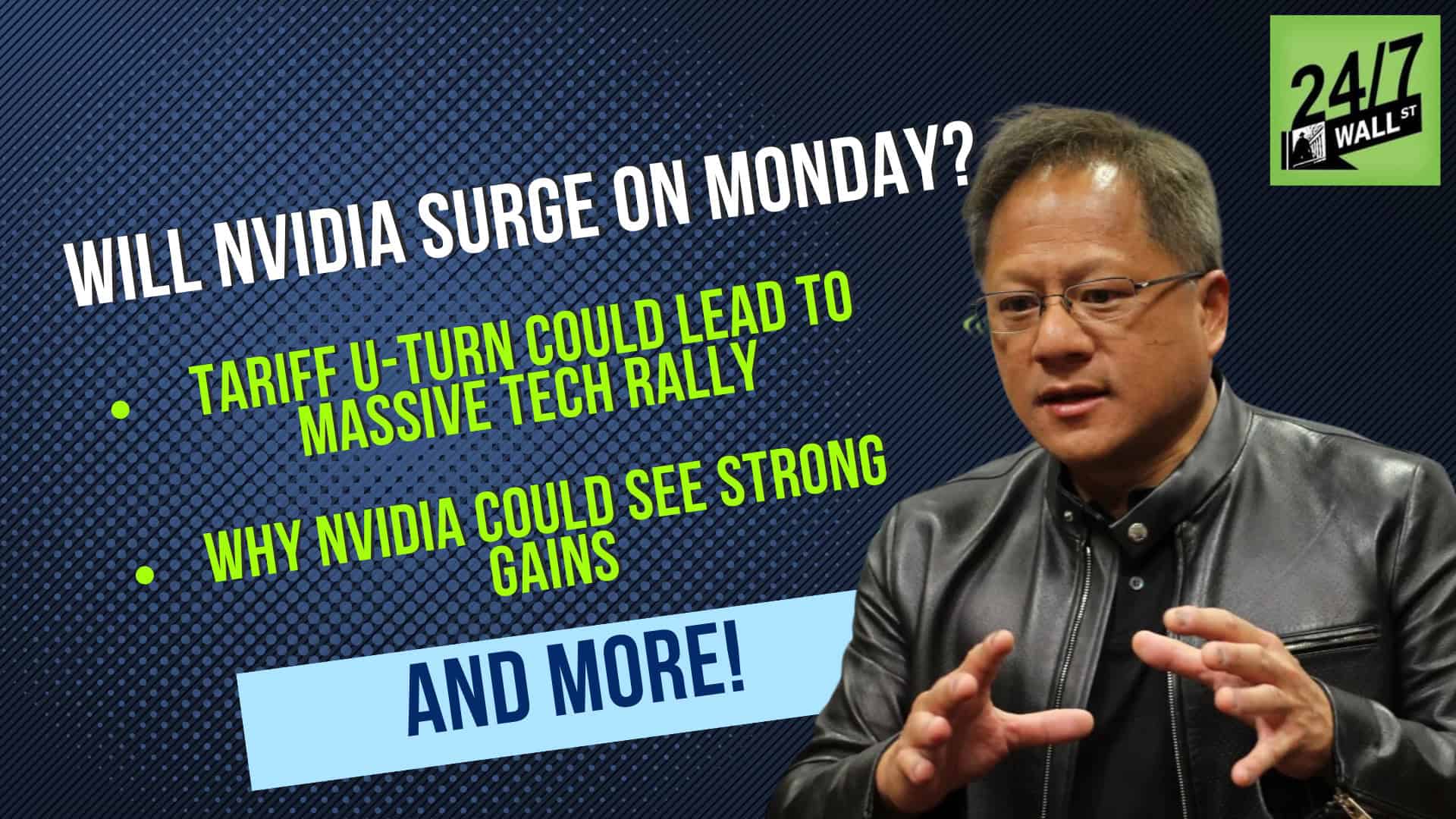

Could Trump’s Tariff U-Turn Cause NVIDIA’s (Nasdaq: NVDA) Stock Price to Soar Monday?

It should be a very good Monday if you own shares of NVIDIA (Nasdaq: NVDA) or other stocks in the semiconductor space. Late Friday night, industries like computers, smartphones, semiconductors, and other electronics categories were exempted from reciprocal tariffs. Some technology analysts are already predicting we could see a “tech stock rally for the ages” come Monday. Let’s take […] The post Could Trump’s Tariff U-Turn Cause NVIDIA’s (Nasdaq: NVDA) Stock Price to Soar Monday? appeared first on 24/7 Wall St..

It should be a very good Monday if you own shares of NVIDIA (Nasdaq: NVDA) or other stocks in the semiconductor space. Late Friday night, industries like computers, smartphones, semiconductors, and other electronics categories were exempted from reciprocal tariffs.

Some technology analysts are already predicting we could see a “tech stock rally for the ages” come Monday. Let’s take a closer look at the news and how much NVIDIA and other semiconductor companies could gain.

Key Points

-

Over the weekend, large categories of consumer electronics and semiconductors were excluded from reciprocal tariffs that have reached as high as a 145% rate levied on China.

-

We believe stocks like NVIDIA and other stocks in the ‘AI infrastructure trade’ could see the strongest returns come Monday.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Trump Exempts A Wide Group of Electronic Products from Reciprocal Tariffs

The ongoing cycle of tariff escalations has punished consumer electronics stocks particularly harshly. Consumer electronics are China’s largest export category to the United States, representing about 22% of total goods exported. So with tariffs on China now reaching 145%, companies with supply chains in China have seen their share prices plummet in recent weeks.

For example, Apple (Nasdaq: AAPL) saw a 22% share price drop in just five days at one point. Dell (Nasdaq: DELL) dropped from a high of about $125 per share at the beginning of the year down to a close of $72.59 at the close of Tuesday’s trading. Even retailers like Best Buy (NYSE: BBY) have felt the pain. The company saw its share plunge 38% from February 28 to April 8.

Semiconductor stocks have also been heavily punished during this cycle. At the beginning of the week, the two worst performers in the Dow Jones year-to-date were Apple and NVIDIA.

So, it shouldn’t surprise you that Trump removing reciprocal tariffs on most consumer electronics categories could be massive market news come Monday. The guidance was issued late Friday night and applies to computers, smartphones, semiconductors, memory cards, solar cells, semiconductors, and more.

On Saturday, the White House clarified that this pause is to give these companies more time to re-shore manufacturing. Another catalyst for technology stocks is that this pause could be seen as an ‘olive branch’ to China that begins a period of de-escalation to the ongoing trade war.

What Stocks Could Be Up Big on Monday?

What are the stocks to watch on Monday? Broadly, I’d recommend watching stocks in the ‘AI infrastructure trade.’ Many of these stocks have been hammered – regardless of their exposure to tariffs – but they could see the strongest rally if technology leads the market higher on Monday.

- NVIDIA: As I noted earlier, NVIDIA had been neck and neck with Apple for the unwanted title of ‘worst performer headed in the Dow in 2025’ at the beginning of the week. NVIDIA has bounced strongly off where it traded at the beginning of the week, but still trades down about 26% from early in 2025. Lost in all the noise about tariffs this week is that the Trump Administration has been weighing reducing export controls on NVIDIA’s H20 chips that are exported to China. Geopolitical movements continue to trend in NVIDIA’s direction.

Another group I’d watch is optical stocks. 24/7 Wall St. hosts a podcast dedicated to investing in the future of AI – named The AI Investor Podcast – and on Friday’s episode, we detailed how optical stocks have the highest exposure to tariffs among stocks in the ‘AI infrastructure trade.’

Stocks to watch include Fabrinet (NYSE: FN), Coherent (Nasdaq: COHR), Lumentum (Nasdaq: LITE), and Applied Optoelectronics (Nasdaq: AAOI). Researcher Semi Analysis had calculated that this group of stocks faced a 25-40% tariff burden with little production in the United States. They should rally strongly on Monday.

Another stock to watch is Taiwan Semiconductor (NYSE: TSM). The company has already been pushing heavily to move production to the United States, but now could trade sharply higher on a de-escalation of tariffs on Taiwanese semiconductor goods as well.

Want more stock ideas? On Friday’s edition of the AI Investor Podcast, I detailed 10 stocks I was loading up on last week. Many of them should be big winners come Monday morning. Simply listen in Apple Podcasts in the player below or go to our AI Investor Page to select the podcast player of your choice.

The post Could Trump’s Tariff U-Turn Cause NVIDIA’s (Nasdaq: NVDA) Stock Price to Soar Monday? appeared first on 24/7 Wall St..