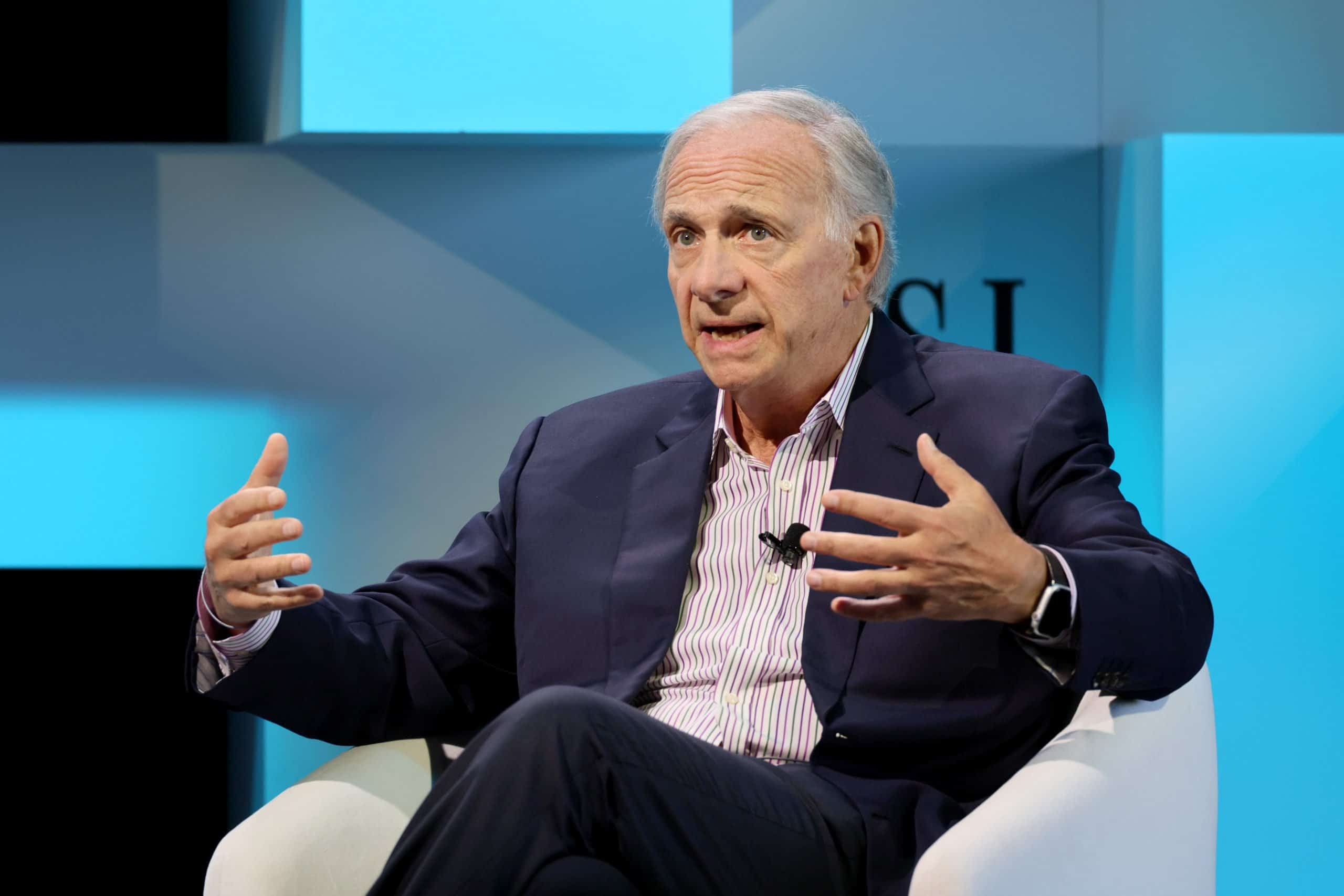

Billionaire Ray Dalio Dumped Some SPY and Bought These Stocks

Ray Dalio, the brilliant billionaire investor over at Bridgewater Associates, made some notable moves in the first quarter that were quite remarkable. Dalio, who’s one of my favorite big money managers to keep tabs on, seems to have positioned his portfolio to do well, regardless of what happens with the U.S. economy. Indeed, if there’s […] The post Billionaire Ray Dalio Dumped Some SPY and Bought These Stocks appeared first on 24/7 Wall St..

Ray Dalio, the brilliant billionaire investor over at Bridgewater Associates, made some notable moves in the first quarter that were quite remarkable. Dalio, who’s one of my favorite big money managers to keep tabs on, seems to have positioned his portfolio to do well, regardless of what happens with the U.S. economy. Indeed, if there’s an investor who knows how to fare well in all sorts of market environments, it’s Dalio.

In the first quarter, Dalio reduced his stake in the SPDR S&P 500 ETF (NYSEARCA:SPY) substantially (more than half was dumped) while also trimming modestly some other positions. In the face of Trump tariff risks and the volatility that was quick to follow the first quarter, such profit-taking was pretty well-timed. Despite selling off a portion of Bridgewater’s SPY stake, the ETF remains the largest position in the portfolio, comprising just over 8.6% of holdings.

Though the latest moves over at Bridgewater, I believe, seem to demonstrate increased caution, I do think some of his latest buys are a sign that there is value to be had in corners of the market where many other investors may not be looking. In this piece, we’ll check in on a few smart buys that self-guided investors may wish to consider stashing on their radars as the broad stock market gets wobbled by Trump tariffs once again.

Indeed, perhaps aggressive buyers were too quick to hit that buy button with the expectation that things can only de-escalate with tariffs from here. In any case, here are two (of many) first-quarter Bridgewater buys that I find to be among the most remarkable.

Key Points

-

Ray Dalio’s Bridgewater made a few intriguing, notable moves in the first quarter.

-

Dumping SPY shares while buying up GLD and BABA shares seems to be a wise move to prepare for the volatility ahead.

-

In my view, Alibaba shares look like a deep-value play while the gold shares are a terrific hedge against further tariff-induced chaos.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here.(Sponsor)

SPDR Gold Shares ETF

As Dalio and company pared their SPY stake, they bought up another SPDR ETF, the SPDR Gold Shares ETF (NYSEARCA:GLD). Such a move, I believe, suggests gold’s sparkling run isn’t quite over yet. With the precious metal spiking on Friday’s session (the GLD rose more than 2%) after more tariff comments from Trump, I’d argue that a position in gold is a grounding force that just about every portfolio should have at such a profoundly uncertain time.

Indeed, gold acted as one of the few safe havens as the stock market tanked in the face of Liberation Day tariffs. And though some may be concerned that gold is getting a tad overheated, I think it’s only wise to maintain a reasonably-sized hedge. It’s hard to know where we’ll be with tariffs by this time next year.

Could a few quarters be dragged significantly down by the levies? It’s certainly possible. In any case, the GLD stands out as a stellar hedge. However, whether the golden opportunity to get in still exists remains up for debate. I guess we’ll just have to wait and see. Either way, I view Dalio’s gold bet as a vote of confidence that has prudence written all over it.

Alibaba

Bridgewater also added to its position in Chinese Alibaba (NASDAQ:BABA), a firm that still looks cheap despite gaining more than 42% year to date. With a low beta of 0.24 and a very modest 16.2 times trailing price-to-earnings (P/E) multiple, I think it’s no mystery as to why some big money managers remain fans of the stock.

It’s cheap, has a good amount of newfound past-year momentum, and has glorious growth drivers (like AI) that Wall Street may be neglecting. Of course, Chinese stocks come with a very different slate of risks. But if you’re getting a depressed price of admission and less correlation to the U.S. markets, perhaps the risk is worth the reward.

With China slashing its benchmark lending rate, perhaps Chinese retail sales will have a chance to recover more meaningful ground in the second half. Add the booming cloud business into the equation, and growth potential from an Alibaba-Apple (NASDAQ:AAPL) partnership into the equation, and BABA stock just looks like a great value play, regardless of what investors fear is up ahead.

The post Billionaire Ray Dalio Dumped Some SPY and Bought These Stocks appeared first on 24/7 Wall St..