Bitcoin Crosses $90K as Trump Delays Canada, Mexico Auto Tariffs

Bitcoin's fundamentals held up well during the latest dip, suggesting underlying strength, Swissblock analysts said.

In the latest whipsaw of headlines this week, Donald Trump's tariff delay Wednesday eased investor worries with bitcoin (BTC) leading the crypto market higher.

The U.S. government confirmed to delay tariffs on auto parts coming from Canada and Mexico by one month just one day after enacting them. Germany's plan to ease debt limits for infrastructure spending and China hiking its target deficit also contributed to rebounding risk markets.

BTC climbed just above $90,000 on the news, up 3.7% over the past 24 hours. Almost all assets in the broad-market CoinDesk 20 Index advanced, with bitcoin cash (BCH), Chainlink's LINK and Aptos' (APT) booking double-digit gains.

Read more: Bitwise Files to Launch Aptos ETF

The tech-focused Nasdaq and the broad-market S&P 500 were also up 1.2% and 1.5%, respectively, in the afternoon hours of the session. Crypto-related stocks also climbed higher from the early week lows. Crypto exchange Coinbase (COIN) was up 3.5%, while the largest corporate bitcoin holder Strategy gained nearly 10%.

Trade tensions and geopolitical risk have taken center stage lately, weighing on investor sentiment, pressuring risk assets like U.S. stocks and digital assets lower.

Similar risk off episodes have usually led investors to flee to the U.S. dollar, translating to downside pressure on crypto assets, said Joel Kruger, market strategist at LMAX Group. However, this time the U.S. dollar index (DXY) cratered to its weakest level since early November and is down more than 5% lower from its mid-January peak.

"With Fed rate expectations shifting back to pricing more rate cuts than less in 2025 and with bitcoin capable of shining as a store of value asset, we believe there are plenty of reasons to expect bitcoin to be well supported on dips," Kruger said.

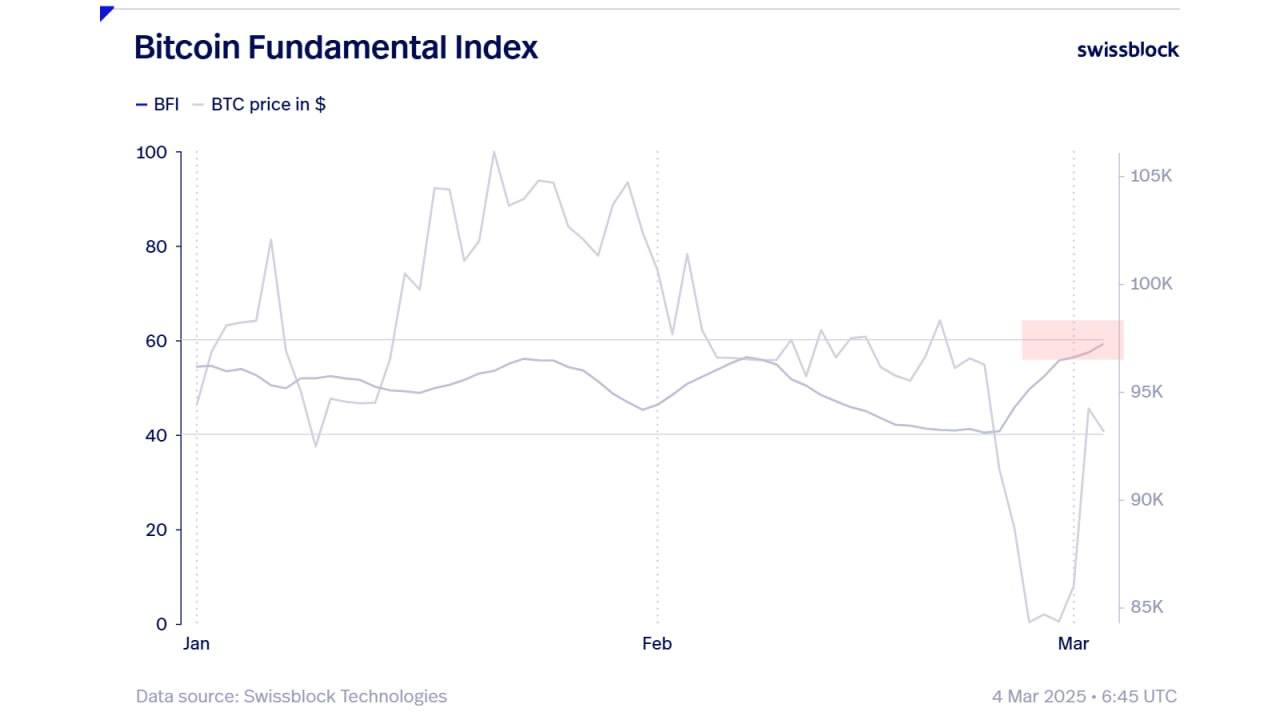

Crypto analytics firm Swissblock noted that despite the wild price swings over the past few days, the firm's Bitcoin Fundamental Index, which measures the overall health of the network, held up relatively well.

"Bitcoin's fundamentals are on the verge of shifting into the bullish quadrant, with sustained improvements in liquidity and network growth," Swissblock analysts said in a Telegram broadcast. "This strength suggests that BTC is unlikely to be driven into a bear market."