Analysts revisit Apple stock price targets as Cook courts Beijing

Apple CEO Tim Cook travels to China this week as sales in the world's biggest smartphone market continue to slide.

Apple shares moved higher in early Monday trading, matching an upside move for U.S. stocks tied to tariff relief bets, but likely face serious headwinds over the coming months following its fumbled AI strategy.

Apple (AAPL) remains firmly in correction territory in the wake of a 15% slump from its late-December peak, a move that loped more than $630 billion from its market value, amid an investor retreat from Magnificent 7 tech stocks and concerns over the fate of its Apple Intelligence rollout.

Last week, in fact, CEO Tim Cook reportedly orchestrated a rare shakeup of his top executive ranks, tapping Vision Pro creator Mike Rockwell to oversee product develop for Siri.

That move followed a bungled upgrade of the tech giant's virtual assistant and delays in the release of features designed to enhance its AI features and drive sales of its newly-released iPhone 16.

Wedbush analyst Dan Ives, a committed Apple bull who carries a $325 price target and an 'outperform' rating on the tech giant, estimates its AI delays will remove around 10 million iPhone handset sales from its fiscal 2025 tally, but sees that total improving over the following year, which begins in October.

That said, any further delays in the Apple Intelligence rollout, or even the release of underwhelming features that fail to capture user imagination, will likely start to erode confidence in the group's ability to entice the next round of smartphone upgrades.

Apple braces for tariff impact

Apple is also bracing for the impact of tariffs on gods from China, which currently come with a 20% levy that could increase over the coming months as President Donald Trump ramps-up his broader economic strategy by targeting nations with persistent trade surpluses with the United States.

Morgan Stanley analyst Erik Woodring, who reiterated his 'overweight' rating and $252 price target in a note published Monday, is seeing an increase in China-based hardware production in March, but argues this is likely the result of trade war issues between Washington and Beijing.

Related: Top analyst overhauls Apple stock price target amid key iPhone challenge

"While we highlighted increased iPhone assembly visibility and China's electronics subsidies as potential upside risks last month, we believe the increase this month reflects Apple pulling forward production to mitigate U.S./China tariffs," he added.

Apple has attempted to mitigate some of that tariff impact, however, by courting officials with new investment plans.

Last month, Apple touted the spending of $500 billion over the next years on U.S.-based projects, a figure that represents around 40% of its planned capex, while winning the endorsement of President Trump for the 20,000 jobs its likely to create.

Cook is also set to woo officials in Beijing this week following a visit to the state-sponsored China Development Forum on Sunday and a planned appearance at a developers' conference in Shanghai on Tuesday.

Apple's China diplomacy

Apple unveiled a partnership with Alibaba (BABA) that will see Asia's biggest tech company support Apple's AI rollout in China last month, as well.

Demand in China itself, however, is also on the wane as a result of stiffer domestic competition and a pullback in consumer spending.

Reports have also suggested that Beijing has banned the use of iPhones by government employees and state-backed enterprises in order to support the launch of Huawei's new Mate 60 handset.

Jefferies analyst Edison Lee, who carries an 'underperform' rating and a $202.33 price target on Apple stock, said iPhone sales are falling far faster than their android-based rivals in the world's biggest smartphone market.

"That indicates the launch of iPhone 16e (shipment started on February 28) has not been able to support overall iPhone sales in China, even though 16e is covered by the government subsidy program," he said.

More AI Stocks:

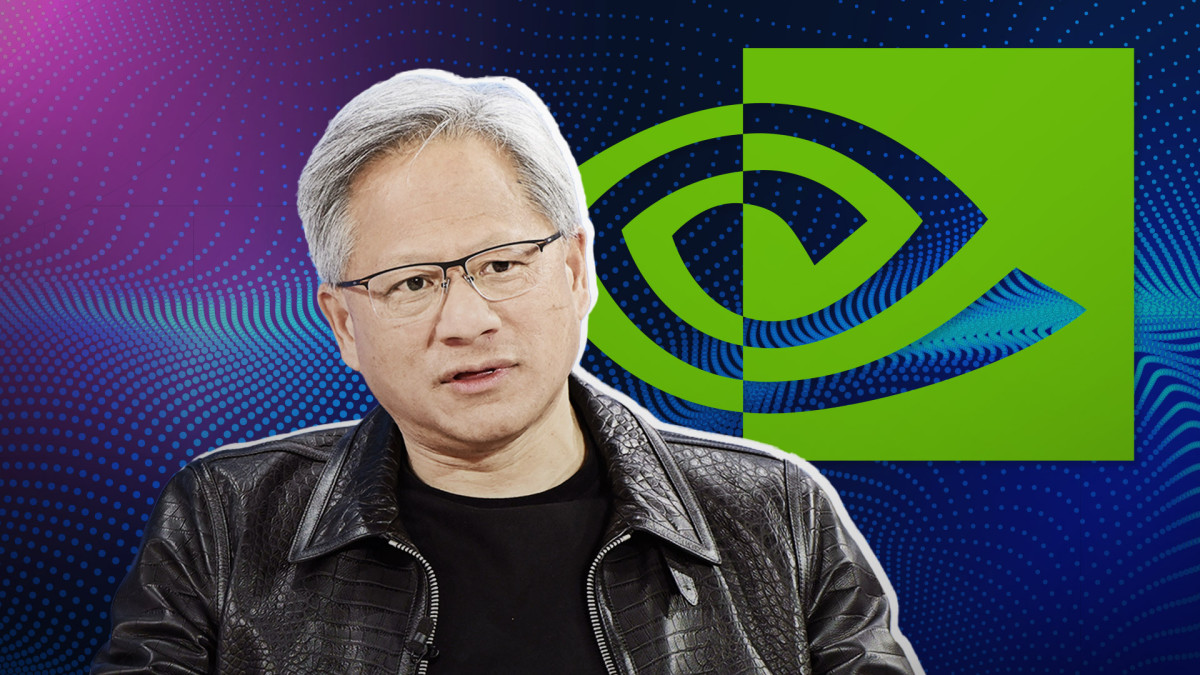

- Fund manager sends blunt message on Nvidia stock before conference

- Fund manager who predicted Nvidia’s selloff makes a bold move on Palantir

- Mark Cuban has some blunt AI advice for entrepreneurs

Apple posted December quarter revenue of $124.3 billion, its highest-ever holiday tally, even as iPhone sales slipped amid the uneven Apple Intelligence rollout.

The group also posted a record bottom line of $36.3 billion, a 10% increase from the year-earlier period, as services revenues rose 14% to $26.3 billion.

Finance chief Kevan Parekh, meanwhile, said Apple's current-quarter revenue would likely rise in the low- to mid-single-digits percent, an advance that likely translates to a tally of between $91.7 billion and $95.3 billion.

Apple share were marked 0.86% higher in premarket trading to indicate an opening bell price of $220.15 each.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast