Archer Aviation (ACHR), Ford (F) and Iamgold (IAG) Are Intriguing Stocks Under $10

Investing used to be a rich man’s game, but over the years the stock market has been democratized. A recent Gallup poll found 62% of U.S. adults own stock, either directly or indirectly, such as through mutual funds or retirement accounts. The barriers to entry have been slowly dismantled over time, first through the appearance […] The post Archer Aviation (ACHR), Ford (F) and Iamgold (IAG) Are Intriguing Stocks Under $10 appeared first on 24/7 Wall St..

Investing used to be a rich man’s game, but over the years the stock market has been democratized. A recent Gallup poll found 62% of U.S. adults own stock, either directly or indirectly, such as through mutual funds or retirement accounts.

The barriers to entry have been slowly dismantled over time, first through the appearance of discount brokers — then deep discount brokers — and more recently by the elimination of transaction fees for buying and selling stock. Now every dollar you invest goes to work for you immediately.

That means that even if you have just $10 to put into the market — and you don’t need it to pay bills or for an emergency — you can begin investing right away. The three stocks below are all priced at $10 or less and are worth considering for your next investment.

Archer Aviation (ACHR)

The first stock to consider buying with your sawbuck is Archer Aviation (NYSE:ACHR), one of the leading players in the electric vertical takeoff and landing (eVTOL) aircraft industry.

Archer is aiming to transform how we move around cities aboard air taxis flying over Abu Dhabi, Tokyo, and Los Angeles. It’s not making money from operations yet, but it plans to launch commercial flights later this year.

Archer is starting production at its ARC facility in Georgia and plans to build up to 10 Midnight eVTOL aircraft this year for testing and early deployments. CEO Adam Goldstein said his company is “on track to deliver our first revenue-generating Midnight aircraft later this year.

The Midnight craft has aced FAA tests and is just awaiting final certification before beginning commercial operations. It has backing from automaker Stellantis (NYSE:STLA), which is financing its manufacturing, and just last week a partnership with Palantir Technologies (NASDAQ:PLTR) for AI-driven aviation systems promises potential defense contracts. Sure, it’s pre-profit, and any delays could hurt, but trading just about $8 a share makes it a cheap introduction to a leader building an industry from the ground up.

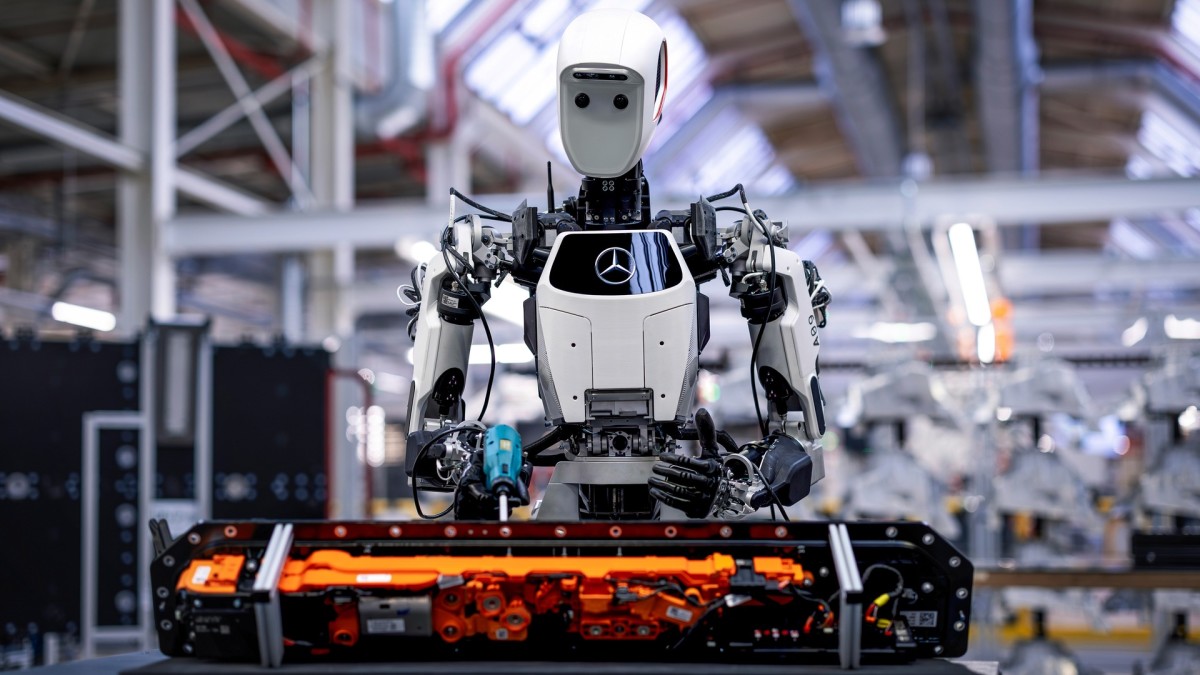

Ford (F)

Ford (NYSE:F) is the second stock worth a look and priced right at $10 per share. Although it has bounced off the lows it hit thanks to a rocky 2024, and President Trump’s tariffs pose some potential hurdles, the automaker remains an intriguing buy.

First, Ford boasts that nearly 80% of Ford vehicles sold in the U.S. are assembled here, which should minimize the impact of the trade wars. Of course, it’s notable that Ford says “assembled” here, which means a lot of its parts come from elsewhere, so it’s not completely smooth sailing for the automaker. And 40% of its production is in Mexico.

Ford is still bleeding cash in its electric vehicle unit, and it expects to lose another $5.5 billion this year on it, but it is going deep on hybrids, the more popular EV model. They outsold EVs 2-to-1 in the fourth quarter, led by the Maverick hybrid that established a new sales record. A new version will drop in June, which could juice sales and add billions of dollars annually.

Ford Pro’s commercial wing is also notable. It raked in $2 billion in operating profits in Q4, a 13% year-over-year increase, and 2025 guidance pegs 15% segment growth as fleet demand surges.

The automaker also pays a dividend that yields 5.9% annually and is backed by $6.7 billion in adjusted free cash flow. Ford’s $38 billion cash pile also offers a cushion, and with F stock trading at 6 times earnings and estimates, plus going for a fraction of its sales and book value, Ford is dirt-cheap for a legacy name with plenty of growth catalysts.

Iamgold (IAG)

The third stock under $10 to buy is gold miner Iamgold (NYSE:IAG). Iamgold is the cheapest of the three at just over $6 a share, yet the fourth quarter saw a 42% jump in revenue to $438.9 million on its Cote Gold mine’s first full quarter in operation. Cote has the potential to become Canada’s third-largest gold mine as it ramps up to 90% capacity.

Gold prices are at record levels of over $3,000 per ounce and full-year production soared to 667,000 ounces. Guidance for the coming year eyes between 700,000 and 810,000 ounces with Cote’s production expected to double. Iamgold has all-in sustaining costs of around $1.700, giving it a wide buffer with current pricing.

IAG stock is also deeply discounted. It trades at 4 times earnings, and with Wall Street predicting long-term profit growth of 20%, shares trade at a tiny fraction of that rate. Its output surge, the ascendance of the Cote project, and gold’s own glow make Iamgold a solid buy.

The post Archer Aviation (ACHR), Ford (F) and Iamgold (IAG) Are Intriguing Stocks Under $10 appeared first on 24/7 Wall St..