Ben Franklin said “beware of little expenses; a small leak will sink a great ship” – Here’s how to eliminate overlooked expenses

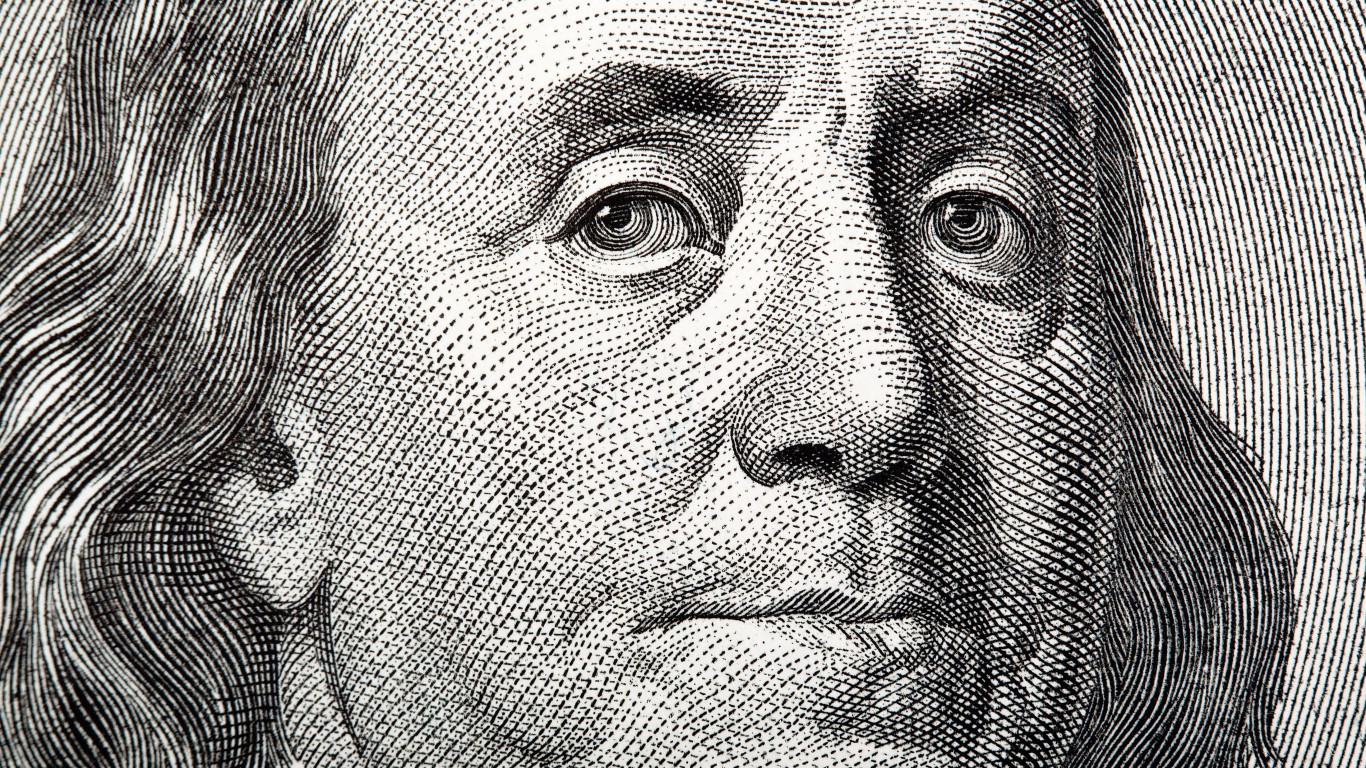

Ben Franklin, known by many young people as the face of the 100-dollar bill, was an American icon of his day and one of Charlie Munger’s role models. Undoubtedly, the remarkable polymath who excelled in a wide range of different subjects, from science to politics and even finance, is worth reading and studying. As the […] The post Ben Franklin said “beware of little expenses; a small leak will sink a great ship” – Here’s how to eliminate overlooked expenses appeared first on 24/7 Wall St..

Ben Franklin, known by many young people as the face of the 100-dollar bill, was an American icon of his day and one of Charlie Munger’s role models. Undoubtedly, the remarkable polymath who excelled in a wide range of different subjects, from science to politics and even finance, is worth reading and studying. As the late, great Munger put it, “You can learn a lot from dead people.”

In this piece, we’ll have a quick look at how Franklin viewed personal finances. By most accounts, Ben Franklin was a financially-savvy man who spent within his means, steered clear of considerable debt loads, and understood the value of long-term investment. Franklin didn’t just spend within his means; he adopted a rather frugal lifestyle, paying careful attention to the “little expenses” that many people may tend to overlook due to their seemingly negligible effect on the overall balance sheet at the end of the month.

Key Points

-

Ben Franklin’s right on the money. The small expenses matter, and they’re worth tracking.

-

Adopting a budget and gradually adopting a more frugal lifestyle could do wonders for your wealth-building journey.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Don’t ignore the smaller expenses. They really do add up. Just ask Ben Franklin!

As the famous Ben Franklin quote goes, “Beware of little expenses. A small leak will sink a great ship.” It’s a simple, timeless quote that arguably applies more so today than at any time in the past, with the rise of monthly subscriptions (why does everything have to be a subscription these days?) and more value placed by young people (think those in the Millennial and Gen Z cohorts) in those seemingly affordable comforts and conveniences.

Of course, you’ve probably heard that treating yourself to that daily brew and croissant is costing you your retirement or something of the sort. While I wouldn’t go to such extremes, I would say that swiping the credit card without tracking expenses may cause you to slow the pace of your wealth-creating journey.

The worst part is that one may be spending a pretty penny on habitual comforts and conveniences that may not even bring one happiness. In any case, Franklin’s words of wisdom go beyond just cutting out the morning cup of cappuccino from your daily routine.

That doesn’t mean cutting the small expenses that bring big happiness, though.

If your retirement milestones are being hit and you’re head and shoulders above the competition (think the average nest egg size for your age), do go for the little expenses if it brings a light of joy to your day. However, if you’re indifferent to going down the more frugal path, whether it be making your own coffee versus going to the patisserie down the street, those “small leaks” may be weighing down the steady ship that is your retirement.

Also, if you’re like many who don’t track expenditures and have forgotten to cancel subscriptions you don’t even use, your “great ship” may already be in the process of sinking, the good news is that it’s not too late to take action and repair all the holes in the hull.

By tracking your monthly spending patterns, axing the expenditures that bring you limited utility (or joy), and focusing on small cost optimization (perhaps you’re paying unnecessary interest on monthly credit card bills), you’ll be able to take Franklin’s advice to heart and move from the right lane to the left one on the retirement highway.

With the advent of various new technologies to track “types” of expenses (your bank may even have one!), budgeting has never been this pain-free.

The bottom line

Getting a budget is a must if you’re serious about accelerating your path to financial freedom. And while being frugal is a great way to shore up extra cash, it is possible to take it too far. If you’re obsessing over small expenses and missing the bigger picture, you may very well be patching up the small leaks in favor of the larger dents in the ship that are more deserving of your immediate attention. Either way, find a balance and adopt a budget if you’ve yet to do so as you set sail toward a comfortable retirement.

The post Ben Franklin said “beware of little expenses; a small leak will sink a great ship” – Here’s how to eliminate overlooked expenses appeared first on 24/7 Wall St..