Baby Boomers: The Only 3 ETFs You Need to Own for Passive Income and Growth Through Retirement

If you’re already retired or just thinking about it, one of the last things you want to worry about is income. After all, this is the time when you can finally relax with no worries. That’s where exchange-traded funds can help, especially those with yield. 24/7 Wall St. : Protect your portfolio from […] The post Baby Boomers: The Only 3 ETFs You Need to Own for Passive Income and Growth Through Retirement appeared first on 24/7 Wall St..

If you’re already retired or just thinking about it, one of the last things you want to worry about is income. After all, this is the time when you can finally relax with no worries.

That’s where exchange-traded funds can help, especially those with yield.

24/7 Wall St. Key Points:

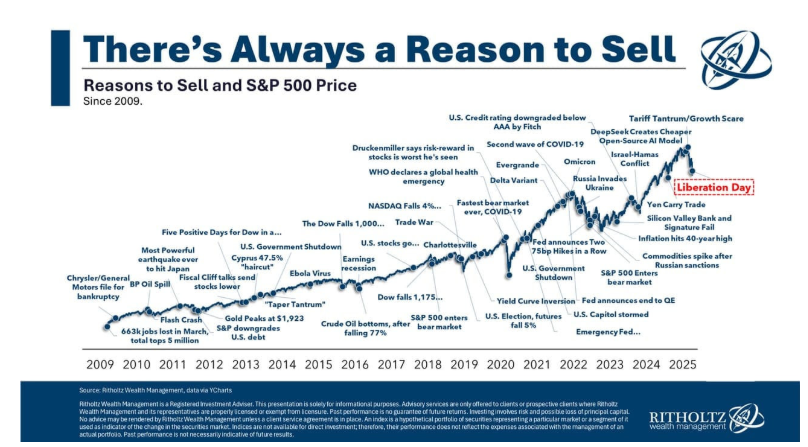

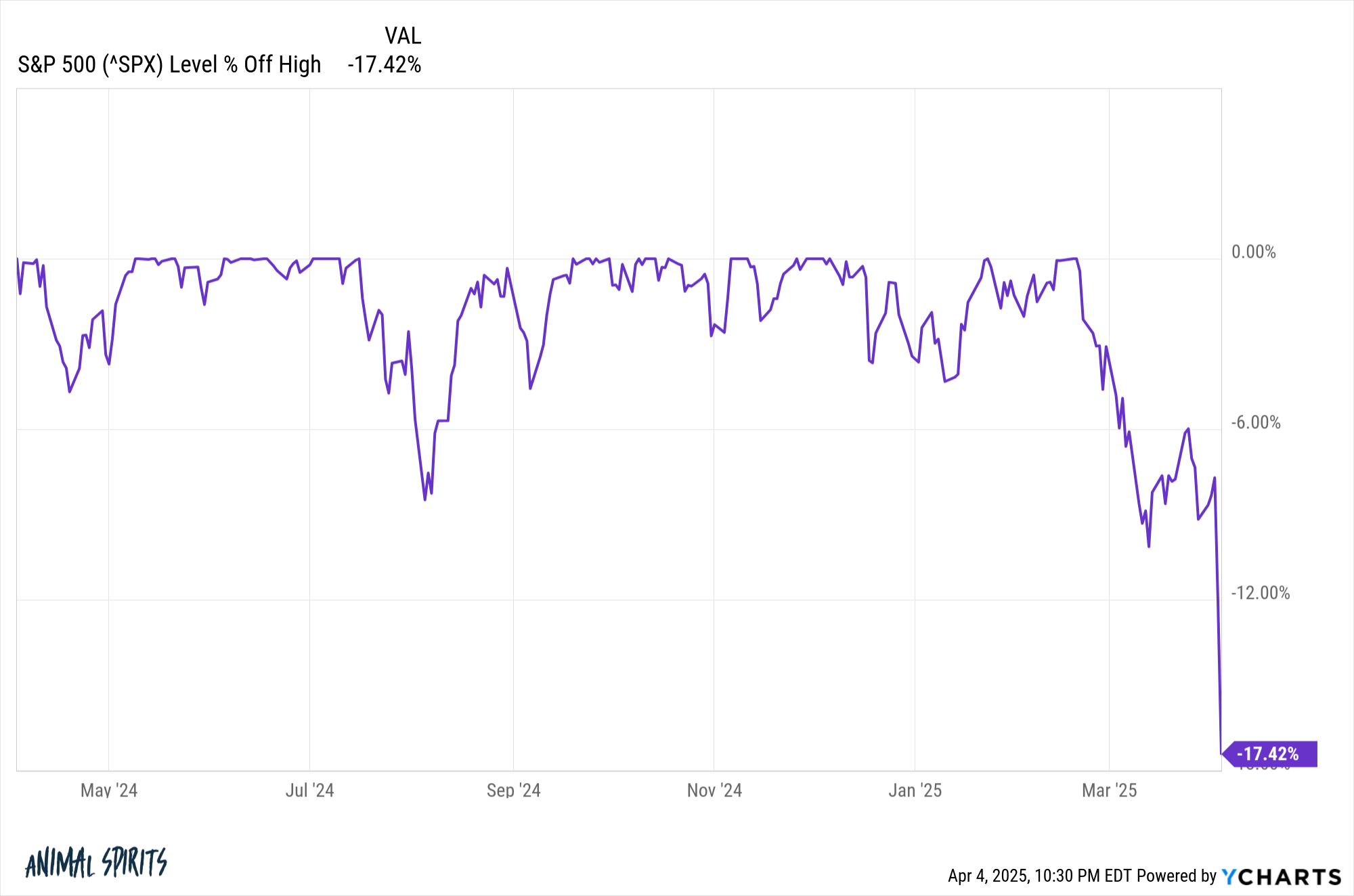

- Protect your portfolio from market volatility with strong dividend ETFs.

- These ETFs offer strong exposure to portfolio diversification and dividends.

- Keep your portfolio well-protected with reliably safe ETFs with yield. You may also want to grab your free copy of “2 Legendary High-Yield Dividend Stocks.”

Look at the Vanguard International High Dividend Yield ETF (NYSEARCA: VYM), for example.

With an expense ratio of 0.17%, the ETF has been paying a dividend quarterly. In fact, the most recent one for $0.9647 was just paid on December 24. Even better, at just $70 a share, the ETF offers exposure to international stocks, including Toyota Motor, Nestle, Roche Holding, Shell, Royal Bank of Canada, Unilever, and another 1,488 holdings.

But that’s just one of many we’d suggest looking into. Here are three more.

Invesco High Yield Equity Dividend Achievers ETF

With an expense ratio of 0.53% and a yield of 4.54%, the Invesco High Yield Equity Dividend Achievers ETF (NASDAQ:PEY) is based on the NASDAQ US Dividend Achievers 50 Index. It’s been paying a dividend monthly, with the last one ($0.08370) distributed on January 24.

Some of its top holdings include Walgreens Boots Alliance, Pfizer, Altria Group, Verizon, Universal Corp. and Avista Corp. to name a few of its 51 holdings.

SPDR Portfolio S&P 500 High Dividend ETF

With a yield of 4.31% and an expense ratio of 0.07%, the SPDR Portfolio S&P 500 High Dividend ETF (NYSE ARCA:SPYD) tracks the total return performance of the S&P 500 High Dividend Index, which is designed to measure the performance of the top 80 high dividend stocks on the S&P 500. Some of its top holdings include IBM, Williams Cos., Gilead Sciences, Entergy and Kellanova.

JPMorgan Nasdaq Equity Premium Equity Income ETF

With a yield of 9.76%, the JPMorgan Nasdaq Equity Premium Equity Income ETF (NASDAQ:JEPQ) generates income by selling options and by investing in U.S. large-cap growth stocks. All of which allows it to deliver a monthly income stream through options premiums and stock dividends. Even better, investors have also benefited from the ETF’s appreciation. JEPQ has an expense ratio of 0.35% at the moment.

The post Baby Boomers: The Only 3 ETFs You Need to Own for Passive Income and Growth Through Retirement appeared first on 24/7 Wall St..