Boeing will find it ‘relatively easy’ to find customers for China’s rejected planes, says jet leasing CEO

Boeing planned to complete 50 orders for Chinese customers this year but is now assessing options as China refuses Boeing plane deliveries due to the trade war.

China’s refusal to accept Boeing planes has become one of the most visible flashpoints of the U.S.-China trade war. Beijing has even sent planes assembled in China back to the U.S. as it retaliates against steep tariffs imposed by President Donald Trump.

Boeing CEO Kelly Ortberg admitted that China has refused to accept two planes that were ready for delivery, thanks to the tariffs. He added that the planemaker was planning to meet 50 Chinese orders this year, but is now “actively assessing” other options.

That shouldn't be too difficult, says Steven Townend, CEO of BOC Aviation, one of the world’s top jet leasing companies. Airlines turn to companies like BOC Aviation when they want to expand their fleet without necessarily making the expensive decision to buy a new plane.

“Boeing continues to see strong demand for their aircraft,” Townend says. “It’s relatively easy for them to find alternate customers for those planes right now.”

The aviation industry is still facing a shortage of planes due to manufacturing struggles at both Boeing and Airbus, caused by factors including the COVID pandemic, safety scandals, and supply hiccups at major suppliers.

Airplanes are made up of 10,000 different parts, and “a delay with any one of those can delay the whole plane,” Townend says and added that an airline will probably will not get a plane before 2030 if it was to order one from Airbus or Boeing today.

That makes a suddenly available Boeing jet a hot commodity. Airlines in Malaysia and India are reportedly eyeing jets that are now suddenly on the market, thanks to China’s refusal to take them.

At the end of March, BOC Aviation announced that it was ordering 50 new Boeing 737-8 aircraft. The company currently has a total order book of 346 aircraft, including both Airbus and Boeing planes, which Townend says is the second-largest among plane lessors.

BOC Aviation has a portfolio of 829 aircraft and engines owned, managed, and on order. The company counts carriers like American Airlines, Turkish Airlines, and Qatar Airways among its clients.

Tariffs are still a problem

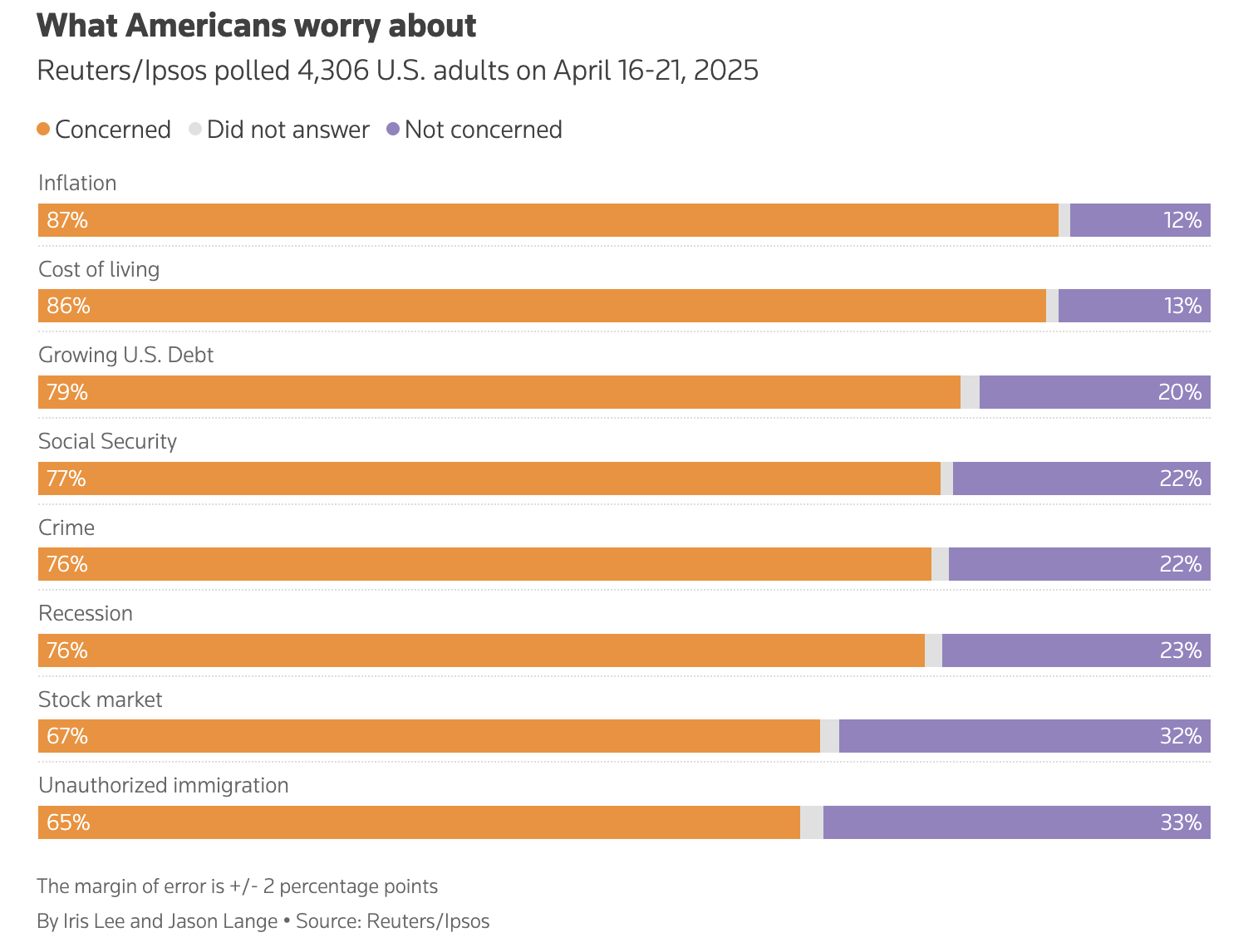

Still, Townend warns that continued U.S. tariff uncertainty could hurt an industry that started the year with a positive outlook.

In December, the International Air Transport Association projected that 5.2 billion people would travel by air in 2025. That would be the first year more than 5 billion people would take to the skies. The group also projected that airlines would earn $36.6 billion in profit this year.

Things don’t look quite so rosy now. In recent weeks, major U.S. airlines have either pulled or softened their guidance, citing uncertainty.

On Thursday, Southwest CEO Bob Jordan warned that the U.S. airline industry is already in a recession. Fellow aviation CEO Robert Isom, of American Airlines, recently warned analysts that “uncertainty is what we’re living with now.”

At the moment, Townened says a tariff-induced hit to travel is still largely constrained to the U.S., with no evidence of a similar drag on European or Asian airlines.

Yet continued uncertainty will inevitably be a global drag on the industry. “Everybody is watching the situation on tariffs,” he says. "If this uncertainty runs for a material length of time, then inevitably it will affect global trade, and one of the things that drives airline traffic is global trade.”

This story was originally featured on Fortune.com