Billionaire David Einhorn Has 42% of His Hedge Fund Invested in Just 3 Stocks

Billionaire David Einhorn spent most of 2024 warning investors about how overvalued stocks were. In early 2025, the hedge fund manager’s feelings hadn’t changed. “‘The market is about the most expensive that it’s ever been in the history of the time that I have been managing the fund,’ Einhorn warns. With risk premiums at ‘roughly […] The post Billionaire David Einhorn Has 42% of His Hedge Fund Invested in Just 3 Stocks appeared first on 24/7 Wall St..

Billionaire David Einhorn spent most of 2024 warning investors about how overvalued stocks were. In early 2025, the hedge fund manager’s feelings hadn’t changed.

“‘The market is about the most expensive that it’s ever been in the history of the time that I have been managing the fund,’ Einhorn warns. With risk premiums at ‘roughly zero versus government bonds,’ equity investors are not being compensated for their exposure,” The Acquirer’s Multiple reported the billionaire’s comments from Skagen Funds’ January 9 investor conference in New York City.

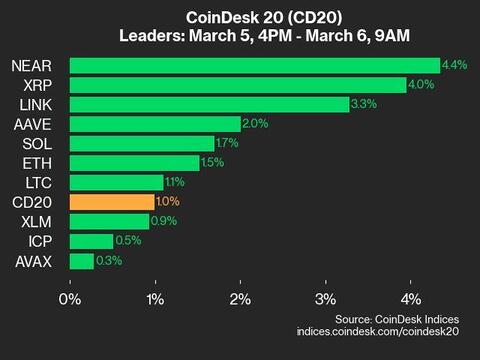

In 2024, Einhorn’s hedge fund, according to Institutional Investor magazine, gained 7.2%, well behind the S&P 500. In 2025, the iconic investor has seen his fortunes improve. Einhorn’s hedge fund was up 5.2% through the end of February, nearly 400 basis points better than the index.

However, the billionaire’s DME Capital Management finished 2024 with three stocks accounting for 42% of its $1.94 billion in assets.

Here’s why.

Key Points About This Article:

- Billionaire hedge fund investor David Einhorn has put 42% of his nearly $2 billion in assets into three stocks.

- DME Capital Management’s investment in homebuilding has matured and grown over more than a decade and it shows.

- Investments in coal and annuities also account for a big piece (14%) of the hedge fund’s assets.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Einhorn’s Focused Portfolio

DME Capital’s Q4 2024 13F shows that the hedge fund had 74 holdings at the end of December. Based on the assets, that’s an average of just $26.3 million. That’s not a significant amount for a well-known investor like Einhorn. Despite the average, Einhorn’s portfolio is focused on the hedge fund’s top ideas.

While the 13F had 74 holdings, if you look more closely, they’re spread across two other affiliated investment managers: DME Advisors LP and Greenlight Masters LLC, so in four instances, Einhorn owns individual stocks through three entities, including DME Capital Management.

From my count, there were 35 stocks in the 13F, with the top 10 holdings accounting for nearly 75% of the $1.94 billion in assets. Three of the top 10 represented 42% of the hedge fund, and 56% of the top 10.

Green Brick Partners Remains Einhorn’s Longest Holding

WhaleWisdom.com says that Einhorn first owned Texas homebuilder Green Brick Partners (NYSE:GRBK) in Q2 2007, a holding period of nearly 18 years.

Unlike many of Einhorn’s positions, Green Brick became a thing because of his friendship with Dallas real estate veteran Jim Brickman. The two met in 2002 when both men were investigating a public company committing significant mortgage fraud.

They became friends and partners in 2008, when Brickman started a real estate equity fund with Einhorn, lending money to distressed builders and buying up lots that were cheap due to the housing market’s collapse.

By 2013, with the housing market back to health, the two partners began building a company with permanent capital to provide housebuilders growth funding. It went public in 2014. Green Brick has been buying home builders ever since.

In Q4 2024, the company created GRBK Mortgage, obtaining two $40 million warehouse facilities, to fund the origination of mortgage loans for single-family residential properties, including its own developments.

Many people are moving to Texas, Georgia, and Florida, which happen to be where Green Brick operates. Over the past five years, Green Brick’s earnings per share have grown by 39% compounded annually from $2.24 a share in 2020, to $8.45 in 2024. Business is healthy.

In 2024, it closed on 3,783 homes, 21.1% higher than in 2023, and a company record. As a result, its 2024 homebuilding gross margin was 33.8%, 290 basis points higher than a year ago, and 740 basis points higher than 2021.

It’s not surprising that GRBK stock is up 157% since the beginning of 2021, despite falling off its October 2024 all-time high of $84.66.

Einhorn’s Green Brick holdings account for 27.51% of DME Capital’s assets. As it goes, so goes his hedge fund.

The Other Two Holdings

Core Natural Resources (NYSE:CNR) was the hedge fund’s second-largest position as of Dec. 30, accounting for 7.65% of its assets. At the end of the year, DME Capital owned 4.74% of the Pennsylvania-based coal producer.

On Jan. 14, CONSOL Energy and Arch Resources merged to create Core Natural Resources. Einhorn owned shares in the former. The stock deal saw Arch Resources shareholders receive 1.326 shares of CNR stock for every share held in Arch.

As a result of the merger, Core Natural Resources is one of North America’s most successful coal producers.

DME Capital’s third-largest holding at the end of December was Brighthouse Financial (NASDAQ:BHF), one of the largest annuities and life insurance providers in the U.S. Brighthouse accounts for 7.01% of the hedge fund’s assets. DME Capital owns 4.78% of Brighthouse.

Both CNR and BHF are stocks long held by Einhorn. The hedge fund first acquired shares in the former in Q4 2020 and Q3 2017 for the latter.

Based on WhaleWisdom’s estimated average price paid for both, Einhorn’s done better from his CONSOL Energy buy than with Brighthouse.

However, without the significant position in Green Brick Partners, Einhorn’s investments wouldn’t be nearly as successful.

The post Billionaire David Einhorn Has 42% of His Hedge Fund Invested in Just 3 Stocks appeared first on 24/7 Wall St..