Broadcom Live: Why AVGO Share Prices Are Shooting Higher Today

This article will be updated throughout the day, so check back often for more daily updates. Broadcom (Nasdaq: AVGO), a key semiconductor stock in the AI era, is shooting higher by nearly 5% in today’s tech-led stock market rally. With today’s gains, which sent the stock above $217 per share, AVGO stock is inching closer […] The post Broadcom Live: Why AVGO Share Prices Are Shooting Higher Today appeared first on 24/7 Wall St..

This article will be updated throughout the day, so check back often for more daily updates.

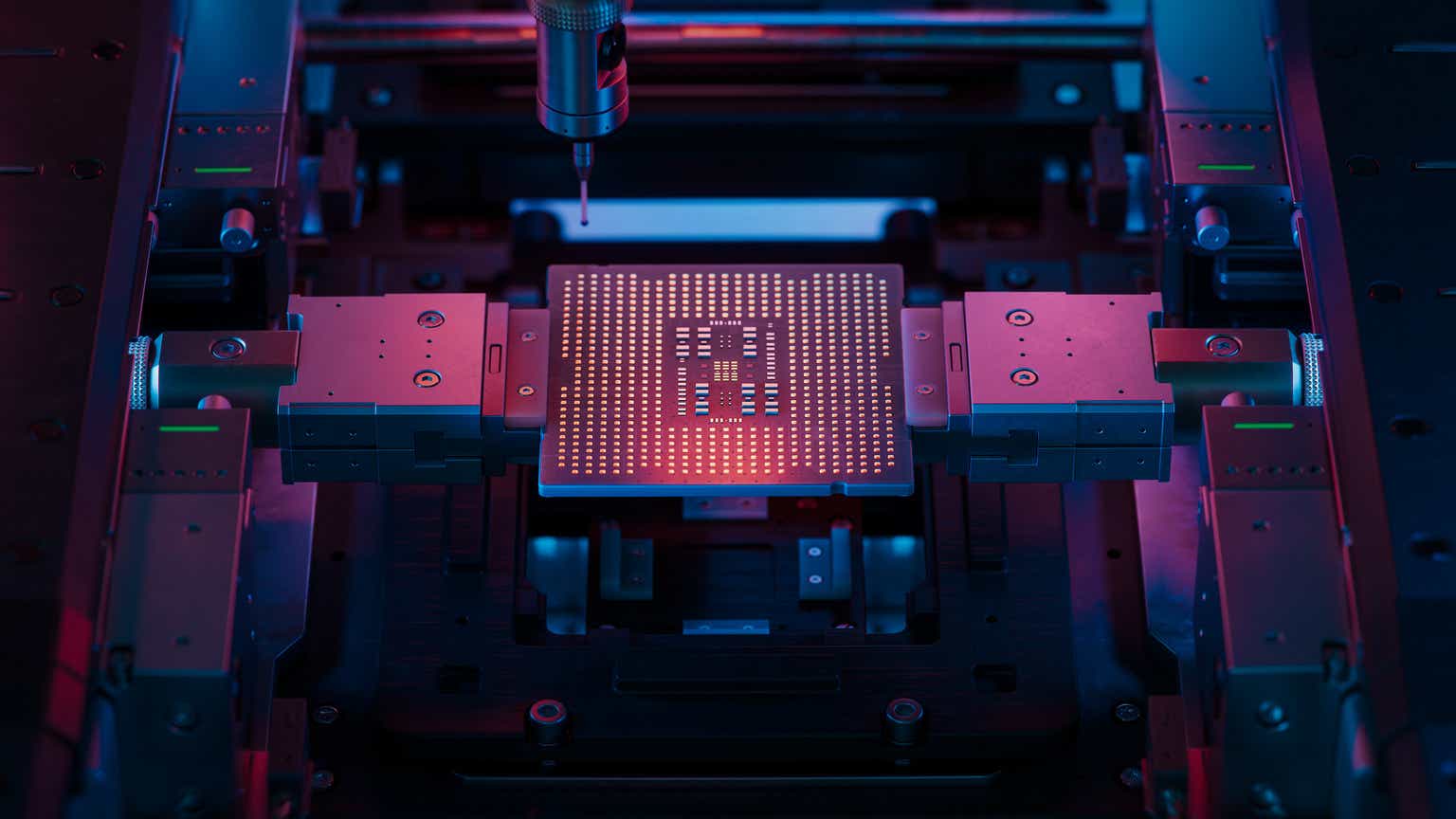

Broadcom (Nasdaq: AVGO), a key semiconductor stock in the AI era, is shooting higher by nearly 5% in today’s tech-led stock market rally. With today’s gains, which sent the stock above $217 per share, AVGO stock is inching closer to all-time high levels of approximately $251 per share.

A China/U.S. trade agreement has been the catalyst to send the semiconductor sector higher today, including Broadcom. Chip stocks as a sector have a great deal of exposure to China, and the successful negotiations suggest they will be able to continue to do business without facing crippling costs.

Broadcom stock is trading on volume of about 8 million shares changing hands, which is actually below the average volume threshold of 31 million shares. Nevertheless, the bulls see a buying opportunity in the stock now that a trade agreement has been reached between the U.S. and China. Broadcom and the broader semiconductor sector are key beneficiaries considering they’ve had a target on their back throughout the height of the trade wars.

Trade Relief

Broadcom’s gains are part of a wider relief rally in the chip sector now that Washington, D.C. and Beijing have reached an agreement. Semiconductor stocks and smartphone manufacturers are seen as key beneficiaries of the successful negotiations. In addition to Broadcom, other chip stocks that are rallying today include industry leader Nvidia (Nasdaq: NVDA), up 3.8%, Advanced Micro Devices (Nasdaq: AMD), up 4.6%, and Qualcomm (Nasdaq: QCOM), up 4.5%. Taiwan Semiconductor’s U.S.-listed stock rallied 6%, while its Taiwan-listed counterpart has yet to trade on the news. The PHLX Sox index is advancing nearly 6%.

Wall Street analysts are largely bullish on Broadcom stock, with an average rating of “strong buy” across about two-dozen analysts. The average price target hovers at approximately $243 per share, with a price target on the high end of the range of $300 per share.

Can It Last?

The China trade agreement is excellent news for Broadcom and the chip sector. However, President Trump has said himself that tariff conditions could revert backwards if there are any hiccups along the way. While today’s advance in AVGO stock is exciting, it is also a reminder of just how volatile the technology sector can be throughout these uncertain economic times. For now, this is working in Broadcom and the wider semi sector’s favor.

The post Broadcom Live: Why AVGO Share Prices Are Shooting Higher Today appeared first on 24/7 Wall St..