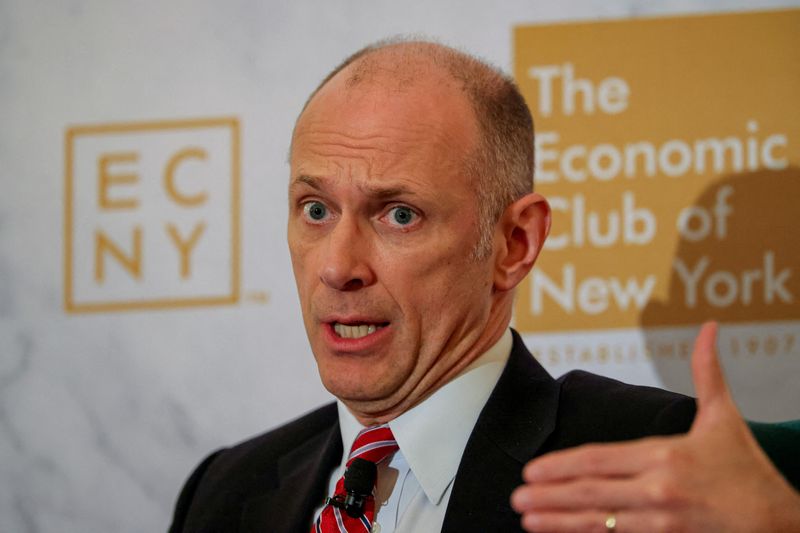

Cardone Capital Adds 1,000 BTC, Eyes 3,000 in Bold Bitcoin Strategy

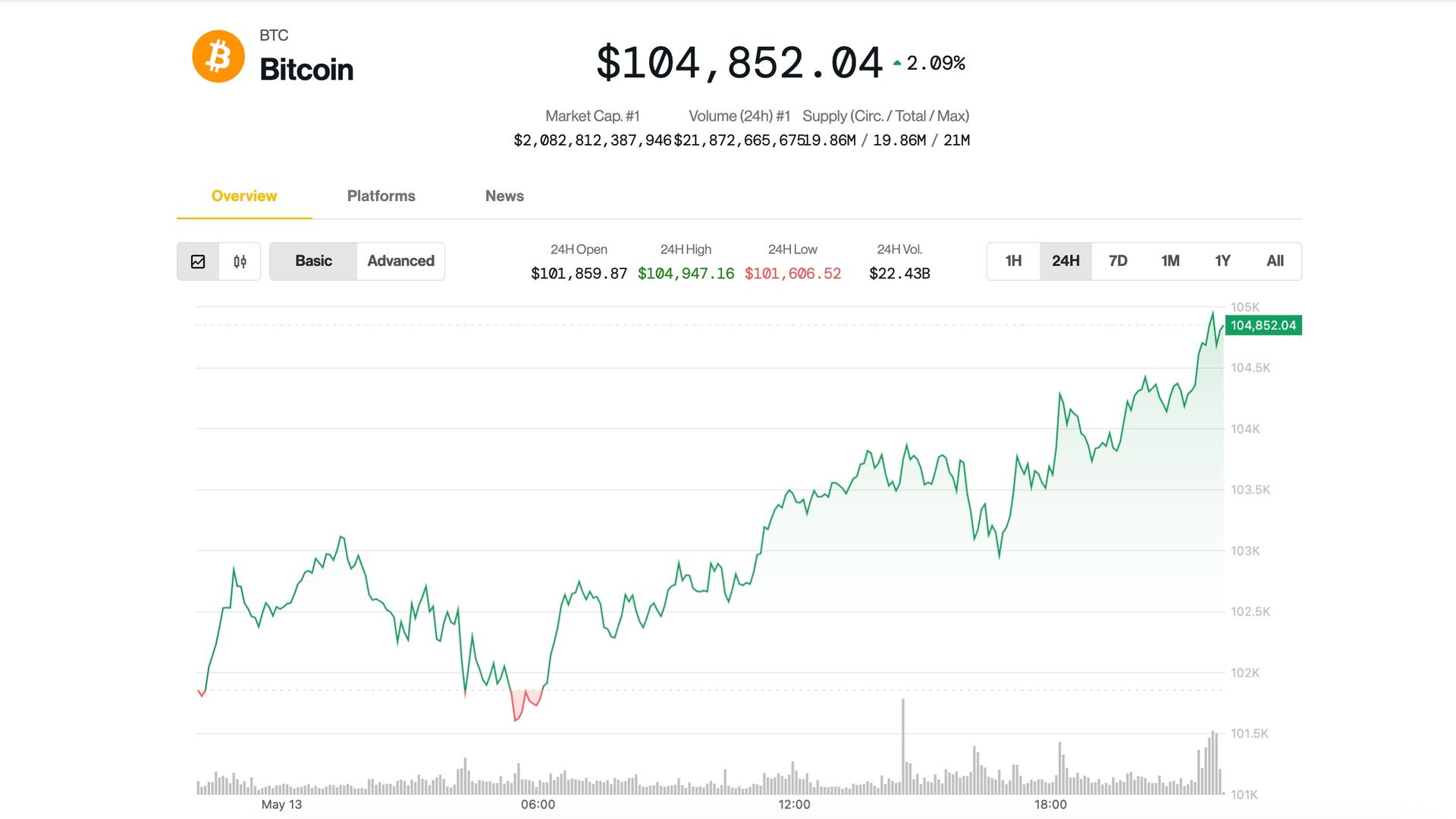

The real estate mogul integrated $100 million in BTC into his firm's balance sheet, eyeing more crypto-backed growth.

Grant Cardone, the well-known real estate investor, has announced that his firm, Cardone Capital, has added 1,000 BTC to its balance sheet.

"CardoneCapital adds 1,000 BTC to balance sheet becoming first ever real estate/BTC company integrated with full BTC strategy combining the two best in class assets," said Cardone in an X post.

At current market prices, the purchase is worth just over $100 million. If Cardone Capital were a publicly traded company, this acquisition would place it among the top 30 corporate bitcoin holders globally, ranking near the 29th largest, according to bitcointreasuries.

Cardone went on to reveal that Cardone Capital currently holds 14,200 residential units and over half a million square feet of Class A office space. The firm expects to add another 3,000 BTC and 5,000 residential units before the year ends.

Back in January, CoinDesk reported Cardone’s intention to use real estate cash flow to acquire Bitcoin, signaling a long-term crypto investment strategy.