Can Solar Shine Again? Why Clean Energy ETFs May Be Undervalued

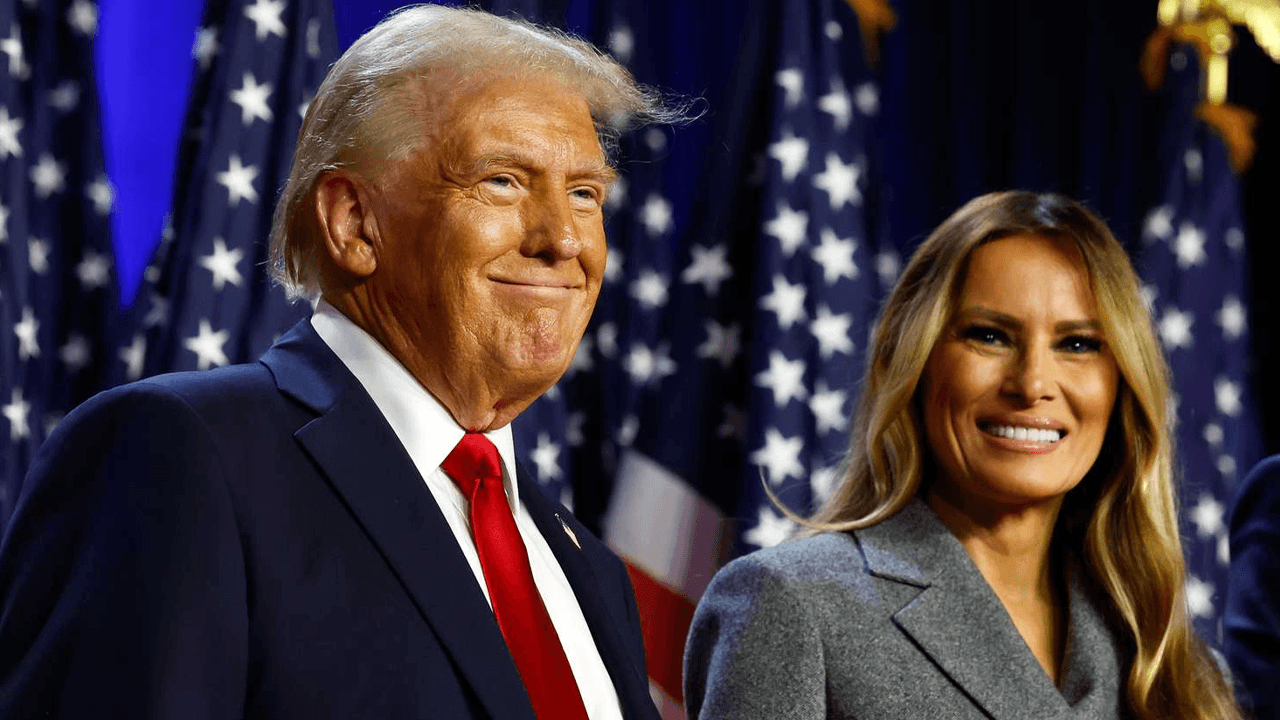

The spotlight that once shone on the solar stocks has dimmed in a significant way in the months leading up to the presidential election. Undoubtedly, when the Trump administration took over, it seemed like it’d be lights out on the once-heated solar trade for a couple of years. Indeed, under Trump, it’s more about fossil […] The post Can Solar Shine Again? Why Clean Energy ETFs May Be Undervalued appeared first on 24/7 Wall St..

The spotlight that once shone on the solar stocks has dimmed in a significant way in the months leading up to the presidential election. Undoubtedly, when the Trump administration took over, it seemed like it’d be lights out on the once-heated solar trade for a couple of years. Indeed, under Trump, it’s more about fossil fuels and less about advancing green energy efforts and curbing emissions.

And while the solar plays may struggle to regain their luster under Trump, as the administration takes steps to “drill, baby, drill,” I do think it’s a mistake to write off the solar energy stocks while they’re down and out. Indeed, there’s already so much pain in the rearview, and as few others talk about the names any longer, there may be more of a chance to get deeper value.

Of course, with limited catalysts under Trump and significant negative momentum riding behind many of the names, investors will need a high tolerance for pain and a lengthy investment horizon. With stocks dipping into a correction, causing some to rotate into more defensive assets, it’s not hard to imagine that investors want less exposure to Washington, not more.

Key Points

-

The solar ETFs are down, out, and may be a source of severe undervaluation.

-

The TAN and RAYS ETFs are intriguing options for investors willing to bet on sunnier days for the top solar firms.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Not many bright days for the solar plays

Looking ahead, it will be interesting to see how heavily policy changes will weigh on earnings results. Whether we’re talking about the cancellation of climate grants or something else, there’s a great deal of fiscal uncertainty with the broad basket of solar names. While I do expect solar to pick up where it left off in due time as solar cell tech becomes more efficient, the shift in energy policy could put the comeback on ice for a few years.

With so few catalysts and added layers of policy risk, the solar stocks couldn’t be less timely. But for those looking for rock-bottom multiples, stashing away a few shares of solar firms (or ETFs) isn’t the worst idea in the world. In fact, it may be the ultimate contrarian trade now that there’s nothing but pessimism baked into the shares of top industry players.

In this piece, we’ll check out two clean energy ETFs that may be trading at hefty discounts that investors may wish to pursue while they stand in the dark.

Invesco Solar ETF

Invesco Solar ETF (NYSEARCA:TAN) shares have been steadily descending since peaking back in early 2021. Undoubtedly, the solar scene was in a bit of a bubble back then. And with the TAN now down close to 74%, the opportunity to pounce may finally be on the table despite mounting uncertainties and limited upside in the face of the AI data center boom as hyperscalers look to go nuclear.

Though the TAN ETF could underperform for quite some time as the four-year sell-off shows few signs of bottoming out (we’re close to five-year depths with the TAN going for $32 and change per share), I do find the ETF intriguing for investors seeking to punch their ticket to solar innovators around the world. Indeed, just because the U.S. is hitting the pause button on solar doesn’t mean the rest of the world will.

With a 0.67% total expense ratio, you’re paying a rather hefty multiple for exposure to a broad range of firms that still may not be all too cheap from a forward price-to-earnings (P/E) perspective. Still, the 1.3 price-to-book (P/B) ratio suggests deep value to be had in the names.

Global X Solar ETF

Global X Solar ETF (NASDAQ:RAYS) is another one-stop-shop ETF for investors seeking exposure to the most innovative firms aiming to advance solar adoption. The total expense ratio is at a cheaper 0.5%, and with ample overlap with the TAN, it’s the RAYS ETF that I believe stands out as a more cost-effective way to get into the solar scene while it’s at multi-year lows.

Of course, there’s not much of a bright side for the solar plays these days, and it could stay this way for some time. Either way, environmentally-conscious investors who aren’t yet ready to throw in the towel may wish to gradually build a position over the coming quarters and years. After all, things tend to be darkest right before dawn!

The post Can Solar Shine Again? Why Clean Energy ETFs May Be Undervalued appeared first on 24/7 Wall St..