Beyond Liam & Olivia: Top money moves to make when you have a baby

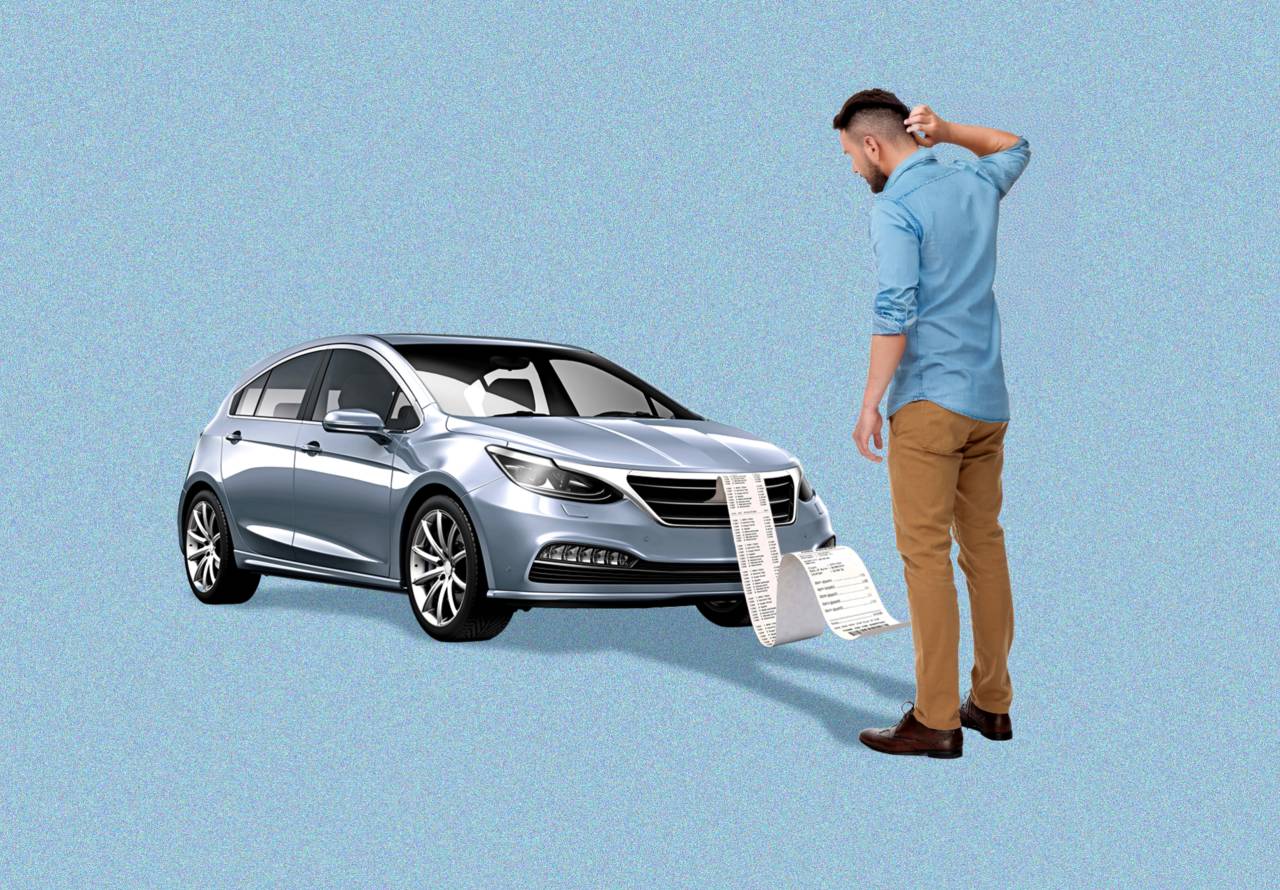

How to plan for the estimated $312,000 reality new parents aren't prepared for.

Choosing between Olivia and Emma or Liam and Noah – America’s most popular baby names for the sixth consecutive year, according to the Social Security Administration's just-released 2024 rankings – might feel momentous.

It's not.

It's actually the easiest financial decision you'll make as a parent.

The hard part? Planning for the estimated $312,000 it costs to raise that precious bundle of joy from birth to adulthood, before factoring in college expenses.

Related: Parents may get a new way to save for their kids' financial future

Most new parents are woefully unprepared for this financial reality. While you're sleep-deprived, mastering diaper changes, and debating the merits of different pacifier brands or strollers, you're also expected to make complex financial decisions that will impact your family for decades.

You're not alone in feeling overwhelmed. That's precisely why financial experts emphasize breaking down these critical tasks into manageable priorities. The name you choose might follow your child for life, but the financial foundation you establish will determine the opportunities available to them.

Financial moves to make when you have a baby

What do financial planners who work with new parents emphasize most? Not college savings. Not investment strategies. Not even budgeting for baby expenses.

Their top concerns are life insurance, estate planning, and identity protection—basic safeguards that too many parents delay implementing.